For the 24 hours to 23:00 GMT, the GBP declined 0.61% against the USD and closed at 1.2838, amid uncertainty over the European Union’s decision on whether to grant Brexit extension.

In economic news, UK’s BBA mortgage approvals fell to a level of 42.3K in September, compared to a revised reading of 42.5K in the prior month.

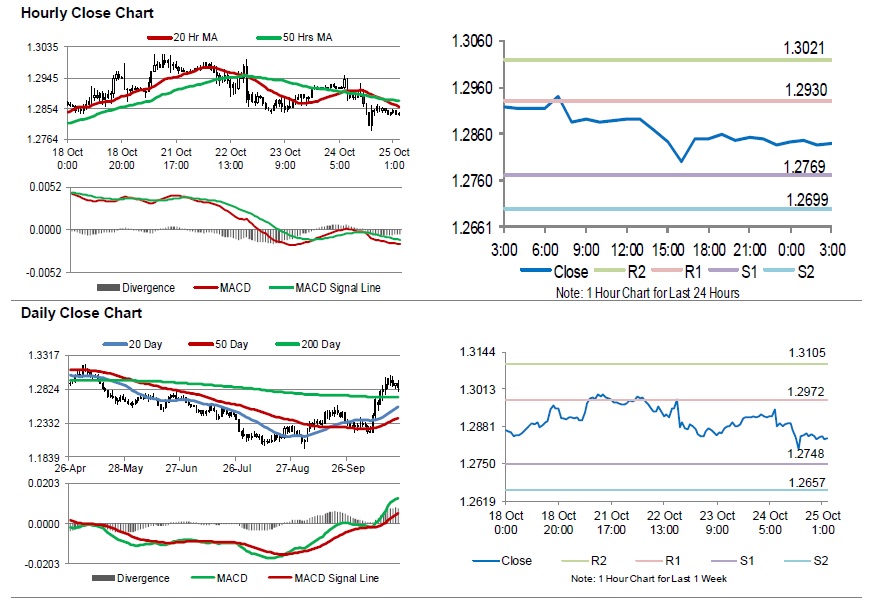

In the Asian session, at GMT0300, the pair is trading at 1.2840, with the GBP trading marginally higher against the USD from yesterday’s close.

The pair is expected to find support at 1.2769, and a fall through could take it to the next support level of 1.2699. The pair is expected to find its first resistance at 1.2930, and a rise through could take it to the next resistance level of 1.3021.

Going ahead, traders would keep an eye on UK’s consumer credit, housing price index, mortgage approvals and the GfK consumer confidence, all set to release next week.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.