For the 24 hours to 23:00 GMT, EUR rose 0.66% against the USD and closed at 1.3676.

The US Dollar came under pressure as the US retail sales missed expectations and declined 0.4% (MoM) in January and after weekly jobless claims unexpectedly rose by 8,000 claims to 339,000, last week.

Meanwhile, in the Euro-zone, the ECB, in its monthly report, reiterated its view for interest rate in the region to remain at current or lower levels for a prolonged period of time. The central bank also expressed concern on the fragile recovery of the Euro-zone and cited a subdued medium-term inflation outlook for the economy. Separately, the ECB Executive Board Member, Benoit Coeure highlighted the central bank’s readiness to resort to negative interest rate in the region if it sees a further deterioration in the Euro-bloc’s inflation rate.

In economic releases, data showed that consumer inflation rate in Germany rose 1.3% (YoY) in January, from a 1.4% increase registered in the preceding month.

Meanwhile, political setbacks continue to plague Italy, after Italian Premier Enrico Letta announced that he would be resigning following withdrawal of an essential support from a party rival.

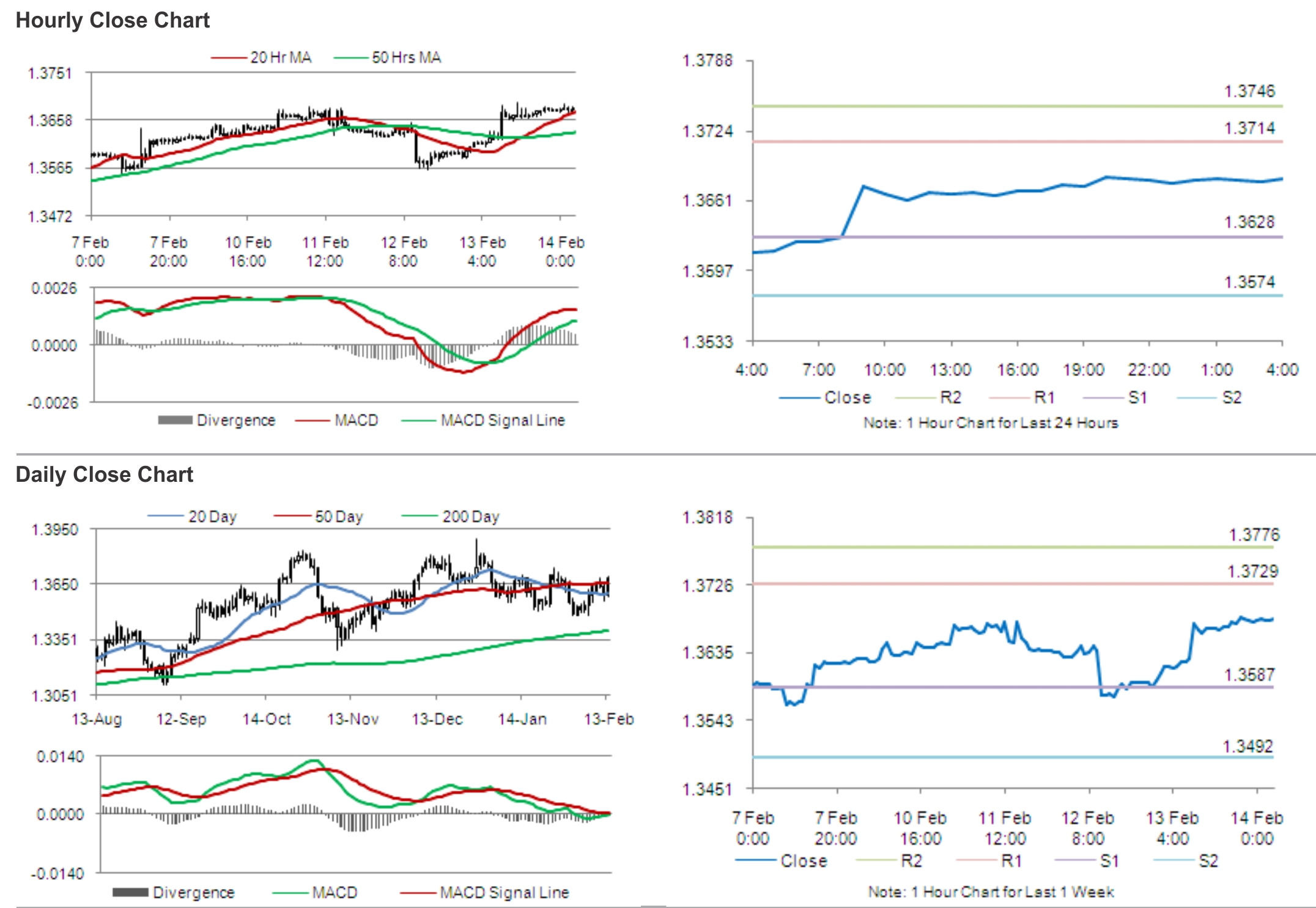

In the Asian session, at GMT0400, the pair is trading at 1.3681, with the EUR trading marginally higher from yesterday’s close.

The pair is expected to find support at 1.3628, and a fall through could take it to the next support level of 1.3574. The pair is expected to find its first resistance at 1.3714, and a rise through could take it to the next resistance level of 1.3746.

Later today, Euro-zone and its periphery nations are expected to release its fourth-quarter Gross Domestic Product (GDP) data.

The currency pair is showing convergence with its 20 Hr moving average and is trading above its 50 Hr moving average.