For the 24 hours to 23:00 GMT, the EUR declined 0.07% against the USD and closed at 1.1021.

In economic news, Germany’s seasonally adjusted final GDP expanded by 0.3% QoQ in 4Q 2015, compared to a similar rise in the previous quarter. Meanwhile, the nation’s IFO business expectations index dropped to a four-year low level of 98.8 in February, lower than market expectations of a fall to a level of 101.6 and after recording a reading of 102.3 in the preceding month. Further, the nation’s IFO business climate index eased more-than-expected to a level of 105.7 in February. Markets expected for a drop to a level of 106.8, following a reading of 107.3 in the previous month, thus indicating that the nation’s overall economic sentiment is hurt by worries about slowdown in global growth and financial market turmoil.

On the other hand, Germany’s IFO current assessment index surprisingly advanced to a level of 112.9 in February, from a reading of 112.5 recorded in the previous month.

In the US, the consumer confidence index fell more-than-anticipated to a seven-month low level of 92.2 in February, indicating that consumers are less optimistic about the nation’s economic outlook, amid downturn in the global growth and volatile financial markets. Analysts expected it to fall to a level of 97.3, following a reading of 98.1 in the previous month.

Other economic data showed that the nation’s existing home sales unexpectedly advanced by 0.4% MoM in January, touching its six-month high level, compared to market expectations for a fall of 2.5%. It had recorded a revised drop of 12.1% in the preceding month.

Separately, the Fed Vice Chairman, Stanley Fischer, stated that it is too early to assess whether the recent global market volatility could affect growth in the US

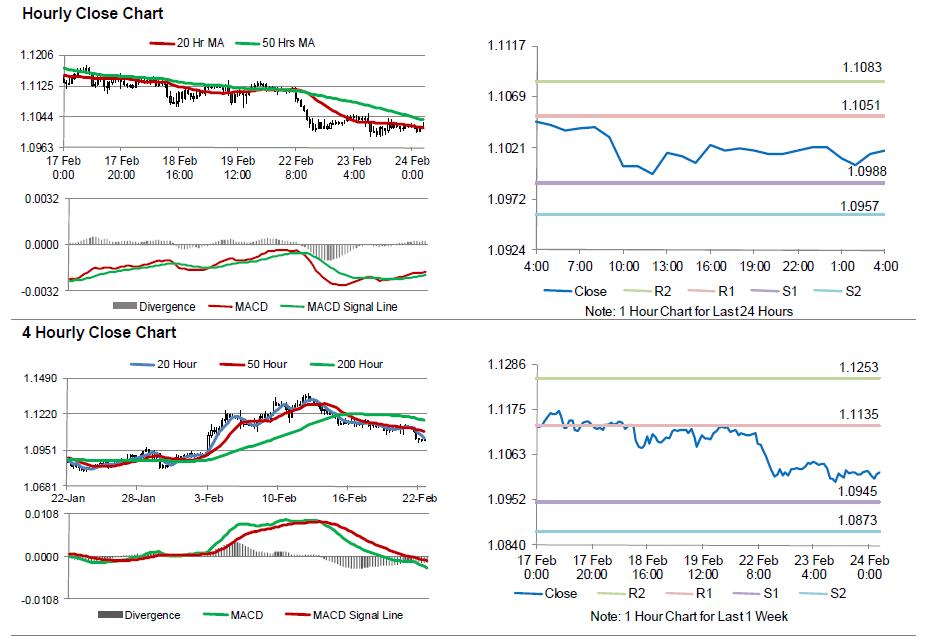

In the Asian session, at GMT0400, the pair is trading at 1.1018, with the EUR trading marginally lower from yesterday’s close.

The pair is expected to find support at 1.0988, and a fall through could take it to the next support level of 1.0957. The pair is expected to find its first resistance at 1.1051, and a rise through could take it to the next resistance level of 1.1083.

Amid no major economic releases in Euro-zone today, investors will look forward to the US Markit services PMI, MBA mortgage applications and new home sales data, slated to be released later in the day.

The currency pair is trading between its 20 Hr and 50 Hr moving averages.