For the 24 hours to 23:00 GMT, EUR declined 0.22% against the USD and closed at 1.3730.

The US Dollar gained ground against the Euro after the minutes from the Federal Reserve’s (Fed) latest policy meeting showed that most of the policymakers favoured a continuation in the gradual reductions of the central bank’s bond-purchase programme. The minutes also hinted that the Fed would continue to trim the size of its QE by $10 billion per month unless it sees a surprise deterioration in the economy’s performance. Furthermore, the possibility of raising interest rates sooner than expected was also discussed, as the officials were of the view that with the unemployment rate approaching 6.5%, it would be appropriate for the central bank to change its forward guidance. Additionally, most of the policymakers were upbeat about the US economy and held the extreme weather responsible for the recent poor employment numbers.

Separately, the Bank of Atlanta Fed President, Dennis Lockhart opined that the central bank would completely wind down its stimulus program by the fourth quarter of this year, unless the economy loses momentum He further highlighted his expectations for the economy to grow as much as 3% adding that it was too early to form any consensus regarding the economy following the recent soft economic data from the US and the temporary effects of a particularly cold winter.

Positive sentiment for the greenback were also fuelled after the St. Louis Fed President, James Bullard expressed optimism on the US labour market conditions and commented that inflation would advance towards the central bank’s target in the near future. Meanwhile, the San Francisco Fed President, John Williams, asserted that the Fed should continue with its tapering program as there was no prominent reason as such to stop it. He further emphasised that weak job growth is enough to have continued improvement in the key labour market and at present the US economy is on a “really solid footing” for this year despite the cold weather that has prompted weaker data reports.

On the macro front, the number of building permits issued last month declined 5.4% to a seasonally adjusted 937,000 units from December’s total of 991,000, while the housing starts slumped 16.0% in January to a level of 880,000 in January, the biggest drop in almost three years. Market had expected housing starts to decline 4.9% in January.

In the Euro-zone, the IMF cautioned about a deflation risk in the region and urged the ECB to consider lowering its benchmark interest rate below 0%. The agency also expressed concerns on the fragile economic recovery in the region and indicated the need for additional QE measures.

In economic news, on a seasonally adjusted basis, construction output rebounded 0.9% (MoM) in December, following a 0.2% drop in the preceding month.

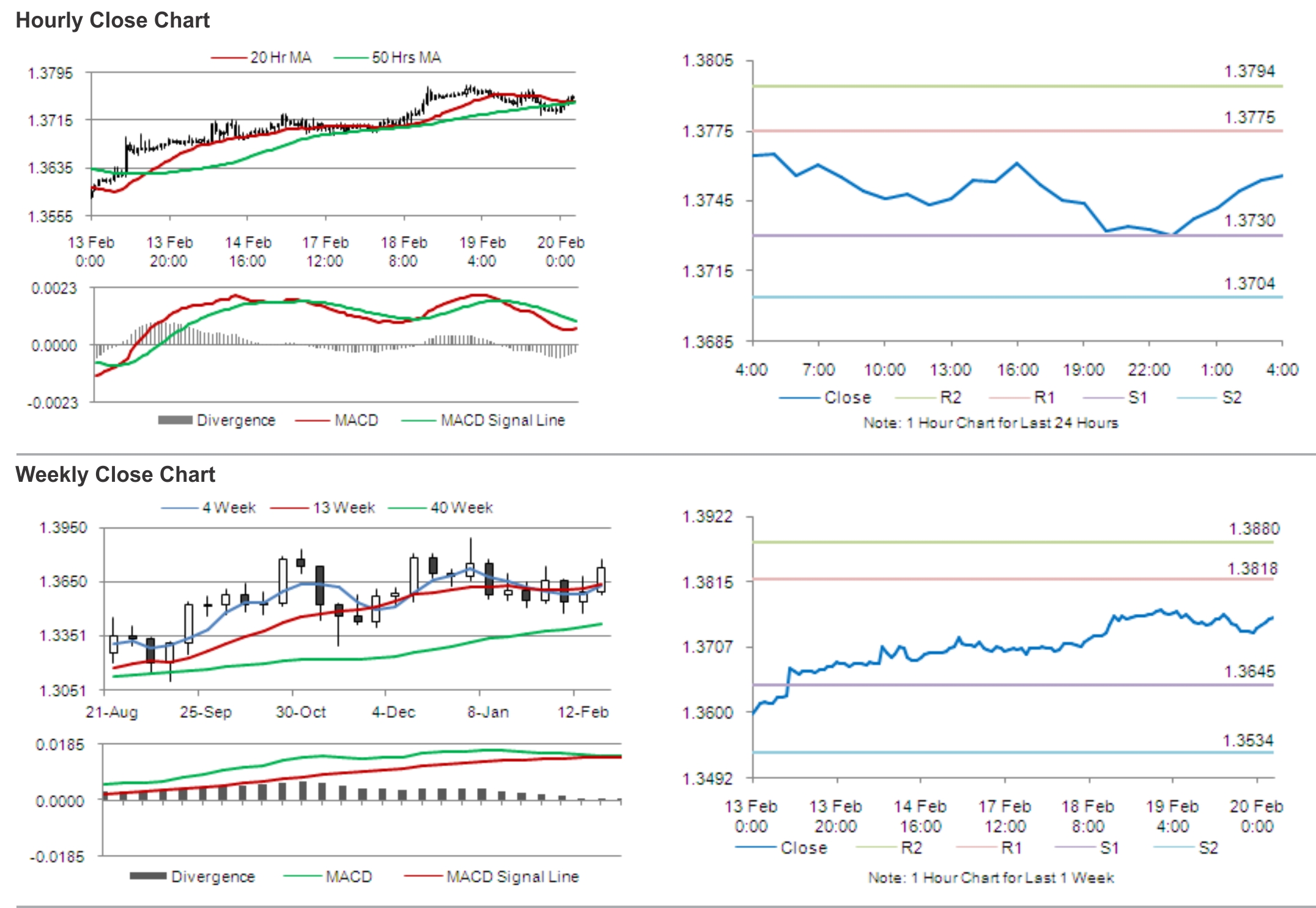

In the Asian session, at GMT0400, the pair is trading at 1.3756, with the EUR trading 0.19% higher from yesterday’s close.

The pair is expected to find support at 1.3730, and a fall through could take it to the next support level of 1.3704. The pair is expected to find its first resistance at 1.3775, and a rise through could take it to the next resistance level of 1.3794.

Traders keenly await Euro-zone’s consumer confidence, Markit manufacturing, service and composite PMI data, for further cues in the Euro.

The currency pair is showing convergence with its 20 Hr moving average and is trading just above its 50 Hr moving average.