For the 24 hours to 23:00 GMT, the EUR declined 0.26% against the USD and closed at 1.3606, as Euro-zone’s debt-ridden banking sector threw up more concerns following news that Portugal’s biggest bank Banco Espirito Santo failed to make its debt payment.

Meanwhile, ECB’s Governing Council member, Ewald Nowotny, rejected calls for additional stimulus measures while another ECB official, Ignazio Visco hinted that the ECB would consider new policy measures, including a QE program, to lift inflation rate in the economy to its 2.0% target.

On the economic front, industrial production of France surprisingly dropped in May, while the June inflation rate in the nation eased to its lowest level since the financial crisis in 2009. Furthermore, the ECB, in its monthly report, indicated that the central bank would pay close attention to both upside and downside risks to the Euro-zone’s price stability and further assured that it would stick to its earlier vow of using unconventional policy measures to combat threats of low inflation in the economy.

The US Dollar rose after data revealed that the number of Americans filing new claims for unemployment benefits declined to a lowest level in seven years last week, suggesting an improvement in the labour market. Additionally, the wholesale inventories also reported a rise in May.

Kansas City Federal Reserve President, Esther George suggested that the recent positive developments in the labour market and the inflation rates rising closer to its target are all indicating for an interest rate hike as early as this year.

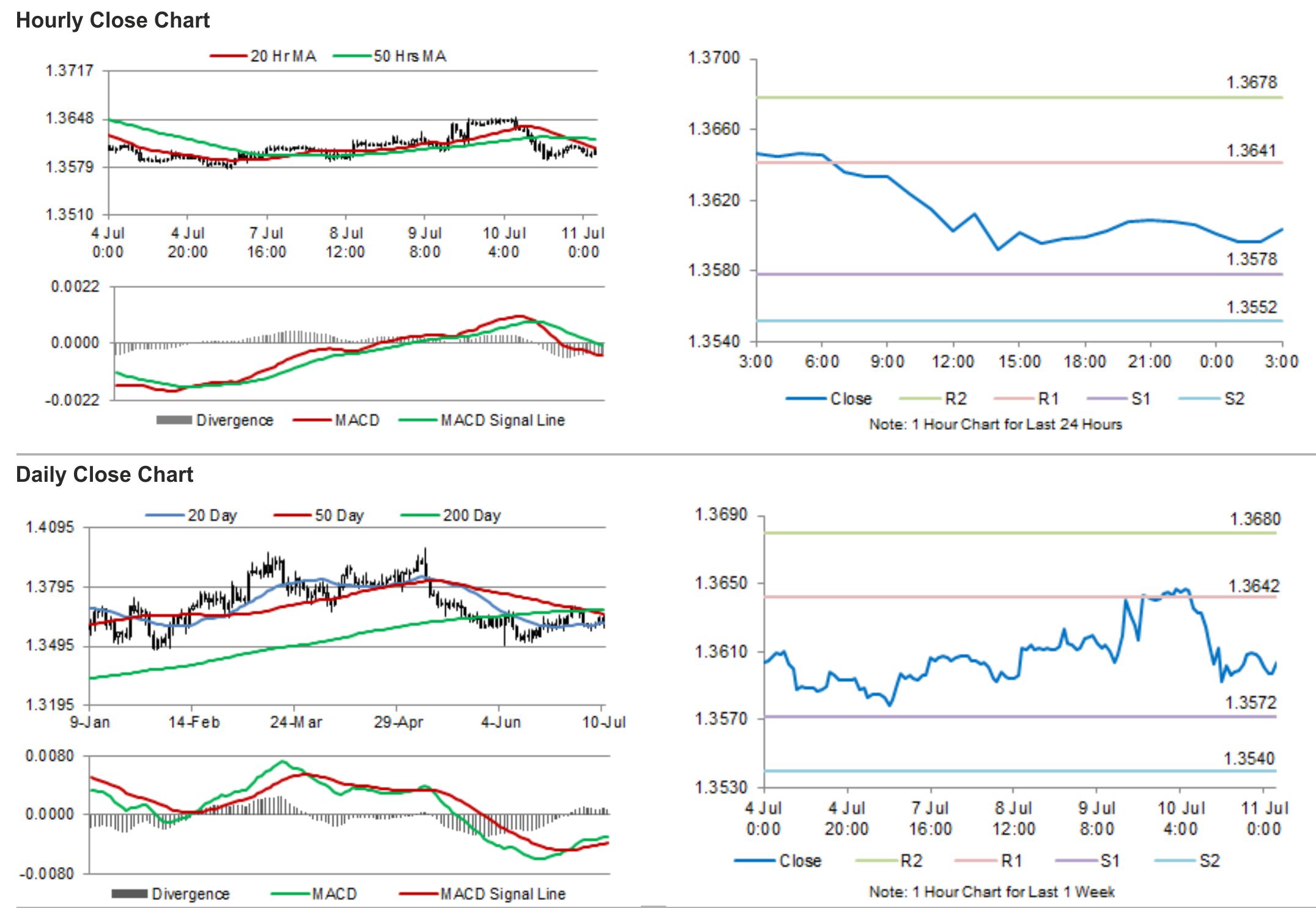

In the Asian session, at GMT0300, the pair is trading at 1.3604, with the EUR trading 0.01% lower from yesterday’s close.

The pair is expected to find support at 1.3578, and a fall through could take it to the next support level of 1.3552. The pair is expected to find its first resistance at 1.3641, and a rise through could take it to the next resistance level of 1.3678.

Trading trends in the pair today are expected to be determined by German inflation rate data and US monthly budget statement to be released later during the day.

The currency pair is showing convergence with its 20 Hr moving average and is trading below its 50 Hr moving average.