For the 24 hours to 23:00 GMT, the EUR declined 0.26% against the USD and closed at 1.1103.

On the macro front, Euro-zone’s preliminary manufacturing PMI remained unchanged at 45.7 in October. Moreover, the region’s flash services PMI rose to a level of 51.8 in October, less than market expectations of an advance to a level of 51.9. In the prior month, the PMI had recorded a level of 51.6.

Separately, in Germany, the flash manufacturing PMI climbed to a level of 41.9 in October, compared to a level of 41.7 in the previous month. Market participants had expected the PMI to rise to a level of 42.0. On the other hand, the nation’s preliminary services PMI unexpectedly eased to a 37-month low level of 51.2 in October, defying market anticipations for a rise to a level of 52.0. In the previous month, the PMI had registered a reading of 51.4.

The European Central Bank (ECB), in its latest monetary policy meeting, held its key interest rate steady at 0.0%, as widely expected and suggested that its main interest rates will remain unchanged till inflation levels recover. Further, the ECB indicated that its key interest rates will remain at their current or lower levels until inflation reaches the ECB’s goal of “below, but close to 2%”. Additionally, the central bank expects a gross domestic product rate for the region of 1.1% in 2019 and 1.2% in 2020. Also, it forecasts a headline inflation rate of 1.2% and 1.0% for 2019 and 2020, respectively.

In his final post-decision press conference ECB President, warned that geopolitical risks are threatening Eurozone’s recovery and urged for a more active fiscal policy in the euro area to help create a conducive environment to raise interest rates in future. Further, he stated that overall assessment was positive as the improvements in the economy more than offset the adverse side effects.

In the US, data showed that the Markit manufacturing PMI unexpectedly advanced to a level of 51.5 in October, defying market consensus for a fall to a level of 50.7. In the prior month, the PMI had recorded a reading of 51.1. Additionally, the US services PMI rose to a level of 51.0 in October, in line with market expectations. In the previous month, the PMI had registered a level of 50.9. Moreover, the seasonally adjusted initial jobless claims fell to a level of 212.0 K in the week ended 18 October 2019, more than market expectations for a drop to a level of 215.0K. In the previous week, initial jobless claims had recorded a revised reading of 218.0K. Meanwhile, the nation’s new home sales declined 0.7% on a monthly basis, to a level of 701.0K in September, compared to a revised reading of 706.0K in the previous month. Also, the US flash durable goods orders dropped 1.1% in September, declining by the most in four months and more than market expectations for a fall of 0.8%. Durable goods orders had recorded a revised rise of 0.3% in the prior month.

In the Asian session, at GMT0300, the pair is trading at 1.1103, with the EUR trading flat against the USD from yesterday’s close.

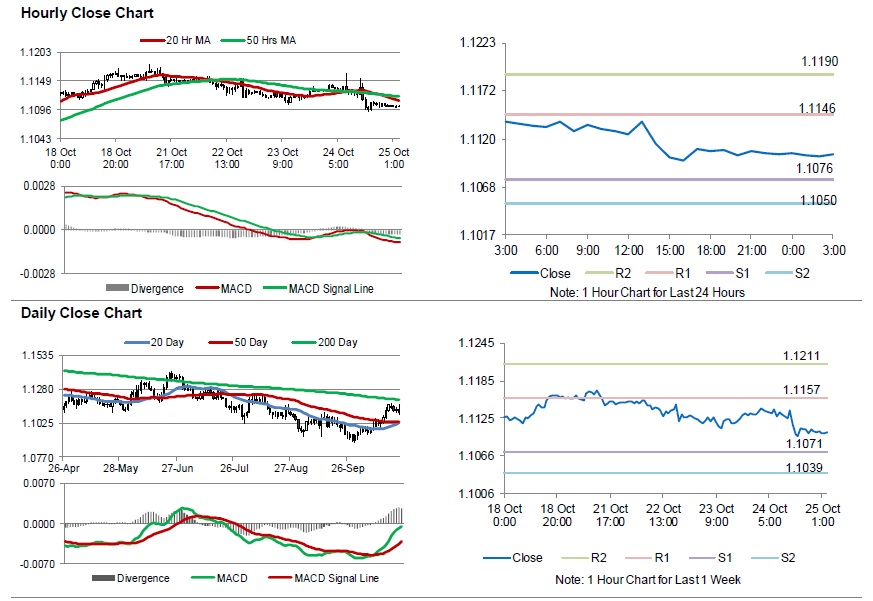

The pair is expected to find support at 1.1076, and a fall through could take it to the next support level of 1.1050. The pair is expected to find its first resistance at 1.1146, and a rise through could take it to the next resistance level of 1.1190.

Looking ahead, traders would await Germany’s GfK consumer confidence index for November and Ifo survey indices for October, set to release in a few hours. Later in the day, the US Michigan consumer sentiment index for October will garner significant amount of investors’ attention.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.