On Friday, EUR rose 0.28% against the USD and closed at 1.3904.

The greenback declined against the Euro-zone’s common currency after the Thomson Reuters/University of Michigan preliminary index on the US consumer confidence fell to a four-month low reading of 79.9 in March, defying market expectations for the index to advance to a reading of 82.0, from previous month’s level of 81.6. Separately, the US producer price index rose less-than-expected 0.9% (YoY) in February, failing to meet analysts’ estimate for a 1.2% rise. Meanwhile, the Dallas Fed President, Richard Fisher, opined that strong 2013-US economic data, including upbeat manufacturing, consumer spending and jobs data in the third quarter, reflects that recovery in the US economy is “proceeding steadily.” Furthermore, he indicated a “sustainable rebound” in the US housing sector, which has been struggling to recover since the last recession.

In the Euro-zone, the Eurostat reported that employment change rose to 0.1% (QoQ) in the fourth-quarter, compared to a flat reading registered in the preceding quarter. Another report from Germany, confirmed that consumer price index in the nation rose 1.2% (YoY) in February, in-line with market estimates and following a 1.3% increase recorded in the previous month.

In a noteworthy event, Moody’s Investors Service upgraded its rating outlook on the European Union to “Stable” from “Negative”, citing improvement in its member nation’s finances and diminishing risks from the Euro-zone debt crisis.

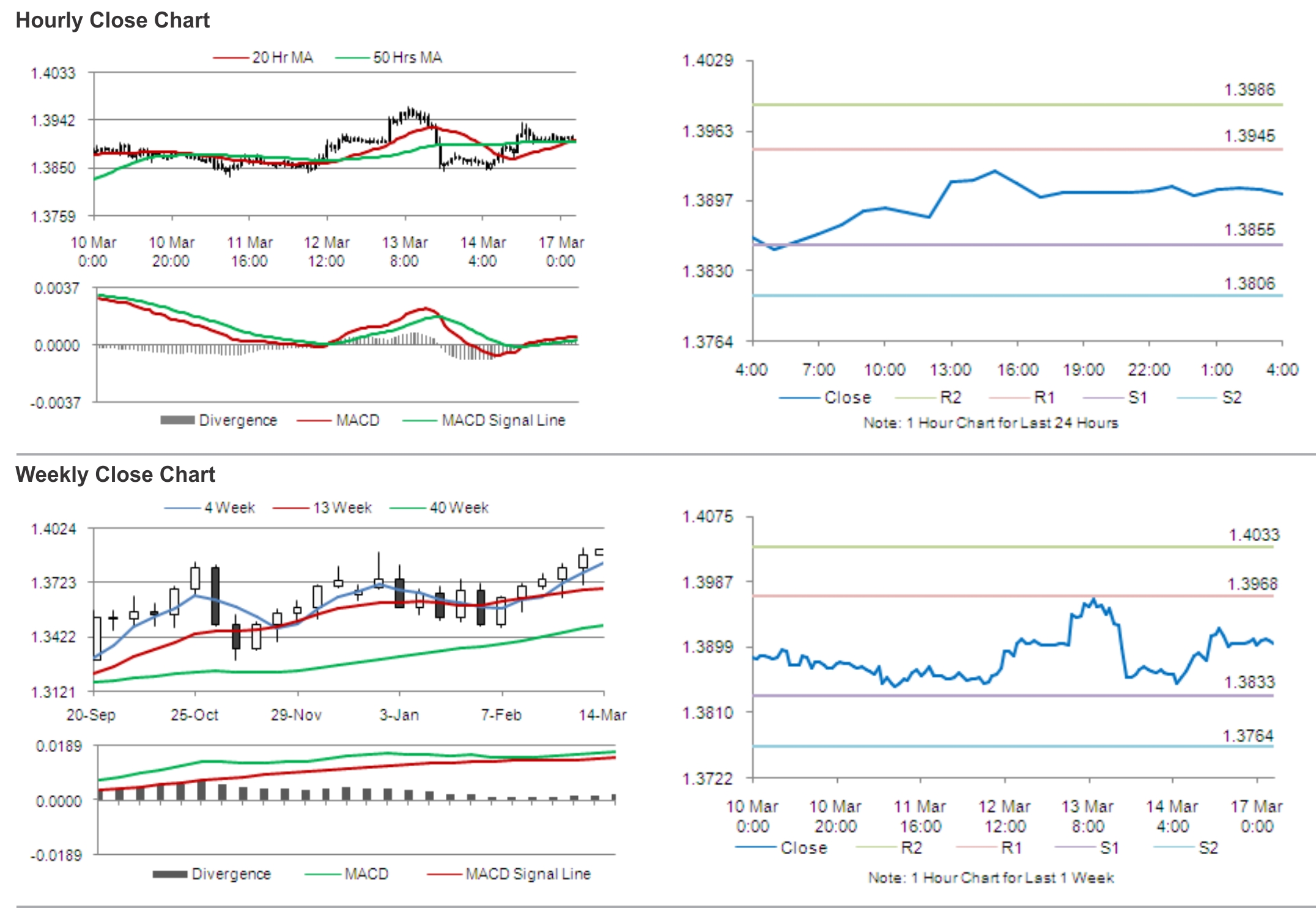

In the Asian session, at GMT0400, the pair is trading at 1.3903, with the EUR trading tad lower from Friday’s close.

The pair is expected to find support at 1.3855, and a fall through could take it to the next support level of 1.3806. The pair is expected to find its first resistance at 1.3945, and a rise through could take it to the next resistance level of 1.3986.

Traders keenly await the Euro-zone’s consumer inflation data, due later today, for further cues in the Euro. Market participants are also expected to keep a tab on the Bundesbank President, Jens Weidmann’s speech, expected to commence later today.

The currency pair is showing convergence with its 20 Hr and 50 Hr moving averages.