For the 24 hours to 23:00 GMT, the GBP declined 0.65% against the USD and closed at 1.2295, after data revealed that the pace of manufacturing sector growth in UK unexpectedly slowed in February.

Britain’s Markit manufacturing PMI unexpectedly declined to a level of 54.6 in February, dropping to a three-month low level and compared to market expectations for a rise to a level of 55.8. In the previous month, the PMI had recorded a revised level of 55.7. On the contrary, the nation’s number of mortgage approvals for house purchases climbed more-than-anticipated to a level of 69.9K in January, registering its highest level in nearly a year, compared to a revised reading of 68.3K in the previous month. Investors had envisaged mortgage approvals to advance to a level of 68.7K. Additionally, the nation’s net consumer credit grew by £1.4 billion in January, in line with market expectations and following a gain of £1.0 billion in the prior month.

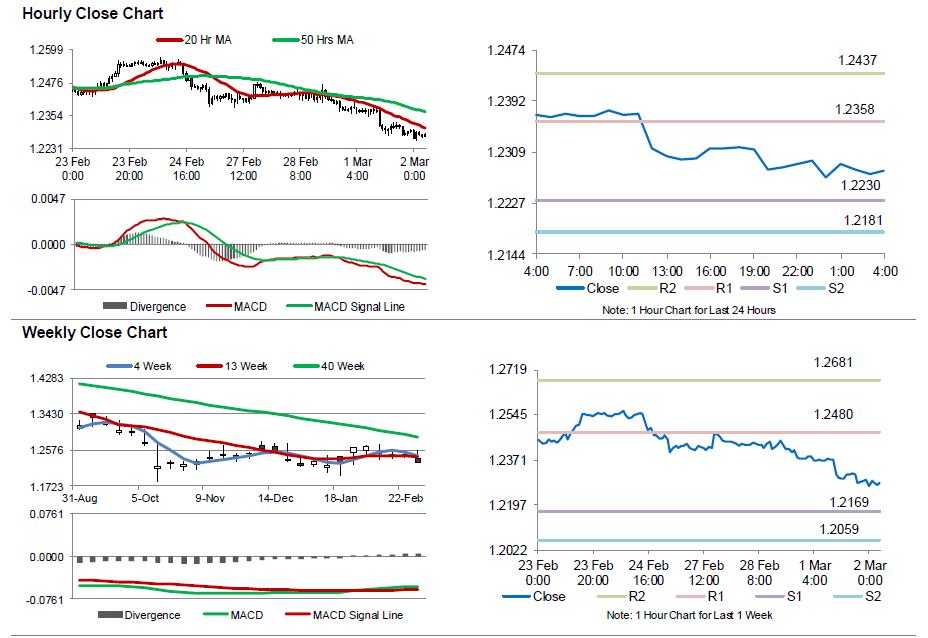

In the Asian session, at GMT0400, the pair is trading at 1.2280, with the GBP trading 0.12% lower against the USD from yesterday’s close.

The pair is expected to find support at 1.2230, and a fall through could take it to the next support level of 1.2181. The pair is expected to find its first resistance at 1.2358, and a rise through could take it to the next resistance level of 1.2437.

Moving ahead, investors will look forward to Britain’s Markit construction PMI for February, slated to release in a few hours.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.