For the 24 hours to 23:00 GMT, the EUR declined 0.34% against the USD and closed at 1.1146, after Germany’s preliminary consumer price index (CPI) unexpectedly remained flat on a monthly basis in August, piling pressure on the European Central Bank to introduce additional monetary policy measures to meet its inflation target. Meanwhile, markets expected the CPI to advance by 0.1%, following a rise of 0.3% in the previous month. On the other hand, the nation’s import price index unexpectedly climbed by 0.1% MoM in July, compared to market expectations for a fall of 0.1% and after recording a rise of 0.5% in the previous month.

Separately, in the Euro-zone, the economic sentiment indicator deteriorated to a level of 103.5 in August, hitting its lowest level since March 2016, indicating that consumers are becoming more pessimistic about the region’s economic growth. The economic sentiment indicator had recorded a revised reading of 104.5 in the previous month. Moreover, the region’s final consumer confidence index eased to a level of -8.5 in August, in line with market expectations and compared to a revised reading of -7.9 in the previous month.

The US Dollar gained ground, after the US consumer confidence index rose more-than-expected to a level of 101.1 in August, notching its highest level in eleven-months, adding to signs that the world’s largest economy was regaining steam in the second half of the year. The index had registered a revised reading of 96.7 in the previous month.

Meanwhile, the US Federal Reserve Vice Chairman, Stanley Fischer, indicated that the US job market has nearly reached its full strength. However, he stopped short of commenting on the timing of the next rate hike and stated that it will all depend on incoming economic data.

In the Asian session, at GMT0300, the pair is trading at 1.1158, with the EUR trading 0.11% higher against the USD from yesterday’s close.

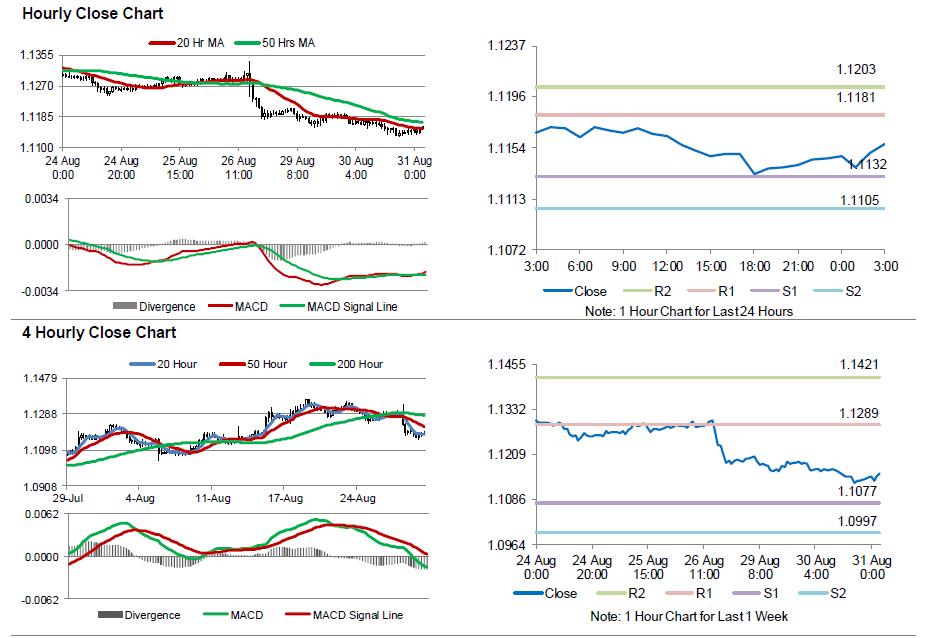

The pair is expected to find support at 1.1132, and a fall through could take it to the next support level of 1.1105. The pair is expected to find its first resistance at 1.1181, and a rise through could take it to the next resistance level of 1.1203.

Moving ahead, market participants would keep a close eye on the unemployment rate data across the Euro-zone and the region’s consumer price index data, slated to release in a few hours. Moreover, in the US, the ADP employment change and pending home sales data, due later in the day, would keep investor’s on their toes.

The currency pair is showing convergence with its 20 Hr moving average and trading below its 50 Hr moving average.