For the 24 hours to 23:00 GMT, the EUR declined 0.08% against the USD and closed at 1.2372 as the latest data offered further evidence of a decline in investor optimism across the Euro-zone.

Data indicated that the Euro-zone’s ZEW economic sentiment index eased to a level of 1.9 in April. In the previous month, the index had recorded a level of 13.4.

Separately, Germany’s ZEW economic sentiment index declined to a level of -8.2 in April, marking its weakest reading since November 2012, as concerns over international trade disputes as well as tensions in Syria weighed on investor morale. In the previous month, the index had recorded a reading of 5.1, while market participants had expected for a fall to a level of -1.0. Moreover, the nation’s ZEW current situation index dropped to a level of 87.9 in April, more than market consensus for a fall to a level of 88.0. The index had registered a level of 90.7 in the previous month.

The greenback advanced against its major peers, as a slew of upbeat economic releases in the US underlined strength in the world’s largest economy.

Data revealed that housing starts in the US unexpectedly climbed 1.9% on monthly basis, to an annual rate of 1319.0K in March, confounding market expectations for a fall to a level of 1267.0K and aided by a rebound in the construction of multi-family homes. Housing starts had registered a revised reading of 1295.0K in the prior month. Furthermore, the nation’s building permits registered an unexpected rise of 2.5% on monthly basis, to an annual rate of 1354.0K in March, while investors had envisaged it to remain steady at a revised level of 1321.0K recorded in the previous month.

Another set of data showed that manufacturing production in the US climbed 0.1% on a monthly basis in March, meeting market expectations and after jumping by a revised 1.5% in the prior month. Also, the nation’s industrial production rose 0.5% on a monthly basis in March, topping market consensus for an advance of 0.3%. In the prior month, industrial production had recorded a revised rise of 1.0%.

In the Asian session, at GMT0300, the pair is trading at 1.2380, with the EUR trading 0.06% higher against the USD from yesterday’s close.

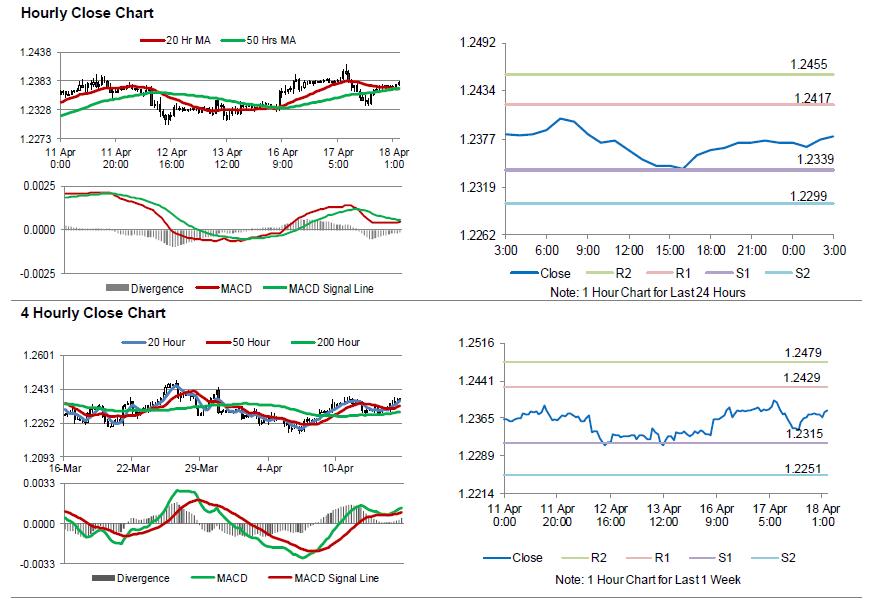

The pair is expected to find support at 1.2339, and a fall through could take it to the next support level of 1.2299. The pair is expected to find its first resistance at 1.2417, and a rise through could take it to the next resistance level of 1.2455.

Going ahead, investors would focus on Euro-zone’s final inflation figures for March and construction output data for February, both due to release in a few hours. Later in the day, the release of the US Federal Reserve’s Beige Book report, will garner significant amount of investor attention.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.