For the 24 hours to 23:00 GMT, the GBP rose 0.28% against the USD and closed at 1.6656, benefiting from comments of Bank of England (BoE) Chief Economist, Spencer Dale, who opined that, given the current economic outlook, investors’ bet for an interest rate hike next year didn’t seem wrong. However, he cautioned that bad weather and flooding across England may weigh on the economic growth in the first quarter.

Meanwhile, the US Dollar gave up ground against the UK Pound as traders digested a downbeat US retail sales and weekly jobless claims data.

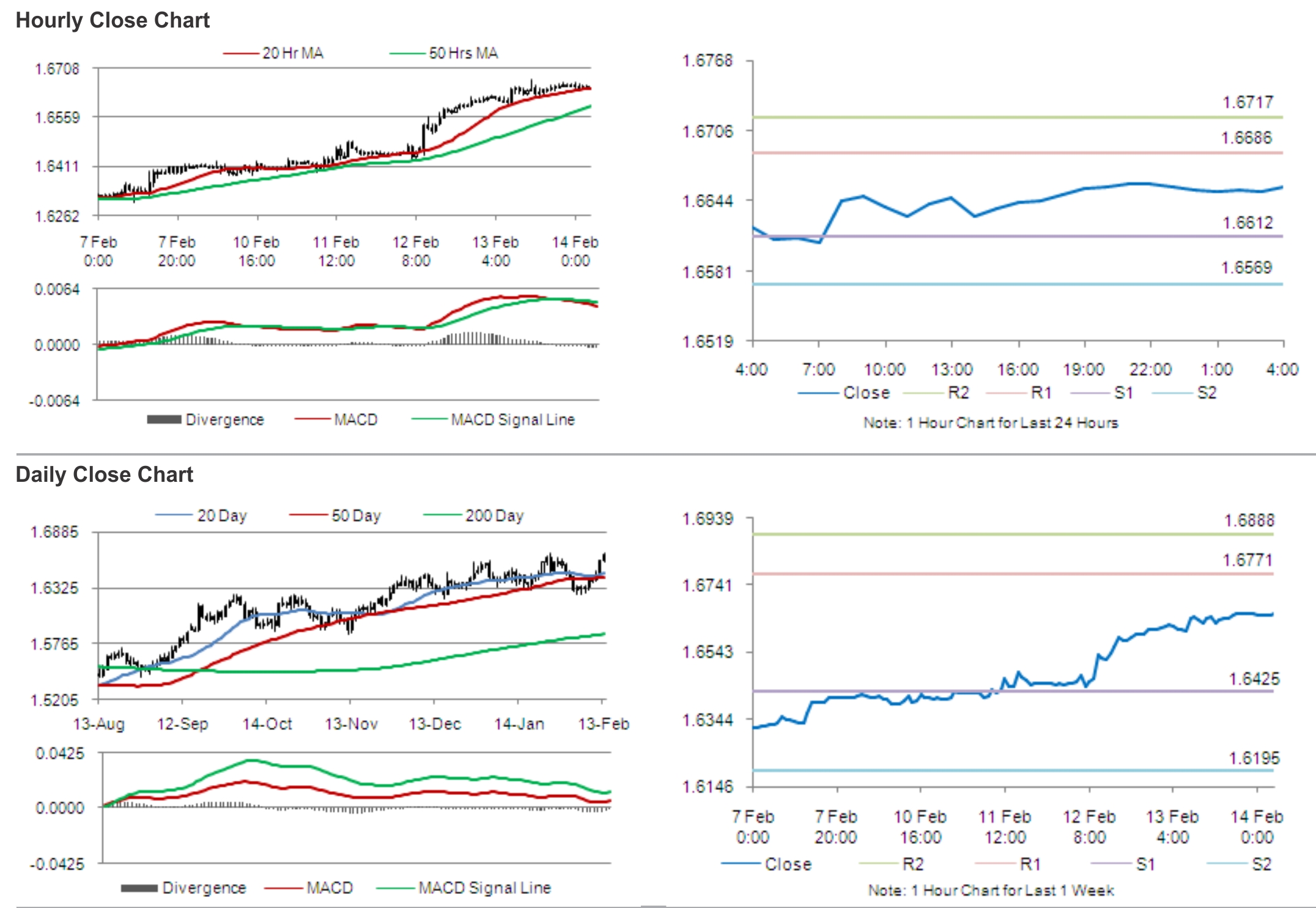

In the Asian session, at GMT0400, the pair is trading at 1.6655, with the GBP trading tad lower from yesterday’s close.

The pair is expected to find support at 1.6612, and a fall through could take it to the next support level of 1.6569. The pair is expected to find its first resistance at 1.6686, and a rise through could take it to the next resistance level of 1.6717.

With no major economic releases from UK, later today, traders are eyeing global economic news for further guidance in the pair.

The currency pair is showing convergence with its 20 Hr moving average and is trading above its 50 Hr moving average.