For the 24 hours to 23:00 GMT, the EUR rose 0.14% against the USD and closed at 1.3607, after an index, measuring investor sentiment in the Euro-zone, surprisingly rose to a two-month high level of 10.1 in July, from previous month’s level of 8.5. Markets had expected the investor confidence index to decline to a level of 7.8 in July. However, industrial production in Germany unexpectedly tumbled at its fastest pace in almost two years in May. The German industrial production declined 1.8% on a seasonally adjusted basis in May, well below expectations of a flat reading. Additionally, industrial output of Spain also came in below expectations and decelerated in May.

Yesterday, the German Finance Minister, Wolfgang Schauble, stressed the need for structural reform measures to fuel growth in the Euro bloc. On the other hand, ECB Governing Council member, Ewald Nowotny, noted that the recent steps taken by the ECB at its June monetary policy have started to show a considerable impact on the growth of the region.

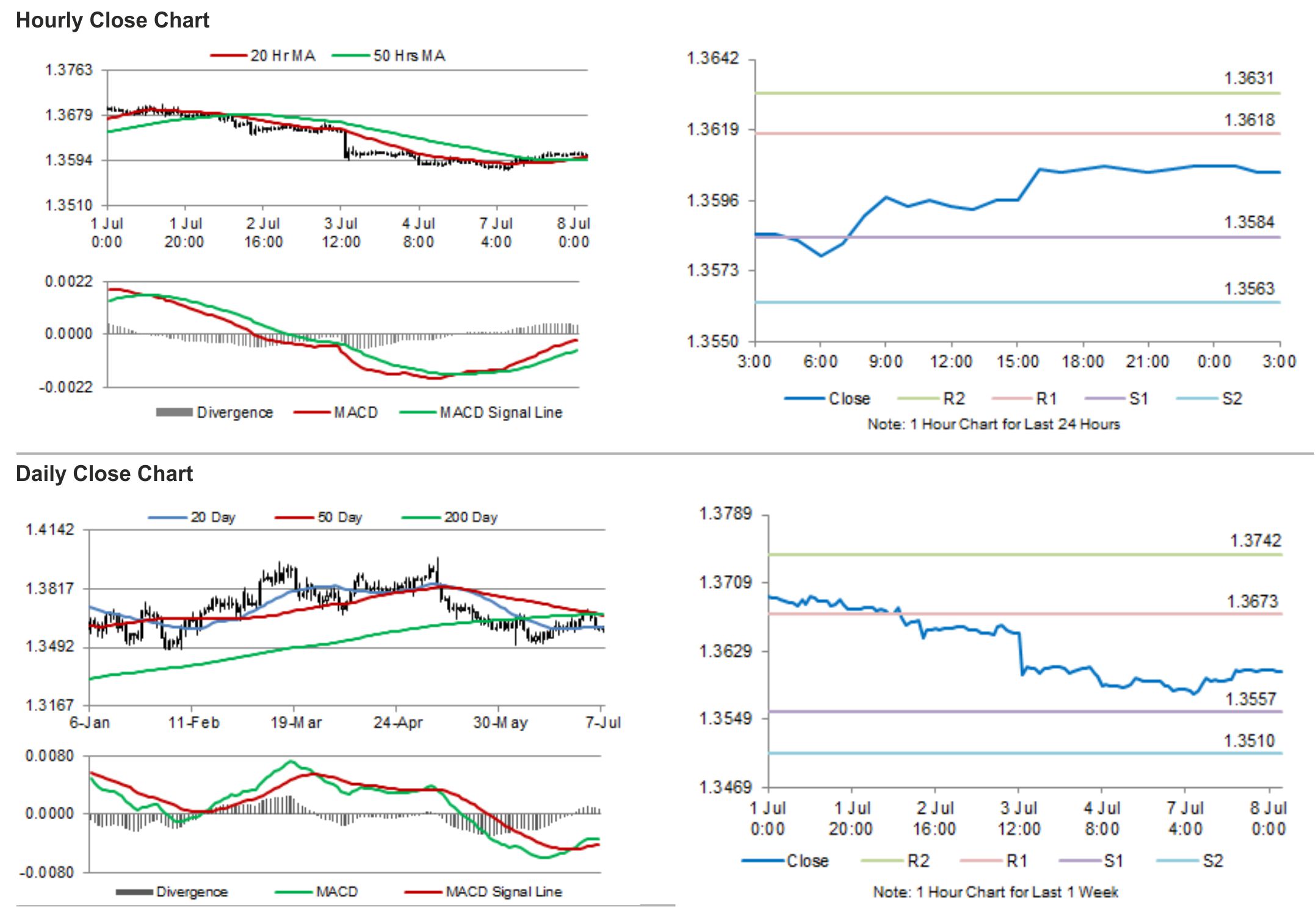

In the Asian session, at GMT0300, the pair is trading at 1.3605, with the EUR trading marginally lower from yesterday’s close.

The pair is expected to find support at 1.3584, and a fall through could take it to the next support level of 1.3563. The pair is expected to find its first resistance at 1.3618, and a rise through could take it to the next resistance level of 1.3631.

Going forward, the trade balance from Germany to be released later during the day would provide further insights in the economic health of the Euro-zone’s second-largest economy.

The currency pair is showing convergence with its 20 Hr and 50 Hr moving averages.