For the 24 hours to 23:00 GMT, the EUR declined 0.07% against the USD and closed at 1.1205.

Yesterday, the International Monetary Fund (IMF), in its latest report on the global economic outlook, revised Euro-zone’s growth forecast for this year and next to 1.7% and 1.5% respectively, up from an earlier projection of 1.6% and 1.4%.

In other economic news, data indicated that Euro-zone’s producer price index (PPI) dropped by 0.2% MoM in August, higher than market expectations for a fall of 0.1% and following a revised gain of 0.3% in the previous month.

In the US, data showed that the IBD/TIPP economic optimism index rose to a level of 49.6 in October, after recording a reading of 46.7 in the prior month.

Meanwhile, the IMF slashed its US economic growth estimate to 1.6% in 2016, from 2.2% forecasted in July while it retained its global growth forecasts at 3.1% and 3.4% for 2016 and 2017 respectively. Further, it warned that political discontent in advanced economies threatens global growth and urged major central banks to maintain easy monetary policies to support growth.

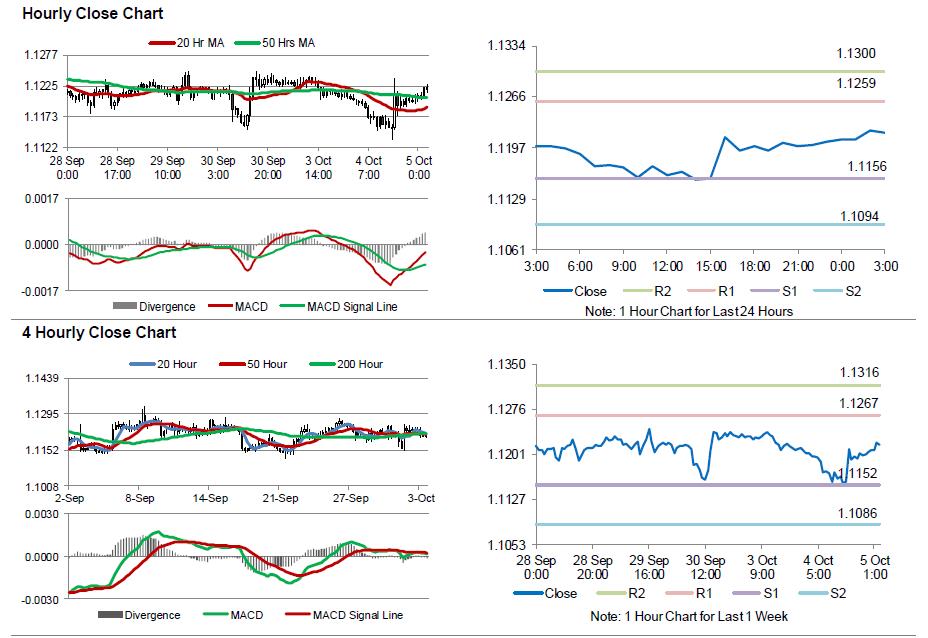

In the Asian session, at GMT0300, the pair is trading at 1.1218, with the EUR trading 0.12% higher against the USD from yesterday’s close.

The pair is expected to find support at 1.1156, and a fall through could take it to the next support level of 1.1094. The pair is expected to find its first resistance at 1.1259, and a rise through could take it to the next resistance level of 1.1300.

Going ahead, investors would look forward to the final Markit services PMI for September across the Euro-zone along with the region’s retail sales for August, scheduled to be released in a few hours. Additionally, the US ISM non-manufacturing PMI, ADP employment change, trade balance, Markit services PMI, factory orders and final durable goods orders data, all slated to release later in the day, would pique a lot of investor attention.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.