For the 24 hours to 23:00 GMT, the GBP fell 0.18% against the USD and closed at 1.7036, after the Bank of England in its minutes of its latest meeting failed to provide any insights on the probable timing of its interest rate hike in the UK. The BoE policymakers voted unanimously to keep interest rates on hold and continue with the central bank’s asset purchase programme. The minutes also revealed that some members of the monetary policy committee were concerned that raising rates too early could destabilize the recovery.

Meanwhile, the BoE Governor, Mark Carney, indicated that the UK economy is gaining momentum, however it would continue facing obstacles in its recovery, due to which rising interest rate at the earliest would not be possible. He clarified that any change in the key benchmark rate would solely depend on data from the UK.

On the economic front, the BBA mortgage approvals in the UK rose to 43.3K in June, higher than market expectations of 41.4K and compared to a revised reading of 41.9K reported in the previous month. Additionally, the CBI distributive trade survey’s retail sales balance in the UK soared to a level of 21.0% in July, compared to a reading of 4.0% level in the previous month, and beating the market estimate of a level of 15.0%.

In the Asian session, at GMT0300, the pair is trading at 1.7033, with the GBP trading tad lower from yesterday’s close.

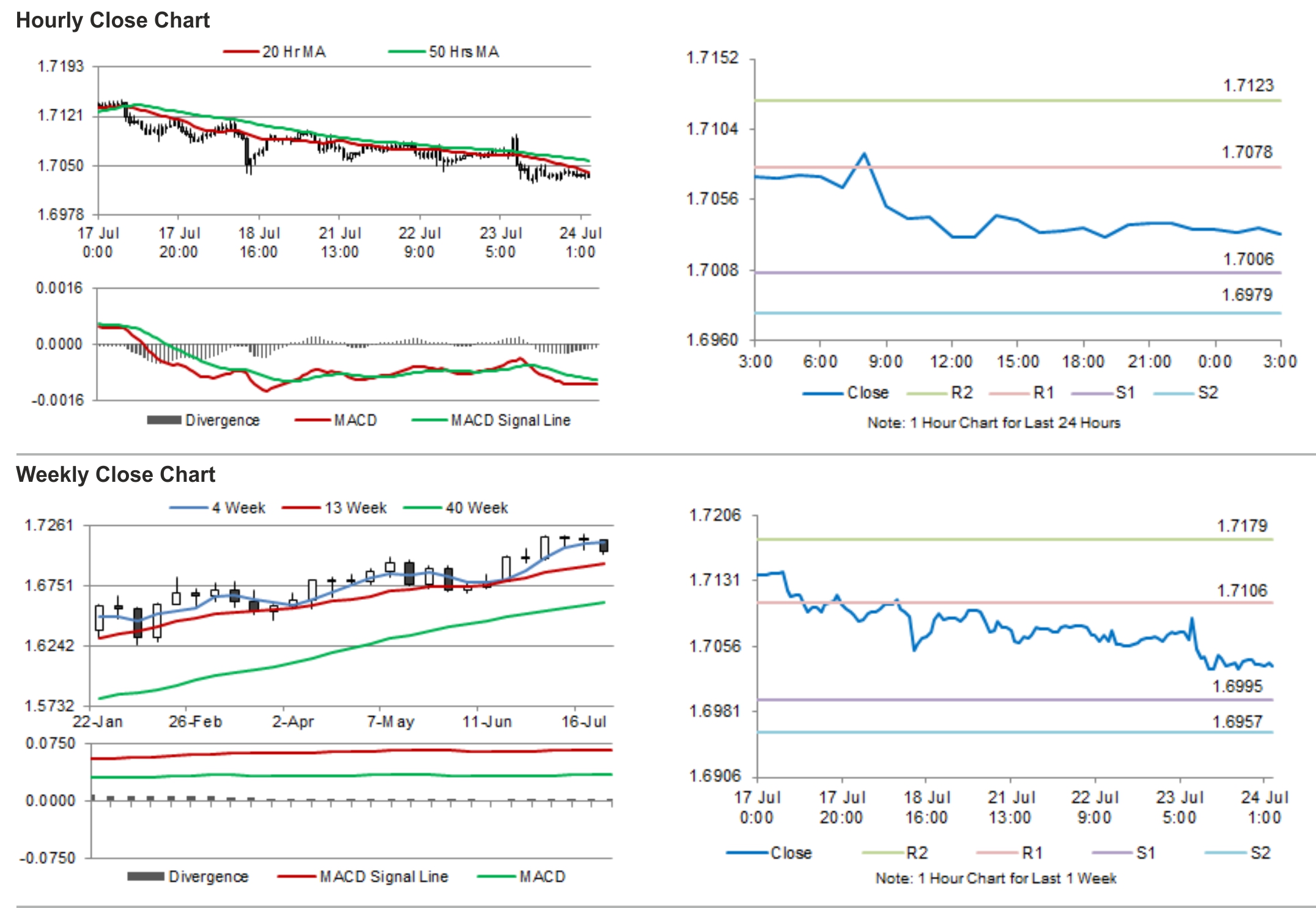

The pair is expected to find support at 1.7006, and a fall through could take it to the next support level of 1.6979. The pair is expected to find its first resistance at 1.7078, and a rise through could take it to the next resistance level of 1.7123.

Going forward, retail sales data from the UK would keep investors on toes.

The currency pair is showing convergence with its 20 Hr moving average and is trading below its 50 Hr moving average.