On Friday, the EUR rose 0.26% against the USD and closed at 1.3648, shrugging off its initial losses, after data showed that consumer prices in Germany, Euro-zone’s largest economy, rose more than expected to 0.3% (MoM) in June. Separately, one of the ECB’s Executive Board member, Yves Mersch rubbished concerns on a deflationary situation in the Euro-zone economy by stating that, “based on our forecasts, we currently see no enhanced or acute deflationary threat.”

In other economic news, consumer confidence in the Euro-zone economy fell to a level of -7.5 in June, defying analysts’ call for an improvement to a reading -6.7. Likewise, Euro-zone economic sentiment deteriorated surprisingly to a reading of 102.0 in June, from a 34-month high level in May.

Meanwhile, in the US, the Reuters/Michigan consumer sentiment index rose above economists’ estimates to a reading of 82.5 in June, from the preliminary reading of 81.2.

During the weekend, in a television interview, St. Louis Fed President, James Bullard, urged the markets to “set aside” the “shockingly negative” estimate of first-quarter US economic growth and “look forward”, as he expects the US economy to expand around 3.0% for the rest of the year and the unemployment rate to fall below 6.0% in the second half of 2014.

In the Asian session, at GMT0300, the pair is trading at 1.3644, with the EUR trading slightly lower from Friday’s close.

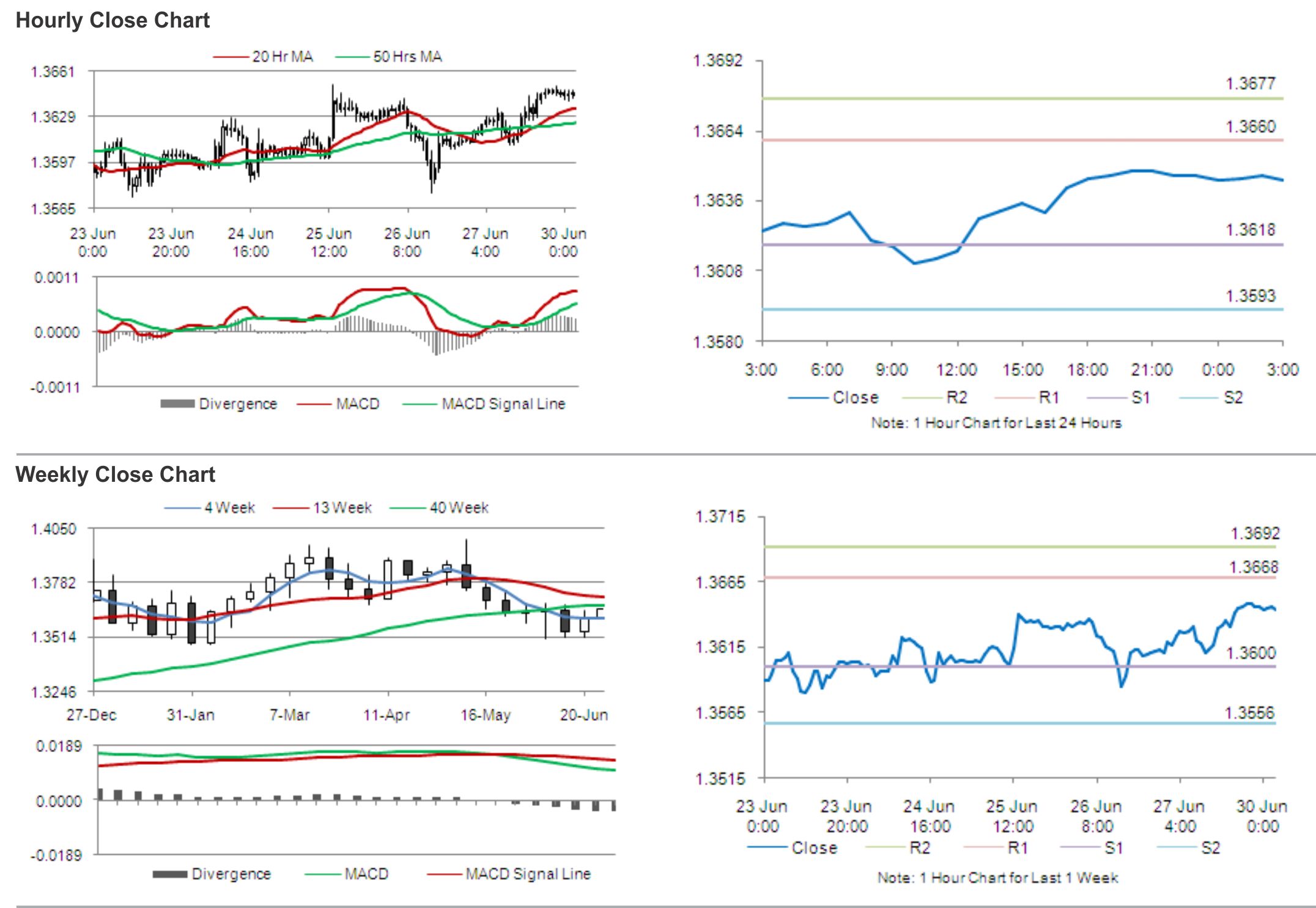

The pair is expected to find support at 1.3618, and a fall through could take it to the next support level of 1.3593. The pair is expected to find its first resistance at 1.3660, and a rise through could take it to the next resistance level of 1.3677.

Later today, traders would keenly await the release of the Euro-zone’s consumer price index data, for further insight into ECB’s future policy decisions.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.