For the 24 hours to 23:00 GMT, the EUR declined 0.21% against the USD and closed at 1.0549.

On the economic data front, the Euro-zone’s final Markit manufacturing PMI advanced to a level of 55.4 in February, notching its highest level since April 2011, as a weaker Euro led to strong demand for the region’s exports. The PMI had registered a level of 55.2 in the previous month. Market participants were expecting it to remain steady at a level of 55.5, recorded in the preliminary print.

Separately, growth in Germany’s manufacturing sector was revised lower to a level of 56.8 in February, compared to a flash reading of 57.0. However, the PMI expanded at its strongest pace in nearly 6-years, thus suggesting that factories will boost economic growth in the Euro-zone’s largest economy in the first quarter of 2017. The PMI had registered a level of 56.4 in the previous month. Moreover, the nation’s flash consumer price index soared to its highest level in more than four-years, after it jumped 2.2% on an annual basis in February, outstripping the European Central Bank’s (ECB) target and thus intensifying calls for an end to the ECB’s ultra loose monetary policy. Meanwhile, markets anticipated the index to advance 2.1%, compared to a rise of 1.9% in the previous month. Also, the nation’s seasonally adjusted unemployment rate remained unchanged at a record low level of 5.9% in February, at par with market expectations.

The US Dollar advanced against most of its major peers, on speculation that the US Federal Reserve (Fed) could lift interest rates later this month.

Gains in the greenback were boosted further, after the US ISM manufacturing activity index surged to a level of 57.7 in February, pushing the index to its highest level in almost three years and beating market expectations for an advance to a level of 56.2. In the previous month, the index had registered a level of 56.0. Additionally, the nation’s personal income registered a higher-than-expected rise of 0.4% MoM in January, following a gain of 0.3% in the previous month. Meanwhile, personal spending rose less-than-anticipated by 0.2% MoM in January, against an increase of 0.5% in the previous month. Also, the nation’s final Markit manufacturing PMI eased more-than-expected to a level of 54.2 in February, compared to a flash estimate of 54.3 and following a reading of 55.0 in the previous month.

In other economic news, construction spending in US unexpectedly fell 1.0% on a monthly basis in January, dropping to its lowest level in nine months, compared to a revised advance of 0.1% in the prior month. Markets were expecting construction spending to climb 0.6%. On the other hand, the nation’s MBA mortgage applications rebounded 5.8% in the week ended 24 February 2017, after registering a drop of 2.0% in the prior week.

Separately, according to the Fed’s Beige Book report, the US economy expanded at a modest-to-moderate pace from early January through mid-February, while some districts reported “widening labour shortages”. However, it also noted that US business optimism has cooled a bit in the wake of the Presidential election.

Separately, the US President, Donald Trump, in his address to Congress, called for major infrastructure spending of around $1.0 trillion, but did not elaborate on any key details about his economic plans.

In the Asian session, at GMT0400, the pair is trading at 1.0532, with the EUR trading 0.16% lower against the USD from yesterday’s close.

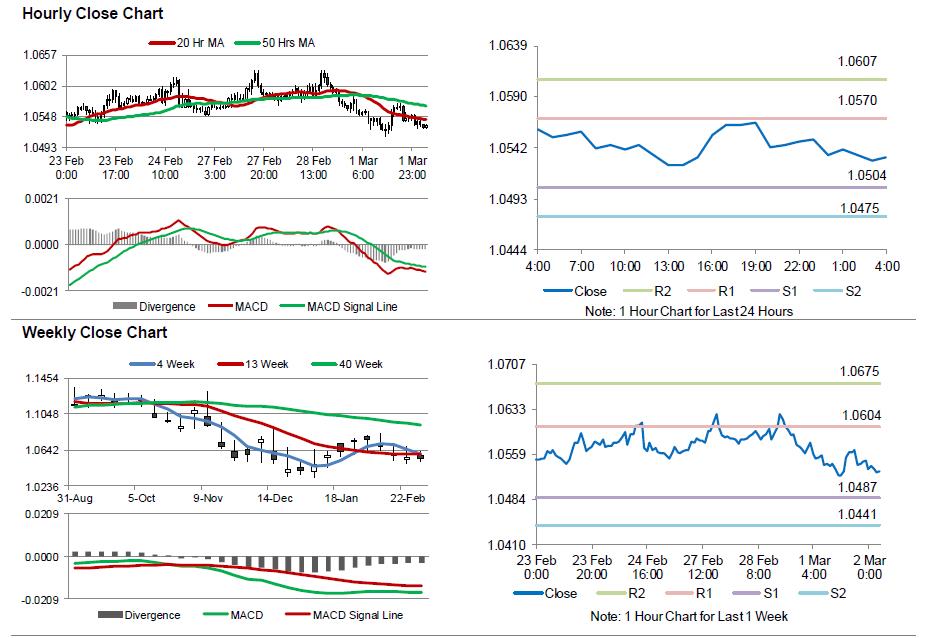

The pair is expected to find support at 1.0504, and a fall through could take it to the next support level of 1.0475. The pair is expected to find its first resistance at 1.0570, and a rise through could take it to the next resistance level of 1.0607.

Trading trend in the Euro is expected to be determined by the release of the Euro-zone’s unemployment rate for January and consumer price index for February, scheduled to release in a few hours. Moreover, the US weekly jobless claims data, set to release later today, will garner a lot of market attention.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.