For the 24 hours to 23:00 GMT, the GBP declined 0.17% against the USD and closed at 1.3082.

In economic news, the number of mortgage approvals for house purchases in the UK eased more-than-expected to a level of 60.9K in July, compared to market expectations for a fall to a level of 61.9K and following a revised reading of 64.2K in the previous month. Further, the nation’s net consumer credit advanced by £1.2 billion in July, rising at the slowest pace since August 2015. Net consumer credit had risen by a revised £1.9 billion in the previous month whereas markets had envisaged a rise of £1.7 billion.

In the Asian session, at GMT0300, the pair is trading at 1.3111, with the GBP trading 0.22% higher against the USD from yesterday’s close.

Overnight data indicated that, the nation’s GfK consumer confidence index improved to a level of -7.0 in August. Markets expected the index to advance to a level of -8.0, after recording a reading of -12.0 in the prior month. Meanwhile, the nation’s Lloyds business barometer index dropped to a level of 16.0 in August, following a level of 29.0 in the previous month.

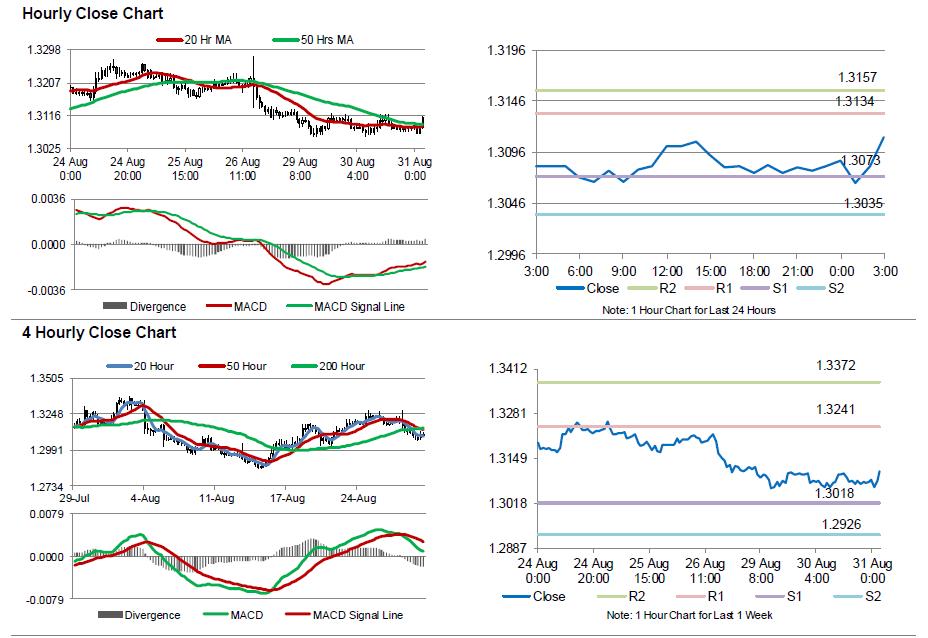

The pair is expected to find support at 1.3073, and a fall through could take it to the next support level of 1.3035. The pair is expected to find its first resistance at 1.3134, and a rise through could take it to the next resistance level of 1.3157.

Going ahead, investors would look forward to UK’s Nationwide house prices data for August, slated to release in a few hours.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.