For the 24 hours to 23:00 GMT, the GBP rose 1.22% against the USD and closed at 1.3042, after UK’s consumer price index rose more-than-expected by 0.6% YoY in July, hitting its highest level since November 2014. Markets expected for a rise of 0.5%, after recording a rise of 0.5% in the prior month. Meanwhile, on a monthly basis, the consumer price index fell 0.1% in July, in line with market expectations and following a rise of 0.2% in the previous month.

In the Asian session, at GMT0300, the pair is trading at 1.3030, with the GBP trading 0.09% lower against the USD from yesterday’s close.

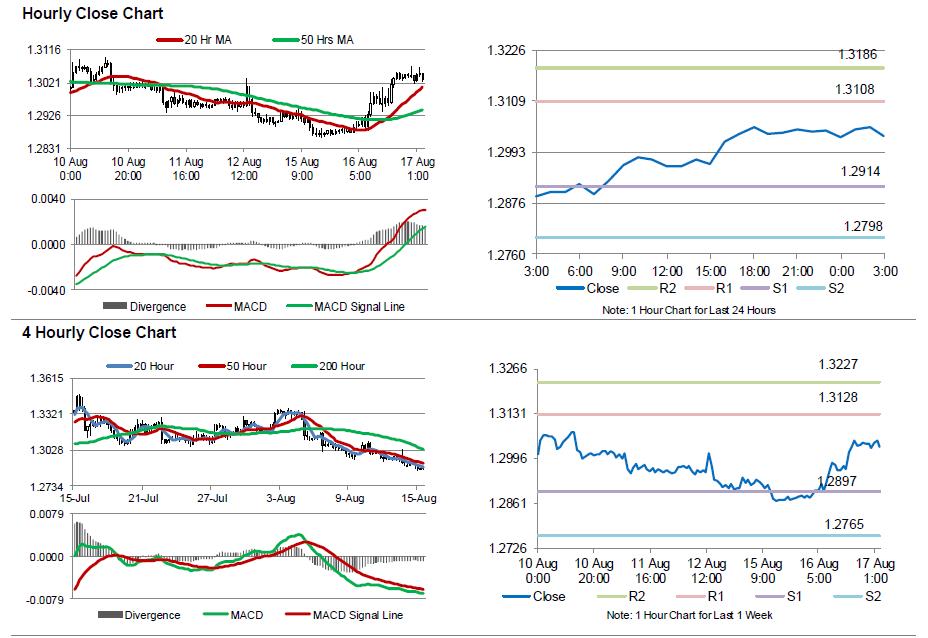

The pair is expected to find support at 1.2914, and a fall through could take it to the next support level of 1.2798. The pair is expected to find its first resistance at 1.3108, and a rise through could take it to the next resistance level of 1.3186.

Moving ahead, market participants would closely monitor UK’s ILO unemployment rate for the three months through June, slated to release in a few hours.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.