For the 24 hours to 23:00 GMT, the GBP rose 0.54% against the USD and closed at 1.2487, after the latest data indicated that UK’s annual inflation remained above the Bank of England’s 2.0% target in March.

Britain’s consumer price index (CPI) rose 2.3% on an annual basis in March, at par with market expectations, as cheaper airfares and falling petrol costs helped to offset a rise in food and clothing prices. The CPI had registered a similar rise in the prior month. Meanwhile, on a monthly basis, the CPI increased more-than-anticipated by 0.4% in March, compared to an advance of 0.7% in the prior month, while investors had envisaged for a gain of 0.3%.

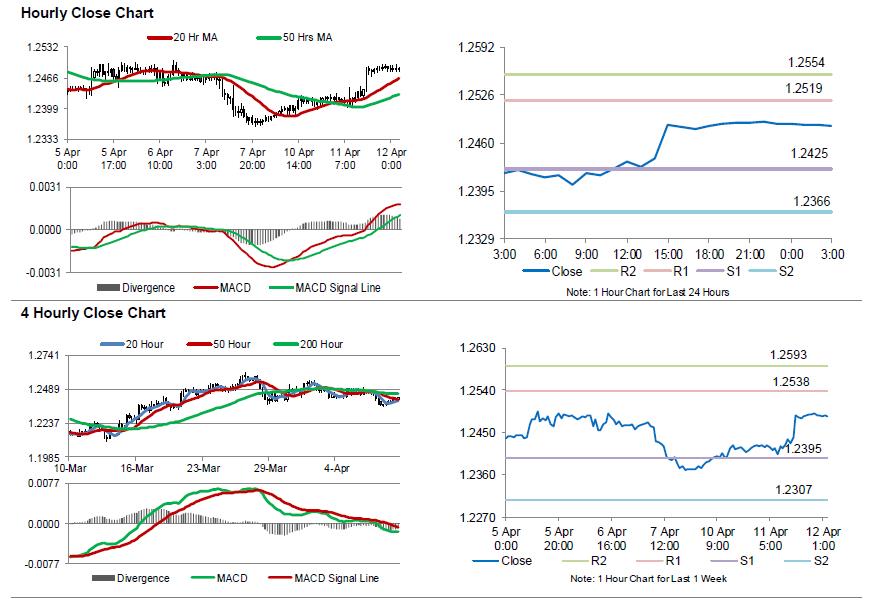

In the Asian session, at GMT0300, the pair is trading at 1.2484, with the GBP trading slightly lower against the USD from yesterday’s close.

The pair is expected to find support at 1.2425, and a fall through could take it to the next support level of 1.2366. The pair is expected to find its first resistance at 1.2519, and a rise through could take it to the next resistance level of 1.2554.

Moving ahead, all eyes would be on a speech by the Bank of England (BoE) Governor, Mark Carney, due in a few hours. Additionally, UK’s ILO unemployment report for the three months to February, will garner a significant amount of market attention.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.