For the 24 hours to 23:00 GMT, the EUR rose 0.81% against the USD and closed at 1.1275, after the ZEW economic sentiment index in the Eurozone rebounded to a level of 4.6 in August, indicating that investor sentiment is regaining some ground after the Brexit shock. The index registered a reading of -14.7 in the previous month. Meanwhile, the region’s seasonally adjusted trade surplus unexpectedly narrowed to a level of €23.4 billion in June, while markets expected the region to post a trade surplus of €25.3 billion and after recording a revised trade surplus of €24.6 billion in the prior month. Separately, Germany’s ZEW economic sentiment index rebounded less-than-expected to a level of 0.5 in August, compared to market expectations for a rise to a level of 2.0 and after recording a level of -6.8 in the previous month.

The US Dollar lost ground against the majors, after the US consumer price index remained flat on a monthly basis in July, at par with market expectations and compared to an advance of 0.2% in the previous month. On the contrary, the nation’s industrial production climbed the most since November 2014, after it advanced 0.7% in July, reinforcing optimism over the health of the nation’s economy. Markets envisaged for an advance of 0.3%, compared to a revised rise of 0.4% in the prior month. Also, the manufacturing production rose more-than-anticipated by 0.5% on a monthly basis in July, compared to a rise of 0.4% in the previous month whereas markets expected for a rise of 0.3%. Moreover, the nation’s housing starts surprisingly rose 2.1% MoM in July, hitting its highest level in five months, compared to market expectations for a drop of 0.8% and after recording a revised gain of 5.1% in the previous month. On the other hand, building permits unexpectedly dropped 0.1% MoM in July, compared to market expectations for a rise of 0.6%. In the prior month, building permits had recorded an increase of 1.5%.

Meanwhile, the New York Fed President, William Dudley, stated that continuous strength in the nation’s labour market and wage gains would likely increase the possibility of a Fed rate hike as soon as September. Also, the Atlanta Fed Chief, Dennis Lockhart, expressed optimism over the health of the US economy and stated that the economy is strong enough to withstand at least one rate hike this year.

In the Asian session, at GMT0300, the pair is trading at 1.1271, with the EUR trading marginally lower against the USD from yesterday’s close.

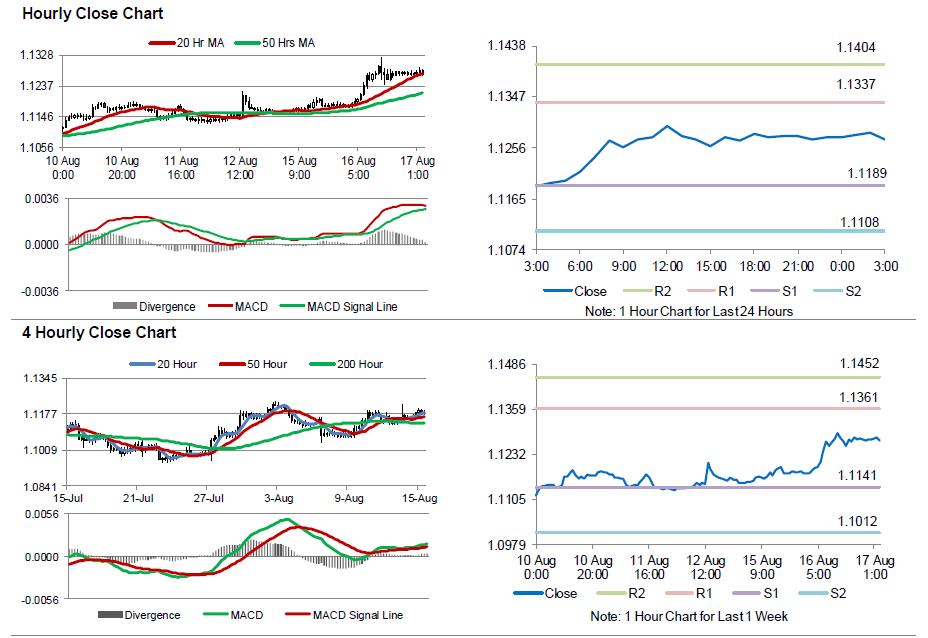

The pair is expected to find support at 1.1189, and a fall through could take it to the next support level of 1.1108. The pair is expected to find its first resistance at 1.1337, and a rise through could take it to the next resistance level of 1.1404.

Moving ahead, investors would anxiously await the release of the FOMC July meeting minutes, due later in the day.

The currency pair is showing convergence with its 20 Hr moving average and trading above its 50 Hr moving average.