For the 24 hours to 23:00 GMT, GBP rose 0.17% against the USD and closed at 1.6608, in a subdued trading session on Monday.

Yesterday, the Office for National Statistics noted that despite the recent substantial GDP growth, the UK economy has recovered only little of the ground lost during the deep recession of 2008-09. Separately, the UK Chancellor, George Osborne unveiled a financial support package for British exporters in order to spur trade and achieve the government’s £1 trillion trade target.

On the economic front, the Lloyds employment confidence index in the UK stood at -2.0 in March, compared to -2.0 reported in the previous month.

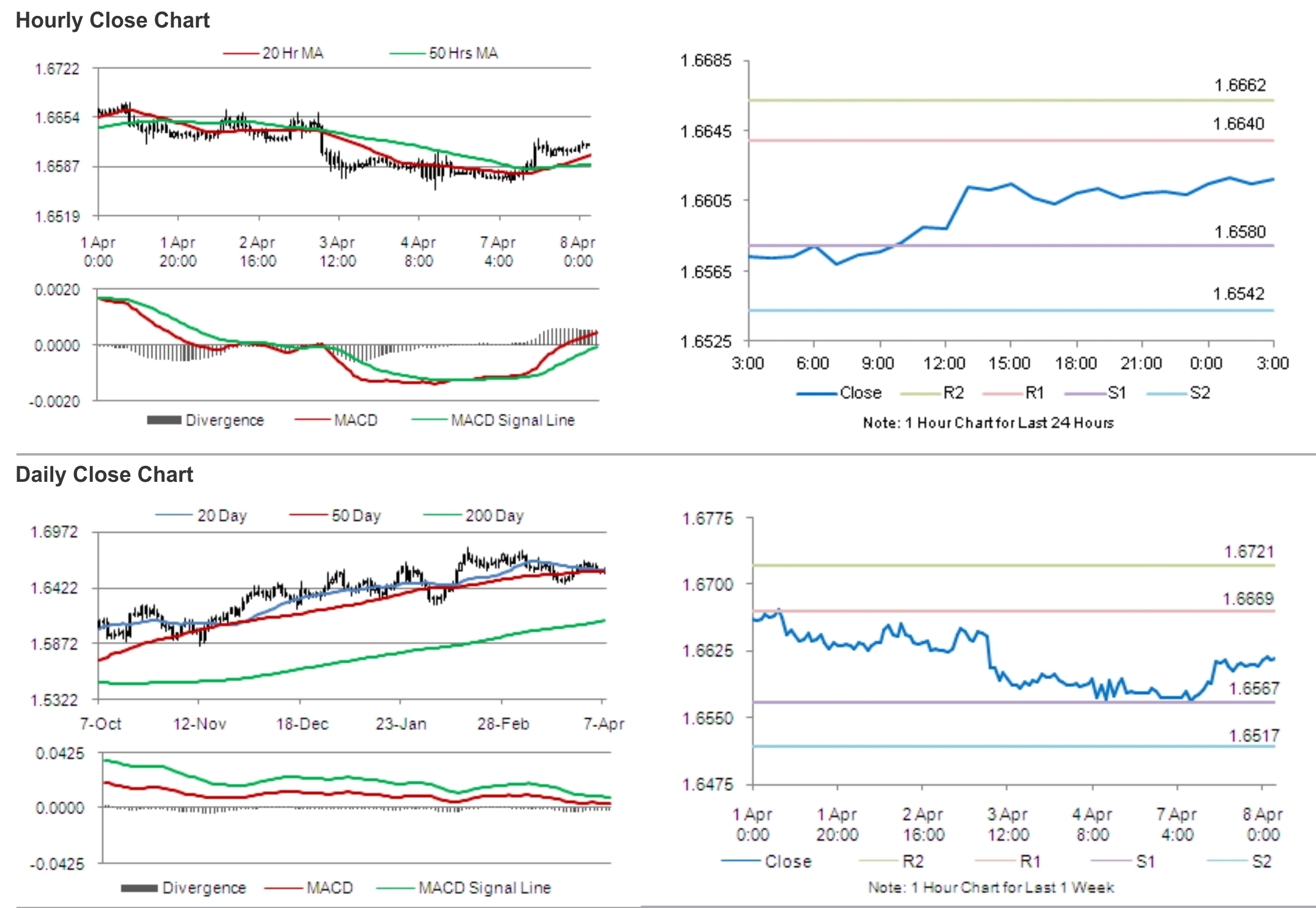

In the Asian session, at GMT0300, the pair is trading at 1.6617, with the GBP trading marginally higher from yesterday’s close.

Earlier this morning, the British Chambers of Commerce (BCC) reported in its survey that the pace of economic recovery in the nation is “not yet secure” and continues to be “short term” in nature, as the growth in the nation is hugely dependent on consumer spending, while the personal debt levels were “too high”. Furthermore, the survey revealed that the services firms in the UK registered the fastest growth in exports on record in the first quarter of 2014 and manufacturers too got off to a strong start to the year.

The pair is expected to find support at 1.6580, and a fall through could take it to the next support level of 1.6542. The pair is expected to find its first resistance at 1.6640, and a rise through could take it to the next resistance level of 1.6662.

Traders keenly await UK’s industrial production, manufacturing production and the NIESR’s GDP estimate data, slated for release later today.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.