For the 24 hours to 23:00 GMT, the EUR rose 0.06% against the USD and closed at 1.0604, following upbeat ZEW survey data across the Euro-zone.

Data revealed that the Euro-zone’s ZEW economic sentiment index surprisingly climbed to a level of 26.3 in April, while markets anticipated for a fall to a level of 25.0. In the prior month, the index had recorded a reading of 25.6. On the contrary, the region’s seasonally adjusted industrial production unexpectedly fell 0.3% on a monthly basis in February, confounding market expectations for a gain of 0.1% and following a revised rise of 0.3% in the prior month.

Additionally, confidence among German investors improved to its highest level since August 2015, after the index jumped more-than-expected to a level of 19.5 in April, as the Euro-bloc’s largest economy proved fairly robust in the first quarter. The index had registered a level of 12.8 in the prior month, whereas markets were anticipating for an advance to a level of 14.8.

In the US, the NFIB small business optimism index registered a drop to a level of 104.7 in March, in line with market expectations and compared to a level of 105.3 in the prior month. On the other hand, the nation’s JOLTs job openings advanced more-than-anticipated to a seven-month high level of 5743.0K in February, compared to market consensus for a rise to a level of 5650.0K and after recording a revised reading of 5625.0K in the previous month.

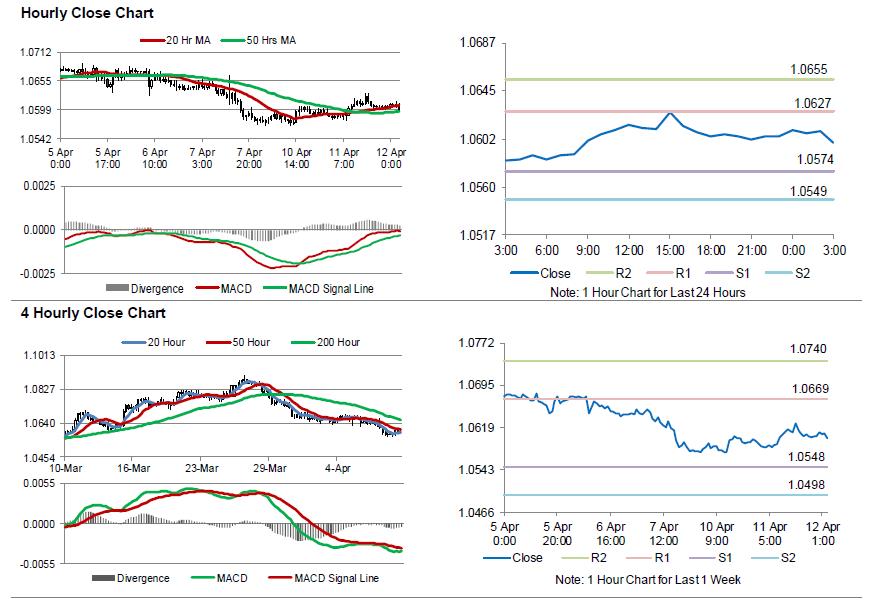

In the Asian session, at GMT0300, the pair is trading at 1.0599, with the EUR trading marginally lower against the USD from yesterday’s close.

The pair is expected to find support at 1.0574, and a fall through could take it to the next support level of 1.0549. The pair is expected to find its first resistance at 1.0627, and a rise through could take it to the next resistance level of 1.0655.

With no major economic releases in the Euro-zone today, investors will look forward to the US monthly budget statement for March, slated to release later in the day.

The currency pair is showing convergence with its 20 Hr moving average and trading above its 50 Hr moving average.