For the 24 hours to 23:00 GMT, the GBP marginally fell against the USD and closed at 1.6677, after data revealed that the UK unemployment rate unexpectedly rose in the three months to December. The ILO unemployment rate in the UK unexpectedly rose to 7.2% in the three months to December, from a level of 7.1% in the previous month. However, the claimant count rate slowed down to 3.6% in January, compared to a level of 3.7% in the previous month.

Yesterday, the minutes from the Bank of England’s (BoE) latest policy meeting, indicated the policymakers’ unanimous view on the central bank’s current and forward guidance. The minutes also highlighted the central bank’s expectation for the UK economy to expand further ahead of an interest rate hike.

Separately, the BoE policymaker, Paul Fisher opined that a premature rise in interest rates may hamper recovery in the Britain economy. He also revealed that none of the members of the Monetary Policy Committee (MPC) pushed for a hike in the interest rate in the recent policy meeting.

In the Asian session, at GMT0400, the pair is trading at 1.6676, with the GBP trading tad lower from yesterday’s close.

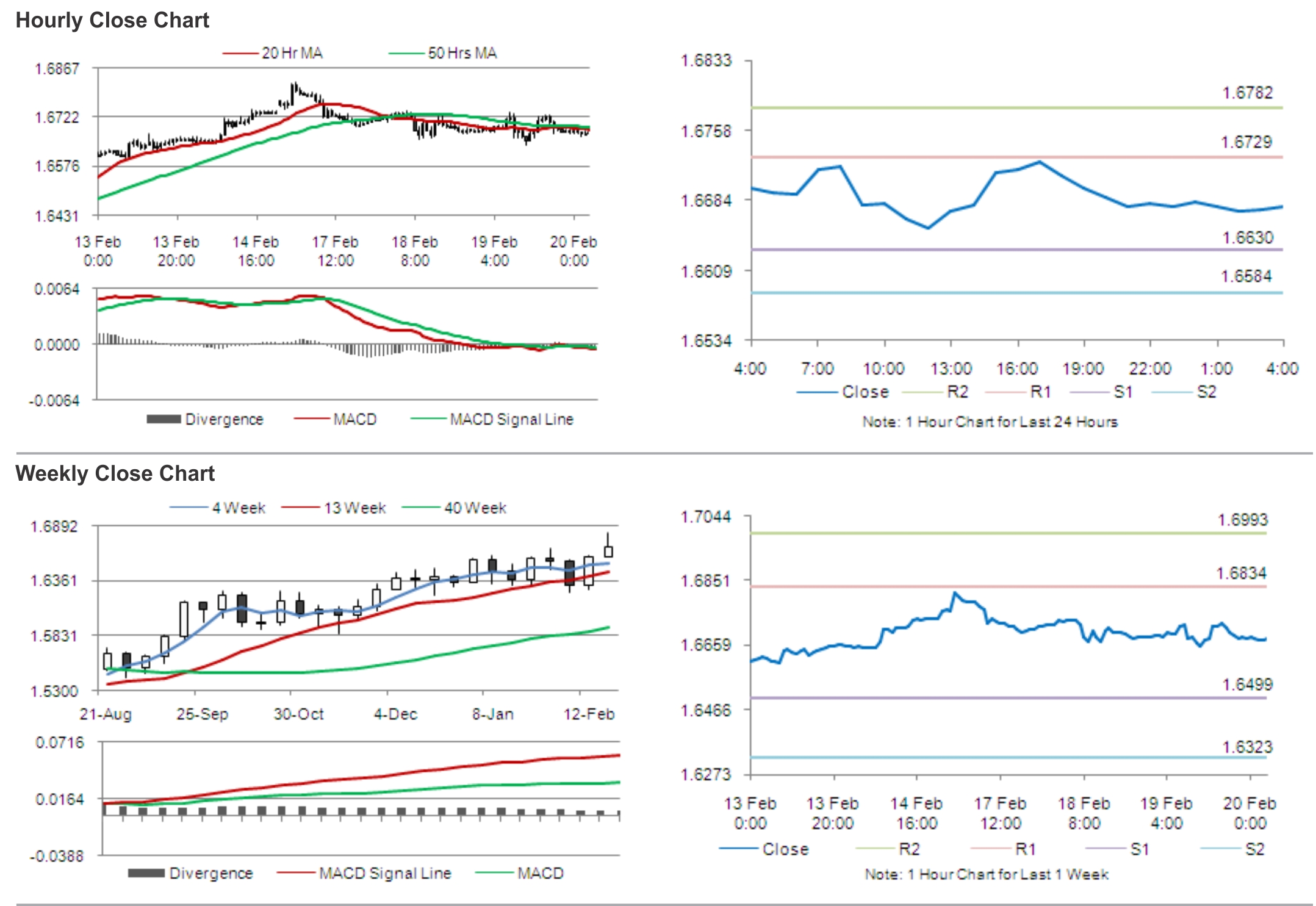

The pair is expected to find support at 1.6630, and a fall through could take it to the next support level of 1.6584. The pair is expected to find its first resistance at 1.6729, and a rise through could take it to the next resistance level of 1.6782.

Market participants are expected to keep a tab on the outcome of the UK 10-year bond auction and a survey report from the CBI on the industrial trends – orders in the UK.

The currency pair is showing convergence with its 20 Hr moving average and is trading just below its 50 Hr moving average.