For the 24 hours to 23:00 GMT, the EUR rose marginally against the USD and closed at 1.3605, paring its initial losses, triggered by the latest batch of downbeat German IFO data for June. The CESifo Group reported that its index on German business sentiment declined more than expected to a six-month low reading of 109.7 in June, marking its second consecutive monthly fall, while its index on economic expectations fell to a figure of 104.8 this month, similar to a level witnessed in autumn 2013. However, the IFO’s current assessment index of Germany stood pat at previous month’s reading of 114.8 in June. Separately, data from Italy, the third largest economy in the Euro-zone, showed that the non-EU trade surplus in the nation widened to €2.5 billion this May. Meanwhile, the wage inflation rose 0.1% (MoM) in May, after being unchanged in the previous two months.

Meanwhile, through a newspaper article, ECB’s Governing Council member, Jens Weidmann cautioned against the perils of weakening fiscal rules in the region by writing that, “doubts about the sustainability of government finances could cause massive shocks to the currency union”. Furthermore, he stressed that, rather than weakening, fiscal rules must be strengthened and their implementation made more binding in the Euro-zone.

In the US, Philadelphia Fed President, Charles Plosser hinted that the central bank could hike its interest rates in the US economy sooner than market expectations if unemployment in the nation continues to fall and inflation continue to rise. Separately, projecting a further fall in the nation’s unemployment rate, the New York Fed Chief, William Dudley, opined that the US Fed could reasonably wait until mid-2015 before raising its interest rates.

In the US economic news, consumer confidence increased for the second straight month in June to reach a level of 85.2, highest since January 2008. Likewise, a separate report revealed that sales of new US homes jumped 18.6% (MoM) in May to the highest level in six years.

In the Asian session, at GMT0300, the pair is trading at 1.3605, with the EUR trading flat from yesterday’s close.

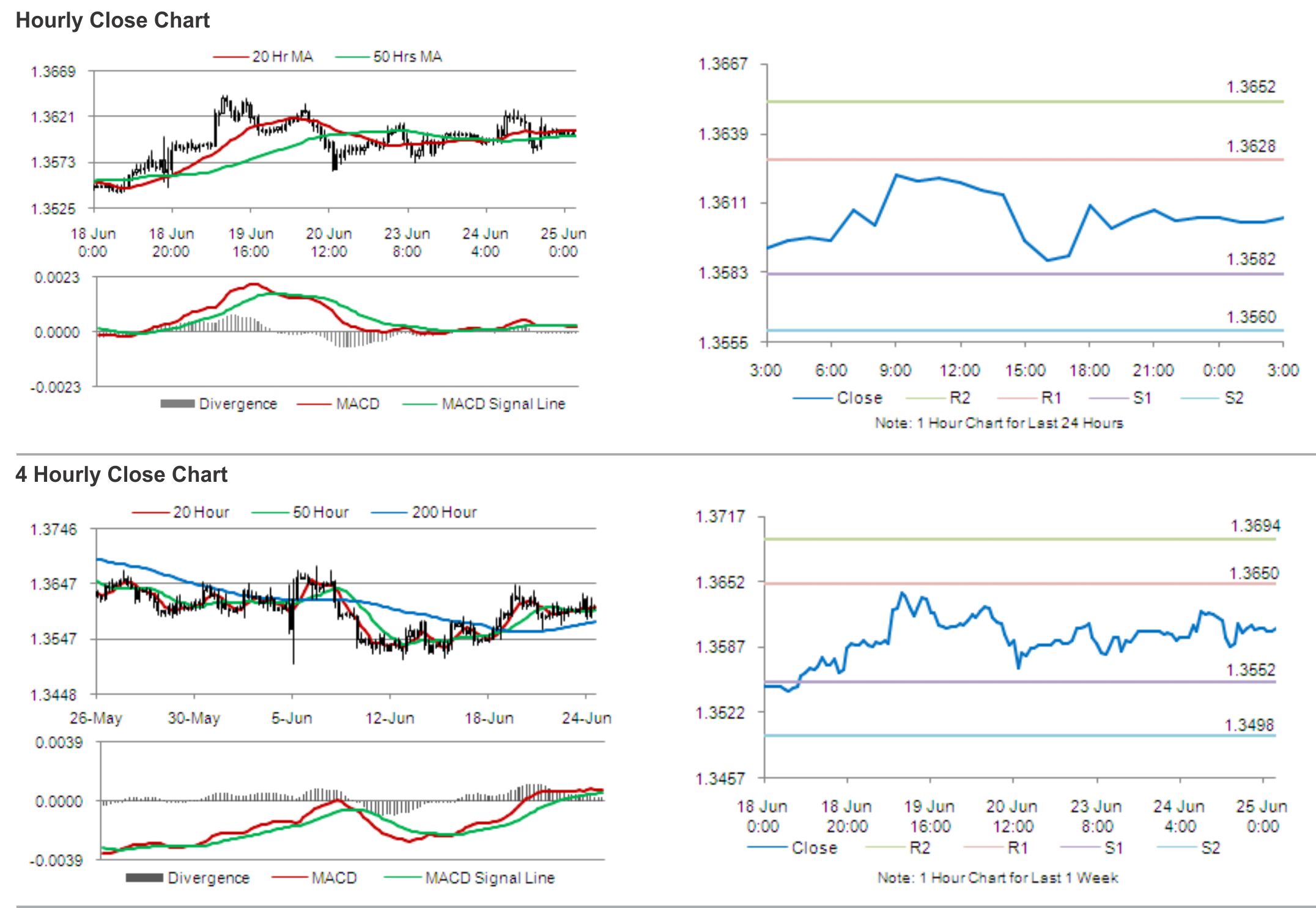

The pair is expected to find support at 1.3582, and a fall through could take it to the next support level of 1.3560. The pair is expected to find its first resistance at 1.3628, and a rise through could take it to the next resistance level of 1.3652.

Traders would eye the US first-quarter GDP as well as durable goods orders from US, scheduled to release later in the day.

The currency pair is showing convergence with its 20 Hr and 50 Hr moving averages.