For the 24 hours to 23:00 GMT, the EUR marginally declined against the USD and closed at 1.3460, as investor appetite continued to be strained about the effects of possible fresh sanctions against Russia by the EU on the Euro-zone economy.

The common currency also lost ground after worries of the economic health of the Euro-zone increased after the consumer confidence data from the region unexpectedly weakened for the second consecutive month in July. The European Commission reported that its preliminary measure of consumer confidence deteriorated to -8.4 in July from -7.5 in June. Economists had expected an unchanged reading. Meanwhile another data from France, the second largest economy in the Euro-zone showed that business sentiment remained unchanged in June, as industrial companies continued to remain cautious about their activity in the coming months.

In a noteworthy development, the EU Council approved Lithuania to join the Euro-zone as its 19th member from January 1, 2015. ECB Executive Board Member, Peter Praet urged the new entrant to pursue appropriate policies in order to avoid economic imbalances.

Yesterday, the IMF cautioned that the Federal Reserve should provide clarity on how it intends to exit accommodative policy stance, as failing to do so could be harmful for the economy. Furthermore, the fund hinted that the central bank may keep its interest rate at zero for a longer time as inflation continued to stay muted and the labour market has not yet shown strong signs of recovery. Meanwhile, it slashed the nation’s growth forecast for this year to 1.7% from an initial prediction of 2.0%.

In the Asian session, at GMT0300, the pair is trading at 1.3460, with the EUR trading flat from yesterday’s close.

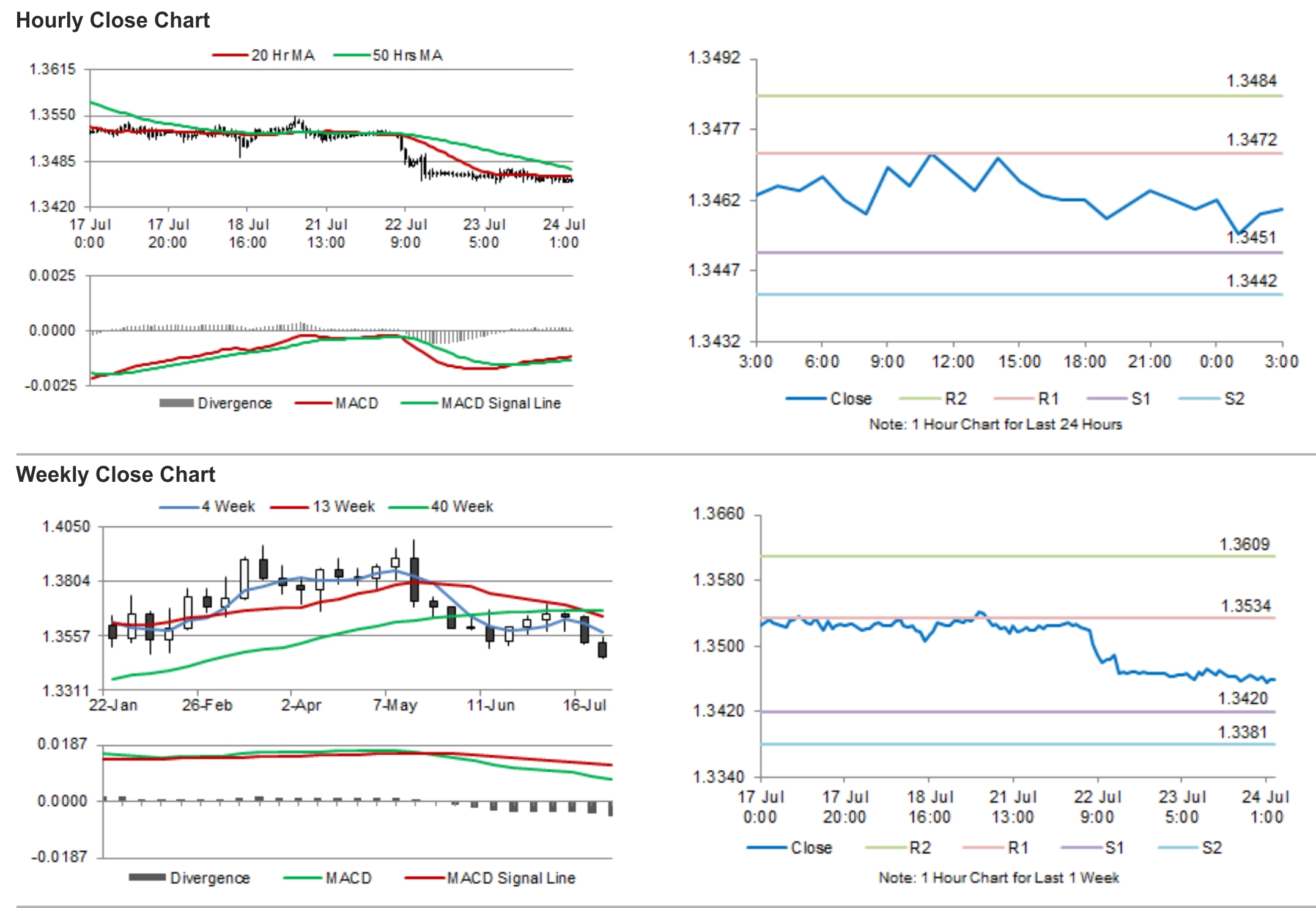

The pair is expected to find support at 1.3451, and a fall through could take it to the next support level of 1.3442. The pair is expected to find its first resistance at 1.3472, and a rise through could take it to the next resistance level of 1.3484.

Investors would turn all their attention to a slew of manufacturing and services activity reports across the Euro-zone slated to be released later during the day. Initial jobless claims and housing data from the US would also be keenly awaited.

The currency pair is showing convergence with its 20 Hr moving average and is trading below its 50 Hr moving average.