On Friday, the GBP rose 0.09% against the USD and closed at 1.7044, as data confirmed that UK GDP rose 0.8% (QoQ) in the first quarter, faster than the 0.7% pace of rise in the preceding quarter, helped by strong business investment in the economy. Separately, UK current account deficit narrowed to £18.5 billion in the first-quarter, from a revised £23.5 billion deficit in the previous quarter, however it failed to meet analysts’ projection for the deficit to narrow to £17.3 billion.

Meanwhile, during his interview with BBC on Saturday, BoE Governor, Mark Carney, hinted that interest rates in the UK economy would not rise to levels previously considered “normal” with the benchmark interest rate not likely to rise much above 2.5%. In another interview with Belfast Telegraph newspaper, Mark Carney, noted the current strength in the UK Pound’s and highlighted the central bank’s intentions to hike interest rates in a “limited and gradual” manner from the current record low 0.5%. Separately, BoE’s Charlie Bean, in an interview to Sky television, projected the central bank to unwind its quantitative easing programme of bond purchases once it starts hiking its interest rates in the nation.

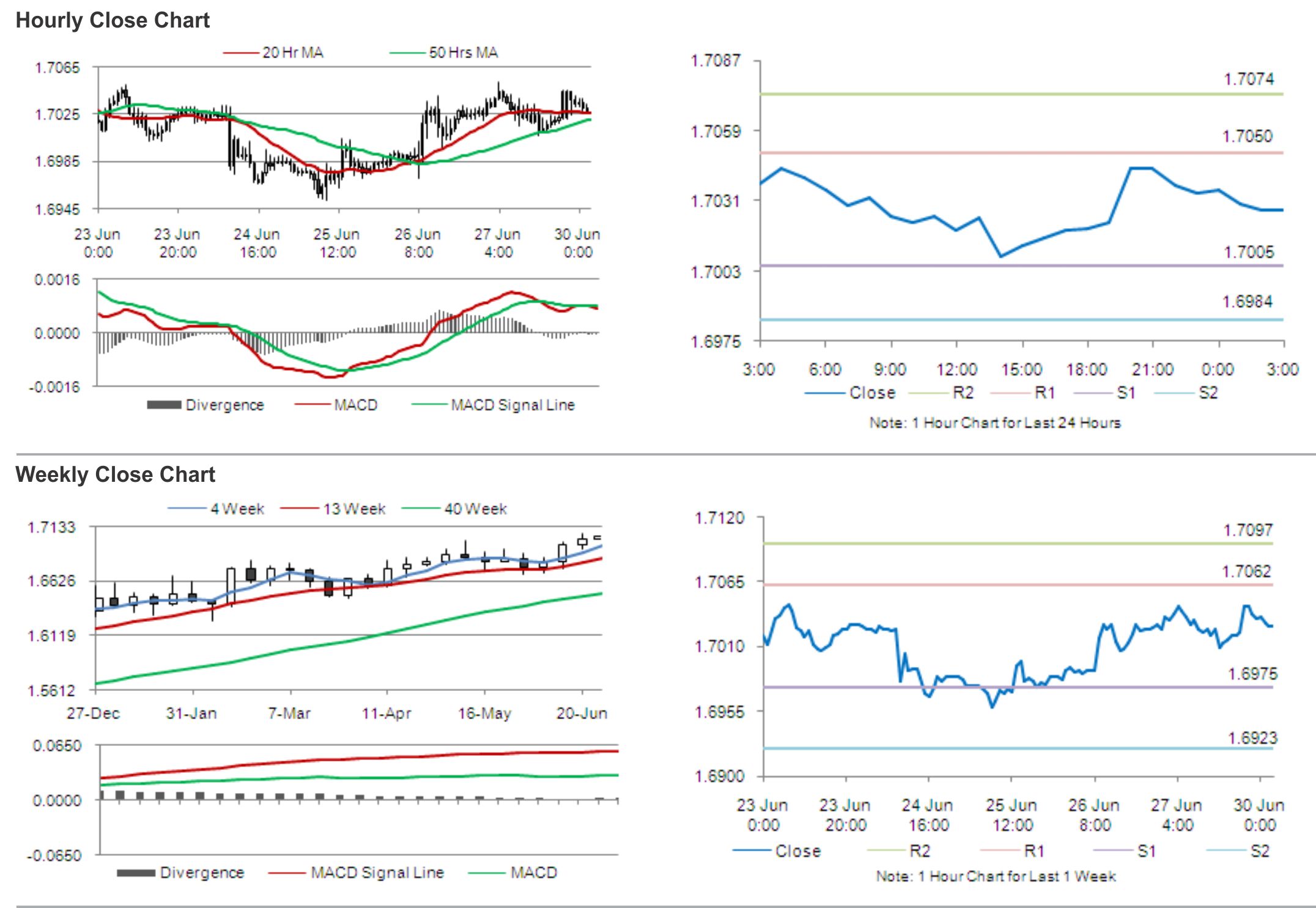

In the Asian session, at GMT0300, the pair is trading at 1.7027, with the GBP trading 0.10% lower from Friday’s close.

The pair is expected to find support at 1.7005, and a fall through could take it to the next support level of 1.6984. The pair is expected to find its first resistance at 1.7050, and a rise through could take it to the next resistance level of 1.7074.

During the later course of the day, market participants would count on mortgage approvals and net lending to individuals data, for further cues in the British Pound.

The currency pair is showing convergence with its 20 Hr moving average and is trading just above its 50 Hr moving average.