For the 24 hours to 23:00 GMT, the GBP fell 0.26% against the USD and closed at 1.6985, as BoE Governor, Mark Carney’s dovish comments on the nation’s labour market conditions dampened expectations for an early interest rate hike. Speaking before the Treasury Select Committee, Mark Carney indicated that the UK economy still had some spare capacity which could be absorbed before an interest rate hike, which, according to him, could be “limited and gradual.”

In economic release, the British Bankers’ Association (BBA) reported that mortgage approvals in the UK economy fell for the fourth-consecutive month to a 9-month low level of 41,800 in May, compared to revised 41,900 approvals reported in April.

In the Asian session, at GMT0300, the pair is trading at 1.6978, with the GBP trading marginally lower from yesterday’s close.

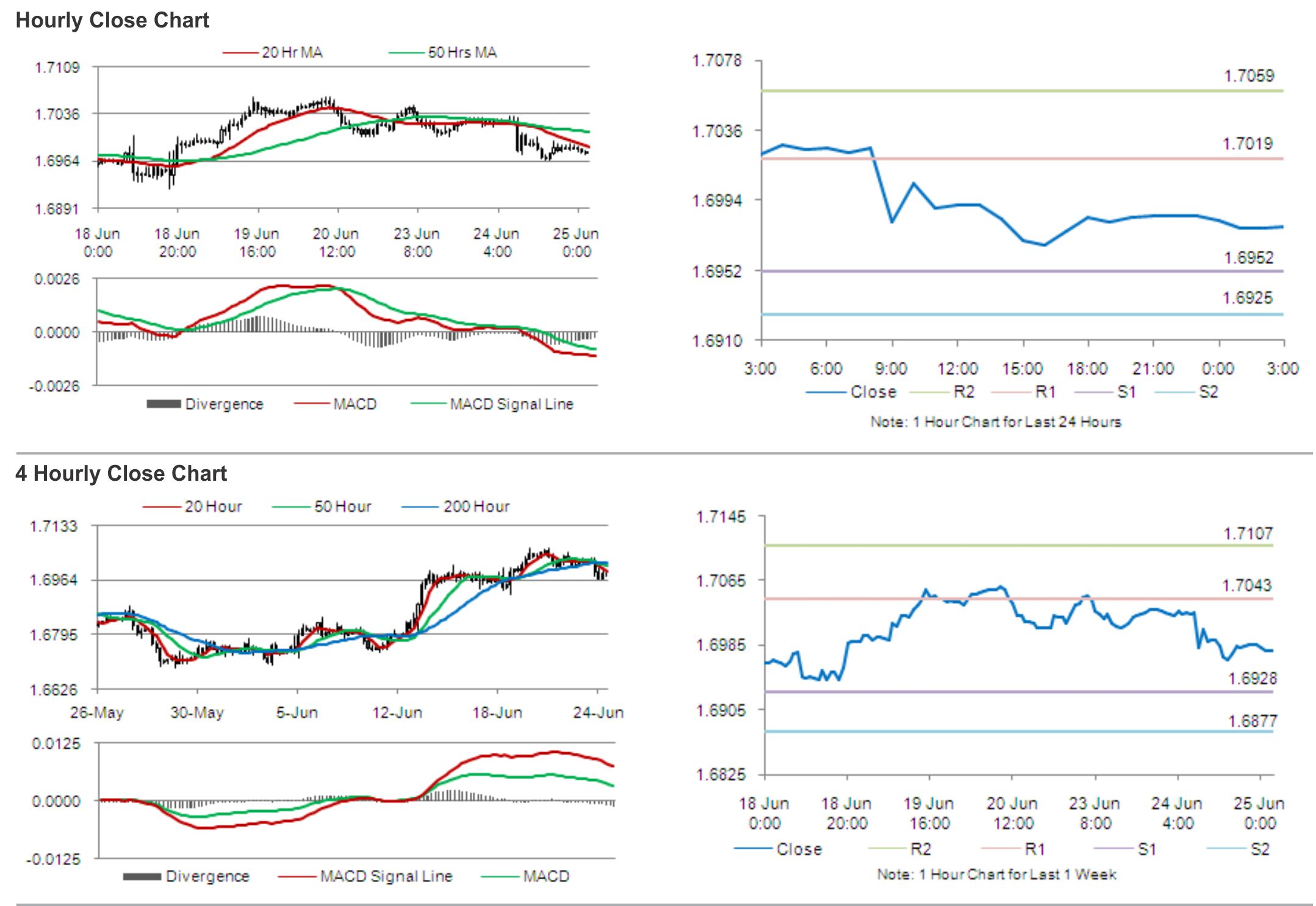

The pair is expected to find support at 1.6952, and a fall through could take it to the next support level of 1.6925. The pair is expected to find its first resistance at 1.7019, and a rise through could take it to the next resistance level of 1.7059.

Later today, the Confederation of British Industry (CBI) is scheduled to report the outcome of its monthly distributive trade survey for June.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.