For the 24 hours to 23:00 GMT, the GBP declined 0.91% against the USD and closed at 1.2730.

On the data front, UK’s construction PMI unexpectedly climbed to a level of 52.3 in September, expanding for the first time since May 2016, thus adding to evidence that the economy is performing better than expected following the historic Brexit vote. Markets expected the PMI to drop to a level of 49.0, following a reading of 49.2 in the prior month.

Separately, the IMF revised up UK’s growth estimate this year, but lowered its forecast for 2017, citing the ultimate impact of Britain’s decision to leave the European Union. It now expects the economy to grow by 1.8% in 2016, from 1.7% estimated in July and 1.1% in 2017, from an earlier prediction of 1.3%.

In the Asian session, at GMT0300, the pair is trading at 1.2736, with the GBP trading a tad higher against the USD from yesterday’s close.

Overnight data indicated that, UK’s BRC shop price index fell further by 1.8% on an annual basis in September. In the previous month, the index had registered a drop of 2.0%.

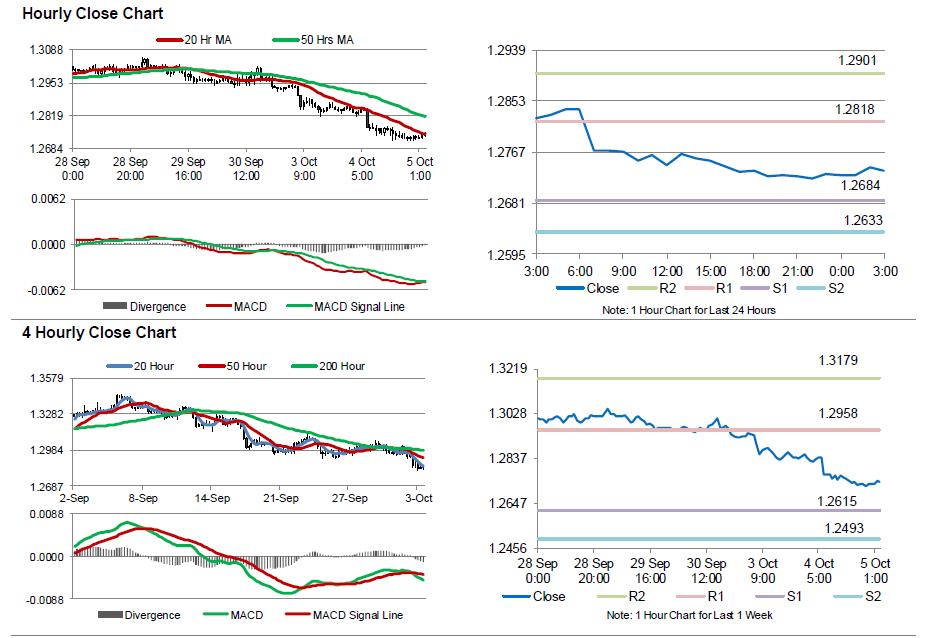

The pair is expected to find support at 1.2684, and a fall through could take it to the next support level of 1.2633. The pair is expected to find its first resistance at 1.2818, and a rise through could take it to the next resistance level of 1.2901.

Moving ahead, investors would turn their attention to UK’s Markit services PMI for September, due to release in a few hours.

The currency pair is showing convergence with its 20 Hr moving average and trading below its 50 Hr moving average.