For the 24 hours to 23:00 GMT, the GBP rose 0.5% against the USD and closed at 1.2301, after UK’s Markit construction PMI unexpectedly rose to a level of 52.6 in October, advancing for a second consecutive month and notching its highest level since March 2016. The index recorded a level of 52.3 in the prior month while markets expected it to ease to a level of 51.8. Further, the nation’s seasonally adjusted Nationwide house prices unexpectedly remained flat on a monthly basis in October, defying market anticipation for it to rise by 0.2% and compared to a gain of 0.3% in the previous month.

In the Asian session, at GMT0300, the pair is trading at 1.2333, with the GBP trading 0.26% higher against the USD from yesterday’s close.

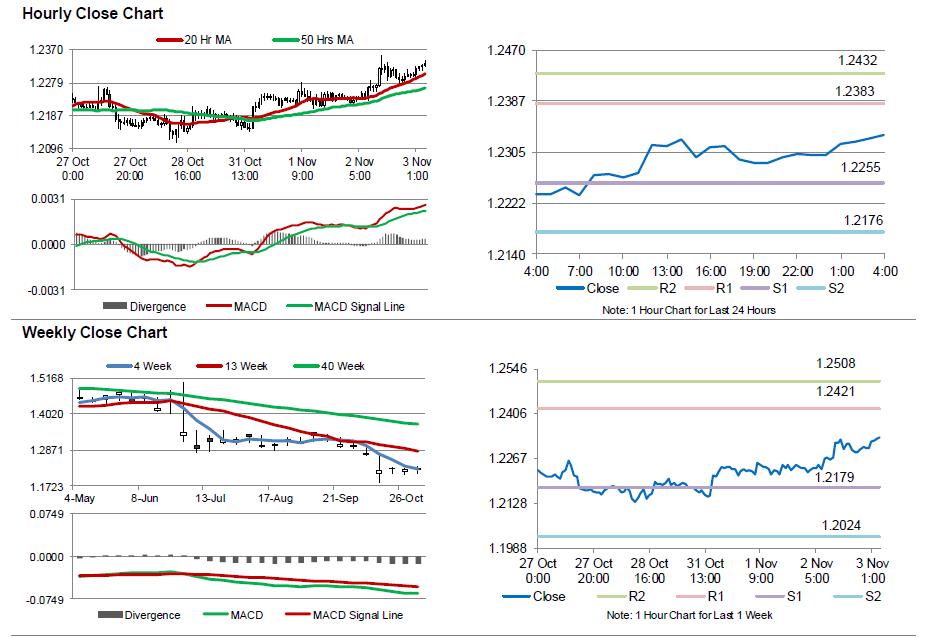

The pair is expected to find support at 1.2255, and a fall through could take it to the next support level of 1.2176. The pair is expected to find its first resistance at 1.2383, and a rise through could take it to the next resistance level of 1.2432.

This afternoon investors would keep a close watch on Bank of England’s (BoE) interest rate decision along with its meeting minutes and quarterly inflation report.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.