For the 24 hours to 23:00 GMT, the GBP declined 0.31% against the USD and closed at 1.4294, following weaker-than-expected wage growth figures in the UK.

Data indicated that Britain’s average earnings including bonus climbed 2.8% on a yearly basis the three months to February 2018, falling short of market expectations for an advance of 3.0%. In the November-January 2018 period, the average earnings including bonus had registered a similar rise. Meanwhile, the nation’s ILO unemployment rate unexpectedly declined to a 42-year low of 4.2% in the December-February 2018 period, while investors had envisaged for a steady reading. In the November-January 2018 period, the ILO unemployment rate had registered a reading of 4.3%.

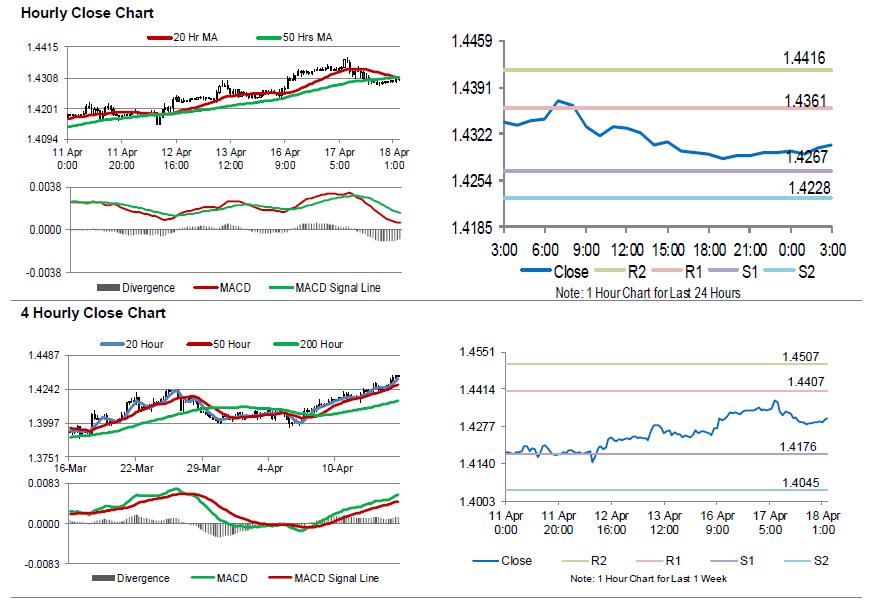

In the Asian session, at GMT0300, the pair is trading at 1.4306, with the GBP trading 0.08% higher against the USD from yesterday’s close.

The pair is expected to find support at 1.4267, and a fall through could take it to the next support level of 1.4228. The pair is expected to find its first resistance at 1.4361, and a rise through could take it to the next resistance level of 1.4416.

Moving ahead, all eyes would be on UK’s crucial inflation numbers for March, slated to release in a few hours.

The currency pair is showing convergence with its 20 Hr and 50 Hr moving averages.