For the 24 hours to 23:00 GMT, the GBP rose 0.08% against the USD and closed at 1.6871.

On Monday, the Confederation of British Industries (CBI), in its latest forecast report, upgraded its growth projections on the Britain economy to 3.0% in 2014 and 2.7% in 2015, from its earlier growth estimate of 2.6% and 2.5%, respectively. However, at the same time, the agency also drew attention to the political uncertainty and unsustainable UK house price inflation, warning that they continue to pose a risk to the nation’s economic recovery.

In the Asian session, at GMT0300, the pair is trading at 1.6873, with the GBP trading slightly higher from yesterday’s close. Early morning, data showed that the BRC retail sales monitor in the UK rebounded 4.2% (YoY) in April following two months of decline, as spending on furniture and flooring grew at its fastest rate since Easter 2006 in April.

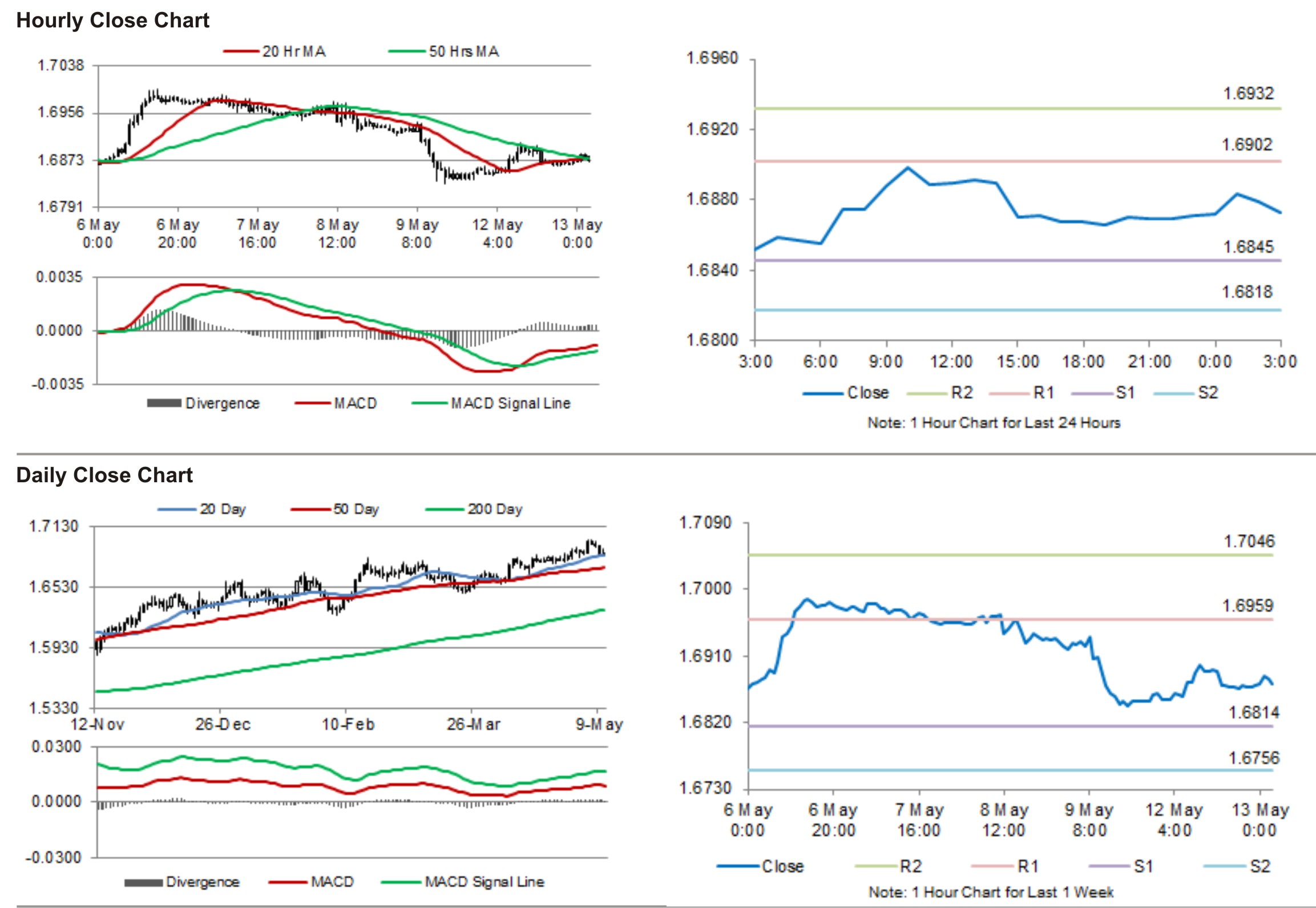

The pair is expected to find support at 1.6845, and a fall through could take it to the next support level of 1.6818. The pair is expected to find its first resistance at 1.6902, and a rise through could take it to the next resistance level of 1.6932.

With no major economic releases from the UK economy, later today, traders are expected to keep a tab on global economic news, along with the US retail sales data, for further guidance in the currency pair.

The currency pair is showing convergence with its 20 Hr and 50 Hr moving averages.