On Friday, GBP marginally rose against the USD and closed at 1.6628, as the latter declined following a downbeat consumer sentiment data.

Meanwhile, the British Pound lost ground after an official data revealed that the total trade deficit in UK widened to £2.565 billion in January, from a deficit of £0.668 billion, registered in the previous month. Similarly, the nation’s goods trade deficit also registered a more-than-expected rise to £9.793 billion in January, following previous month’s deficit of £7.662 billion. Separately, the Conference Board reported that its leading economic index rose 0.7% in January, compared to a 0.1% drop recorded in the previous month.

Meanwhile, Charlie Bean, a senior official from the Bank of England (BoE), hinted that growth in the UK economy could come in stronger than what the Office for National Statistics might be expecting.

In the Asian session, at GMT0400, the pair is trading at 1.6630, with the GBP trading marginally higher from Friday’s close. Earlier today, the Rightmove house price index in the UK advanced 1.6% (MoM) in March, following a 3.3% (MoM) rise in the preceding month.

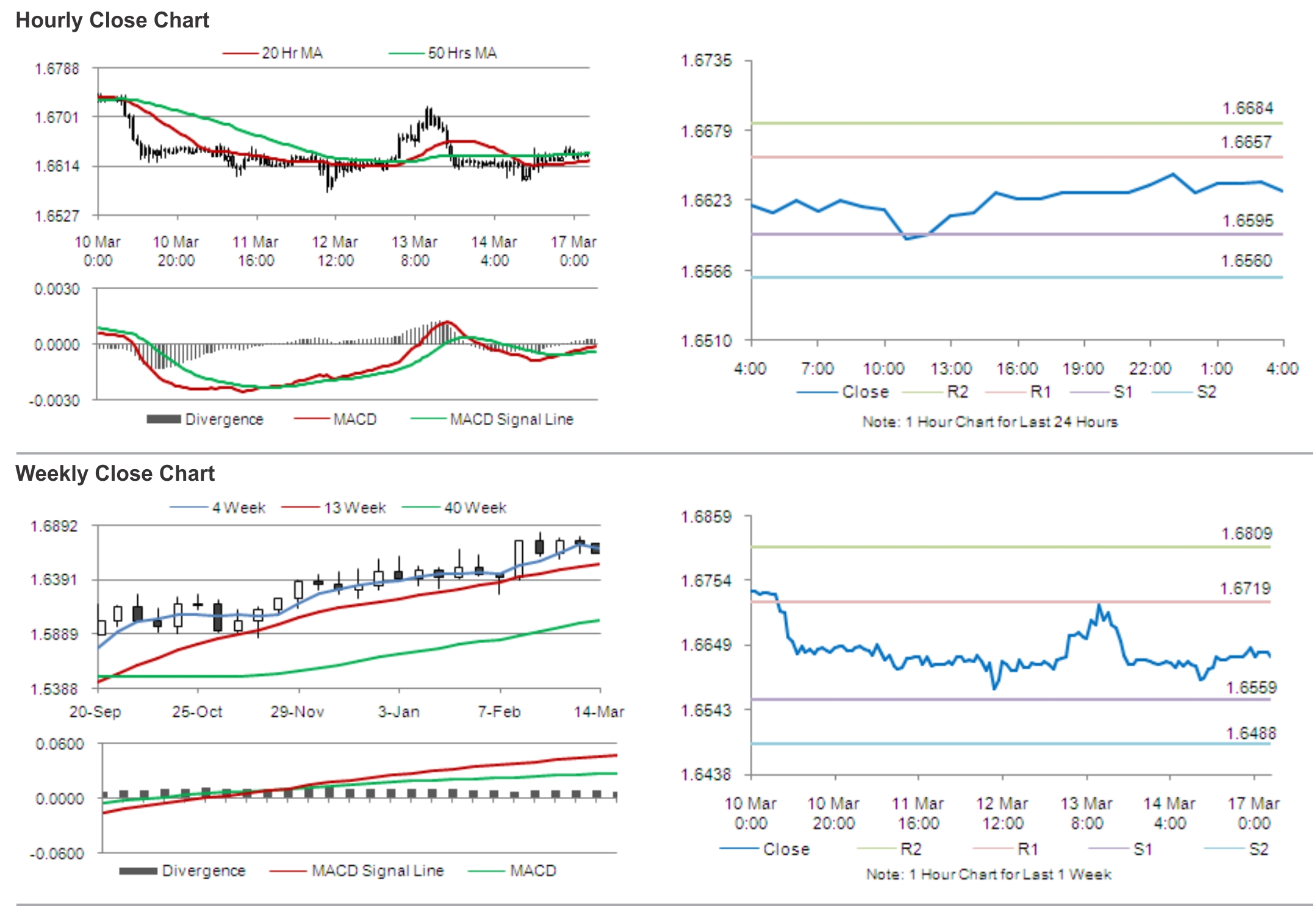

The pair is expected to find support at 1.6595, and a fall through could take it to the next support level of 1.6560. The pair is expected to find its first resistance at 1.6657, and a rise through could take it to the next resistance level of 1.6684.

With no major economic releases in the UK, during the later course of the day, traders would keep an eye on global economic news for further cues in the pair. Meanwhile, the labour data during the week from the UK, would help to gauge the strength of Britain’s economic recovery.

The currency pair is trading just above its 20 Hr moving average and is showing convergence with its 50 Hr moving average.