For the 24 hours to 23:00 GMT, the GBP declined 0.9% against the USD and closed at 1.4025, after the BoE Governor, Mark Carney, hinted for additional stimulus in the economy.

Yesterday, the BoE Governor, Mark Carney, in a speech to the Treasury select committee, mentioned that the central bank has “considerable room” to ease the monetary policy and it might cut interest rates to zero or engage in additional assets purchase programme, if the outlook worsens. Meanwhile, he downplayed the probability of deploying negative interest rates.

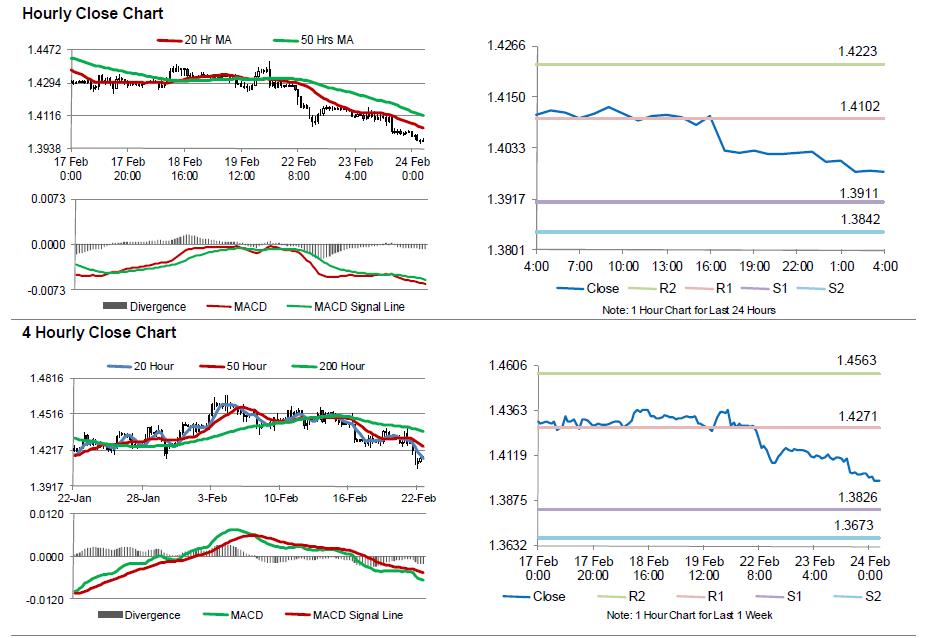

In the Asian session, at GMT0400, the pair is trading at 1.398, with the GBP trading 0.32% lower from yesterday’s close.

The pair is expected to find support at 1.3911, and a fall through could take it to the next support level of 1.3842. The pair is expected to find its first resistance at 1.4102, and a rise through could take it to the next resistance level of 1.4223.

Looking ahead, investors await the release of UK’s BBA mortgage approvals data for January, slated to be released in a few hours.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.