For the 24 hours to 23:00 GMT, the GBP fell 0.12% against the USD and closed at 1.7134. However, losses were kept in check, as the currency continued to enjoy support amid moutning expectations that the BoE would raise its key interest rates in its monetary policy meeting scheduled later during the week.

On the economic front, the employment confidence index in the UK eased to level of 1.0 in June from a level of 4.0 recorded in the previous month.

In the Asian session, at GMT0300, the pair is trading at 1.7131, with the GBP trading tad lower from yesterday’s close.

This morning, the British Chambers of Commerce (BCC), citing a decreasing momentum in the manufacturing and services sectors during the second quarter, cautioned the BoE to not rush into raising interest rates.

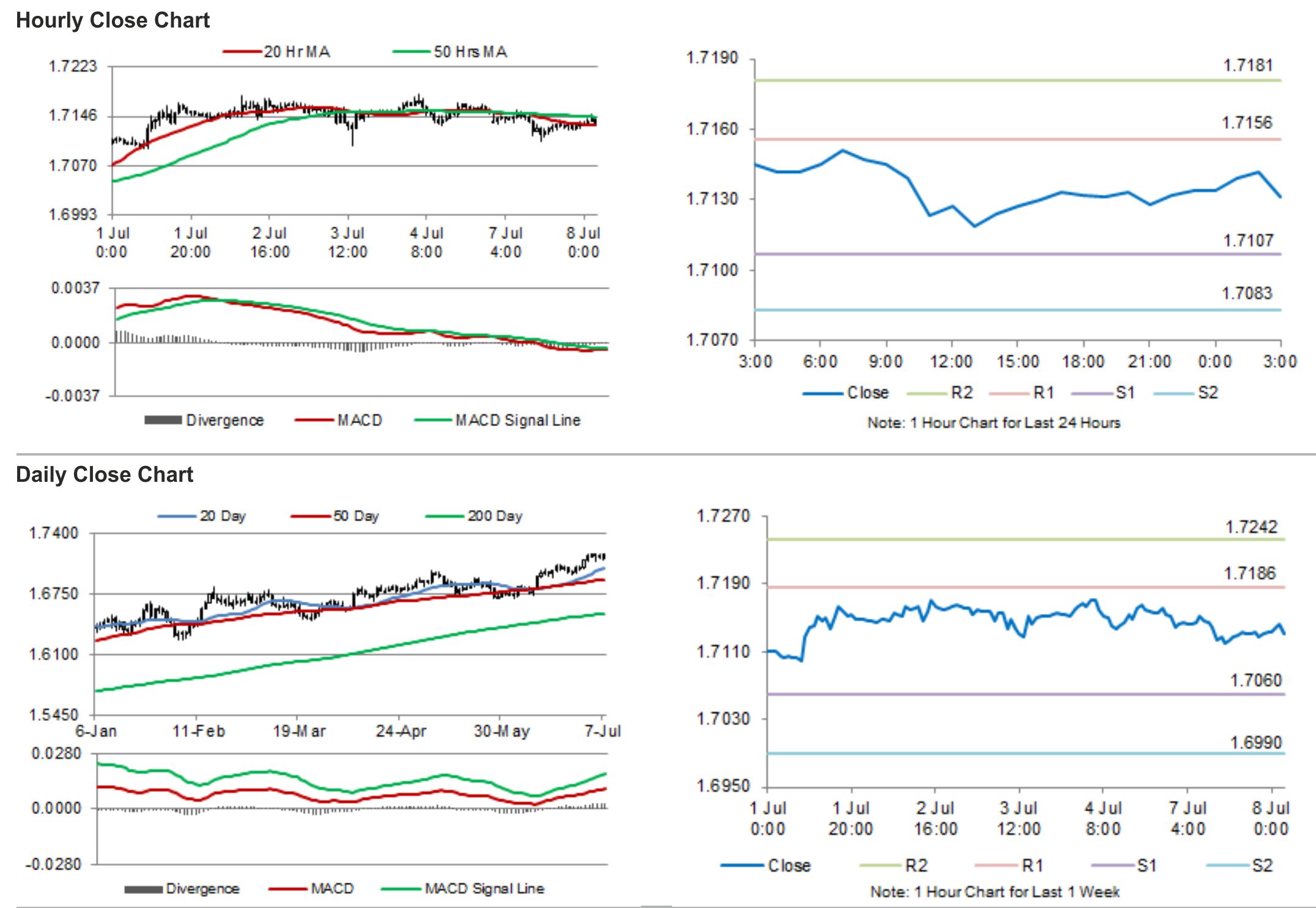

The pair is expected to find support at 1.7107, and a fall through could take it to the next support level of 1.7083. The pair is expected to find its first resistance at 1.7156, and a rise through could take it to the next resistance level of 1.7181.

Trading trends in the pair today are expected to be determined by the UK industrial and manufacturing production report to be released later during the day. Meanwhile, the NIESR GDP estimate would report the pace of growth in the UK during the second quarter, considering last week’s largely upbeat economic releases.

The currency pair is showing convergence with its 20 Hr and 50 Hr moving averages.