For the 24 hours to 23:00 GMT, the EUR rose 0.37% against the USD and closed at 1.1097, after Germany’s seasonally adjusted unemployment rate unexpectedly dropped to 6.0% in October, declining for a second straight month and hitting its lowest level in twenty-five years, thus adding to signs that the Euro-zone’s largest economy is gaining strong momentum. Markets had envisaged the unemployment rate to remain steady at 6.1%, recorded in the previous month. Additionally, the nation’s final Markit manufacturing PMI surprisingly rose to a nearly three year high level of 55.0 in October, compared to a level of 54.3 in the previous month while markets expected it to remain steady at a level of 55.1, recorded in the preliminary estimate.

Elsewhere, activity in the Euro-zone’s manufacturing sector accelerated at its fastest rate in almost three years, after it registered a level of 53.5 in October, compared to a reading of 52.6 in the prior month and following an advance to a level of 53.3 in the preliminary figures.

The greenback lost ground against most of its major peers on continued nervousness over the outcome of the US Presidential election.

Yesterday, the US Federal Reserve (Fed), in its latest monetary policy meeting, left the key interest rates steady at 0.50%, in line with market expectations, but hinted that it could tighten monetary policy in December as the economy gains steam and inflation picks up.

According to a statement post meeting, policymakers judged that the case for an interest rate hike has continued to strengthen but decided, for the time being, to wait for some further evidence of continued progress in the economy. Further, the central bank indicated that the economy had strengthened while job gains remained solid and also expressed optimism that inflation was moving towards its 2.0% target.

In other economic news, the US ADP employment change data indicated that the number of people employed rose less-than-expected by 147.0K in October, marking the smallest increase since May 2016 and raising fresh doubts on the health of the nation’s labour market. Investors anticipated for an advance of 165.0K, following a revised increase of 202.0K in the prior month. Moreover, the nation’s mortgage applications eased by 1.2% in the week ended 28 October 2016, hitting a five-month low level, against a drop of 4.1% in the prior week.

In the Asian session, at GMT0400, the pair is trading at 1.1115, with the EUR trading 0.16% higher against the USD from yesterday’s close.

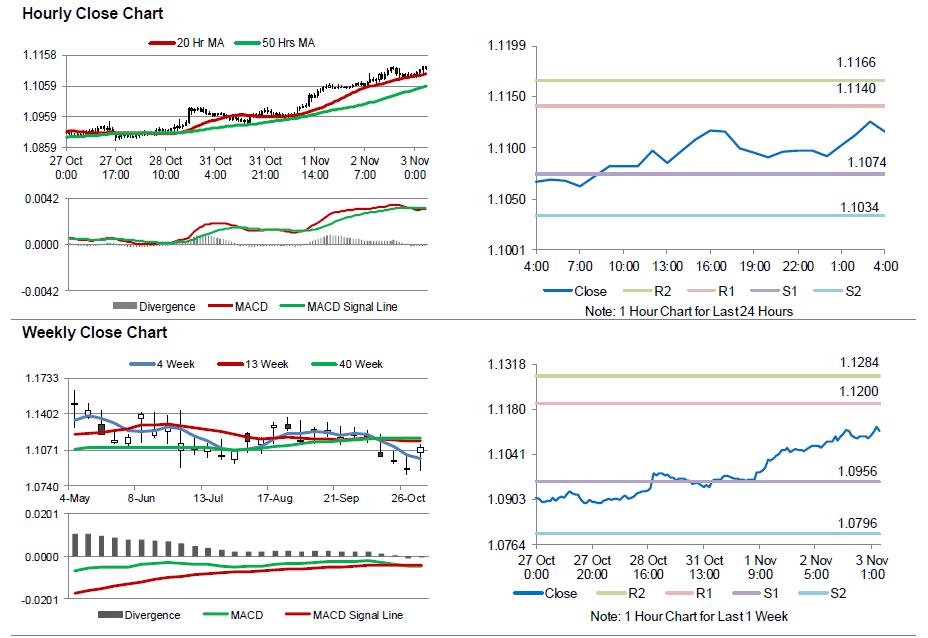

The pair is expected to find support at 1.1074, and a fall through could take it to the next support level of 1.1034. The pair is expected to find its first resistance at 1.114, and a rise through could take it to the next resistance level of 1.1166.

Going ahead, investors would look forward to the Euro-zone’s unemployment rate for September and ECB’s economic bulletin report, due to release in a few hours. Also, the US ISM non-manufacturing PMI and the final Markit services PMI, both for October accompanied with factory orders and final durable goods orders, both for September as well as initial jobless claims, scheduled to release later today, will also garner significant amount of market attention.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.