For the 24 hours to 23:00 GMT, the EUR declined marginally against the USD and closed at 1.3756, paring some of its initial losses accrued due to speculation of an ECB stimulus. Negative sentiment for the Euro was also fuelled after the ECB Vice President, Vitor Constancio, projected inflation in the Euro-zone economy to stay below 1.0% for an extended period of time and hinted that the future monetary policy action would act as the main factor in determining its medium-term inflation outlook. Furthermore, he reiterated that the central bank was closely scrutinising the euro exchange rate as it was responsible for a 0.5-percentage-point decline in the region’s headline HICP rate since May 2013. Separately, another ECB policymaker, Ewald Nowotny, highlighted the pitfalls of an intensified regulation for the Euro-zone banking sector, stating that shadow banking sector could be the area where banks may flee. Meanwhile, during her interview with the German daily Handelsblatt, the IMF Chief, Christine Lagarde, warned of risks to a Euro-zone recovery and urged authorities to frame policies beneficial to growth.

In a noteworthy event, the Fitch Ratings, in its latest sovereign snapshot report on the Euro-zone economy, stated that the overall outlook for the Euro-zone economy remained “Stable” rather than “Positive”, even as downward pressure on the region’s sovereign ratings continued to diminish notably.

Meanwhile, in the US, the Philadelphia Fed President, Charles Plosser opined that the decline in the US labour participation rate since 2007 in mainly was due to increased retirement and “movements into disability.” Separately, the San Francisco Fed, in its research note, projected the US economy to likely face low level of inflation for some years to come even as the risks to the inflation outlook appeared to have ebbed markedly.

On the economic front, the US government recorded a budget surplus of $106.9 billion in April, following a deficit of $36.9 billion in the previous month.

In the Asian session, at GMT0300, the pair is trading at 1.3755, with the EUR trading a tad lower from yesterday’s close.

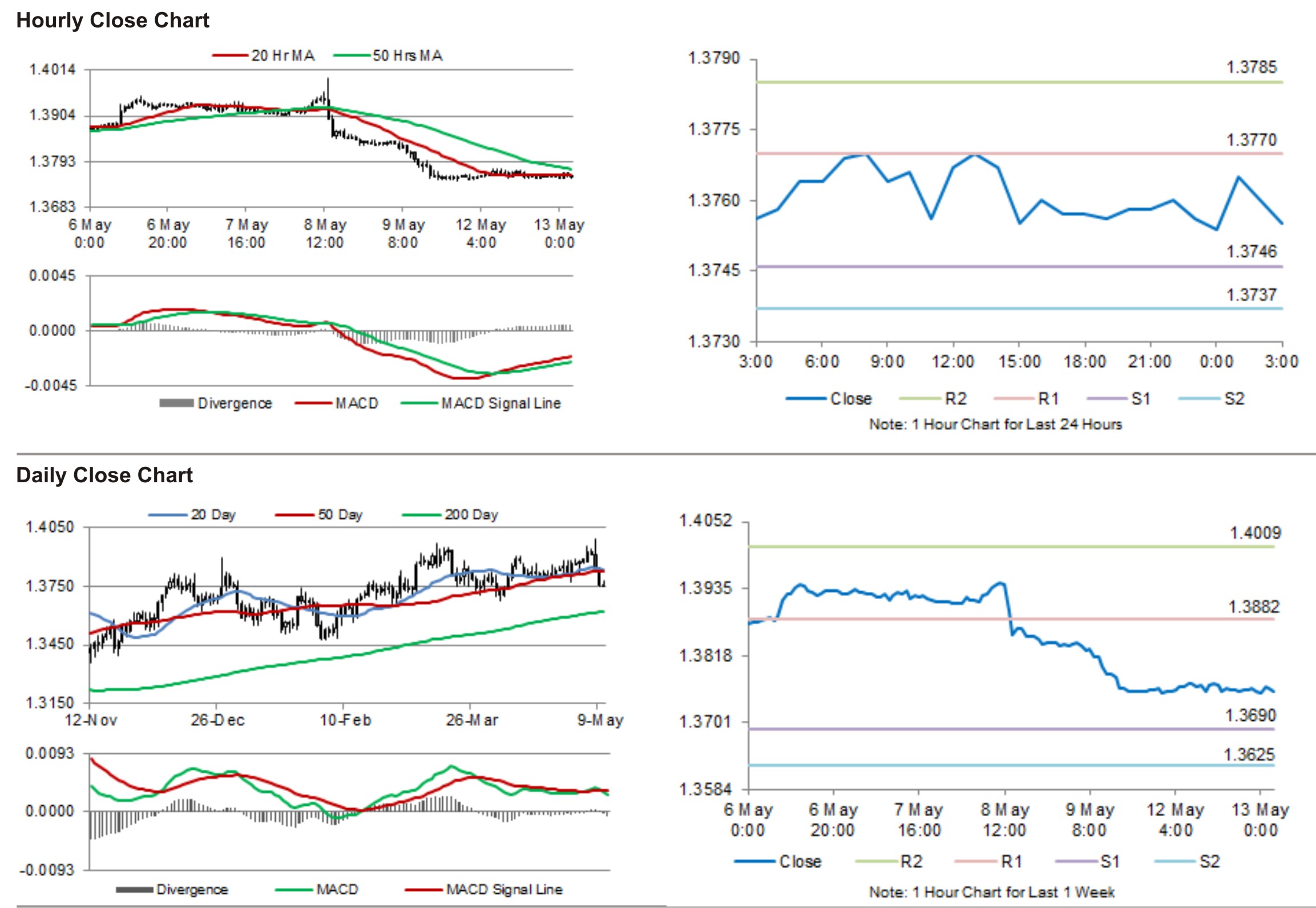

The pair is expected to find support at 1.3746, and a fall through could take it to the next support level of 1.3737. The pair is expected to find its first resistance at 1.3770, and a rise through could take it to the next resistance level of 1.3785.

Later today, traders would keep a close watch over the release of the ZEW survey data for the Euro-zone and the German economy, along with the US April retail sales data, for cues in the currency pair.

The currency pair is showing convergence with its 20 Hr moving average and is trading just below its 50 Hr moving average.