For the 24 hours to 23:00 GMT, EUR traded flat against the USD and closed at 1.3704, in a thin holiday trade.

Yesterday, the ECB Chief, Mario Draghi, asserted that he may act to counter low inflation as soon as next month, increasing speculation that the central bank may opt for monetary policy easing at its next monthly meeting in March.

Earlier during the day, the ECB Governing Council member, Ewald Nowotny opined that interest rates in the Euro-zone would remain at current or lower level as long as inflation in the region does not surpass the 2% threshold limit. Furthermore, he indicated that the ECB was still mulling the option of using negative interest rate as a likely mechanism to shore up the fragile economic recovery in the region.

Meanwhile, in a press conference following the Eurogroup meeting in Brussels, the Eurogroup President, Jeroen Dijsselbloem, expressed optimism on the recovery of the Euro-zone economy. Additionally, the EU Commissioner for Economic and Monetary Affairs, Olli Rehn, stated that the economic recovery in the region was gradually gaining strength despite it being subdued owing to the lingering impact of financial crisis and economic recession in the region. Similarly, the OECD too reported that the Euro-zone was showing signs of recovery, but cautioned that the outlook for growth was still weak and inconsistent. Furthermore, the OECD urged for more policy reform efforts that would support the recovery, promote competitiveness, and boost job creation in the region.

On the economic front, data from Greece showed that the harmonised consumer prices index fell less-than-expected 1.4% (YoY) in January, following a 1.8% (YoY) drop registered in the preceding month.

In a key development, Italian President Giorgio Napolitano has nominated Matteo Renzi Prime Minister, thus giving him the mandate to form a new cabinet. EU’s Economic Chief Olli Rehn expressed confidence that the new government would continue to pursue economic reforms and address important issues.

In the Asian session, at GMT0400, the pair is trading at 1.3712, with the EUR trading 0.06% higher from yesterday’s close.

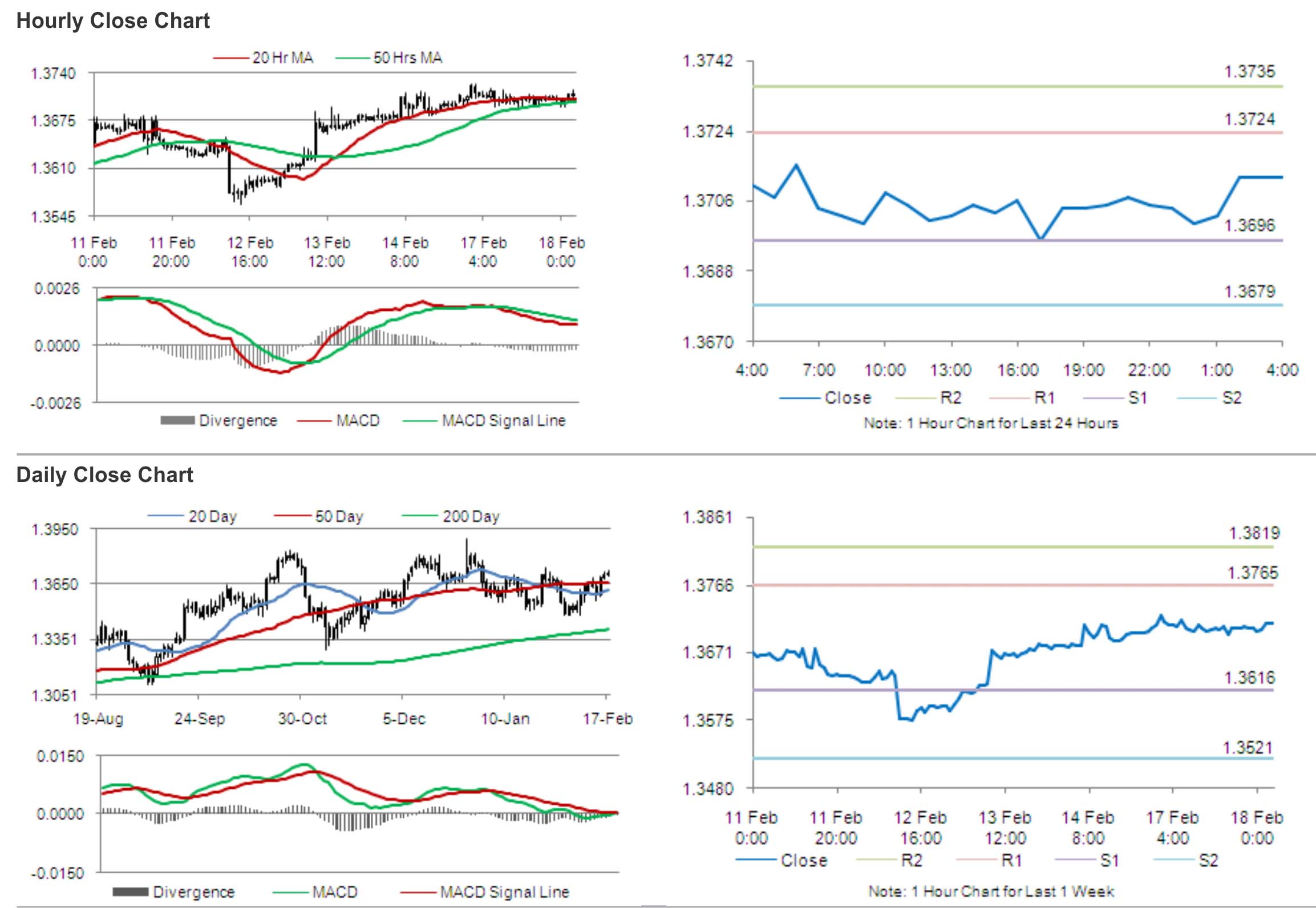

The pair is expected to find support at 1.3696, and a fall through could take it to the next support level of 1.3679. The pair is expected to find its first resistance at 1.3724, and a rise through could take it to the next resistance level of 1.3735.

Market participants keenly await the ZEW survey on Euro-zone’s economic sentiment, which is widely expected to show an improvement in February. Traders are also expected to keep a tab on the outcome of the EcoFin meeting, scheduled to commence later today.

The currency pair is showing convergence with its 20 Hr and 50 Hr moving averages.