For the 24 hours to 23:00 GMT, EUR rose 0.28% against the USD and closed at 1.3742, after an ECB board member, Yves Mersch eased concerns on QE measures in the Euro-zone economy by stating that “there’s a very big difference between QE in theory and actually implementing it.” Furthermore, he indicated that he sees no imminent risk of an economically damaging fall in the economy’s consumer prices. Separately, another ECB policymaker, Ewald Nowotny, opined that he did not see an immediate need for the central bank to take steps against low inflation in the region because the strengthening economy could itself reduce the danger of deflation in the Euro-zone. However, the ECB Vice President, Vitor Constancio hinted that the central bank is determined to keep an accommodative policy stance to counter expectations for a prolonged period of low inflation rate in the Euro-zone. He further urged the Governing Council to reconsider its medium-term inflation outlook, as March’s inflation rate had come as a huge surprise to the ECB and negative inflation would be hugely damaging to the region.

Positive sentiment for the Euro-zone’s shared currency was also fuelled after industrial production in Germany rose more than expected for the fourth consecutive month in February and after the Sentix investor confidence rose to a reading of 14.1 in April, from previous month’s level of 13.9.

Meanwhile, in the US, the St. Louis Fed President, James Bullard commended the impact of the central bank’s easy-money policies on the economic growth of the nation and stated that the rebound in hiring during March indicates that the recovery in the nation is once again gaining momentum, after being hit by adverse climatic conditions during the start of the year.

On the economic front, consumer credit in the US rose more than market expectations by $16.49 billion in February, following a revised rise of $13.80 billion recorded in the prior month.

In the Asian session, at GMT0300, the pair is trading at 1.3743, with the EUR trading tad higher from yesterday’s close.

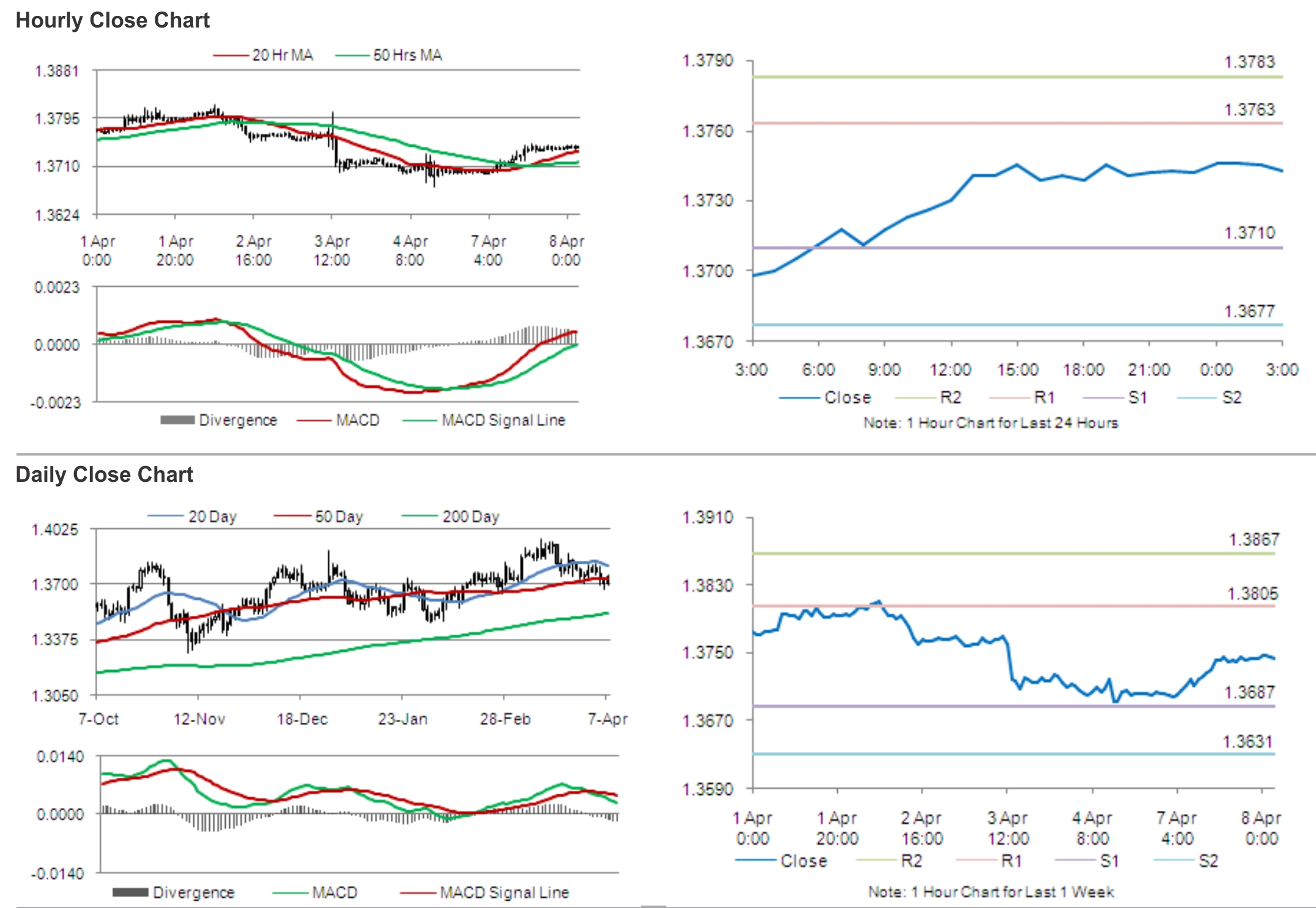

The pair is expected to find support at 1.3710, and a fall through could take it to the next support level of 1.3677. The pair is expected to find its first resistance at 1.3763, and a rise through could take it to the next resistance level of 1.3783.

Amid lack of major economic releases in the Euro-zone and the US during the later course of the day, traders would eye global economic news for further cues in the currency pair.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.