For the 24 hours to 23:00 GMT, the GBP fell 0.15% against the USD and closed at 1.7129, after trade deficit in the UK unexpectedly widened to £2.4 billion in May, raising fears that the strength of the British Pound may be weighing on the nation’s exports.

Yesterday, the Bank of England (BoE) left its main interest rate at a low of 0.5% and the size of its asset purchase program unchanged at £375 billion.

In the Asian session, at GMT0300, the pair is trading at 1.7134, with the GBP trading marginally higher from yesterday’s close.

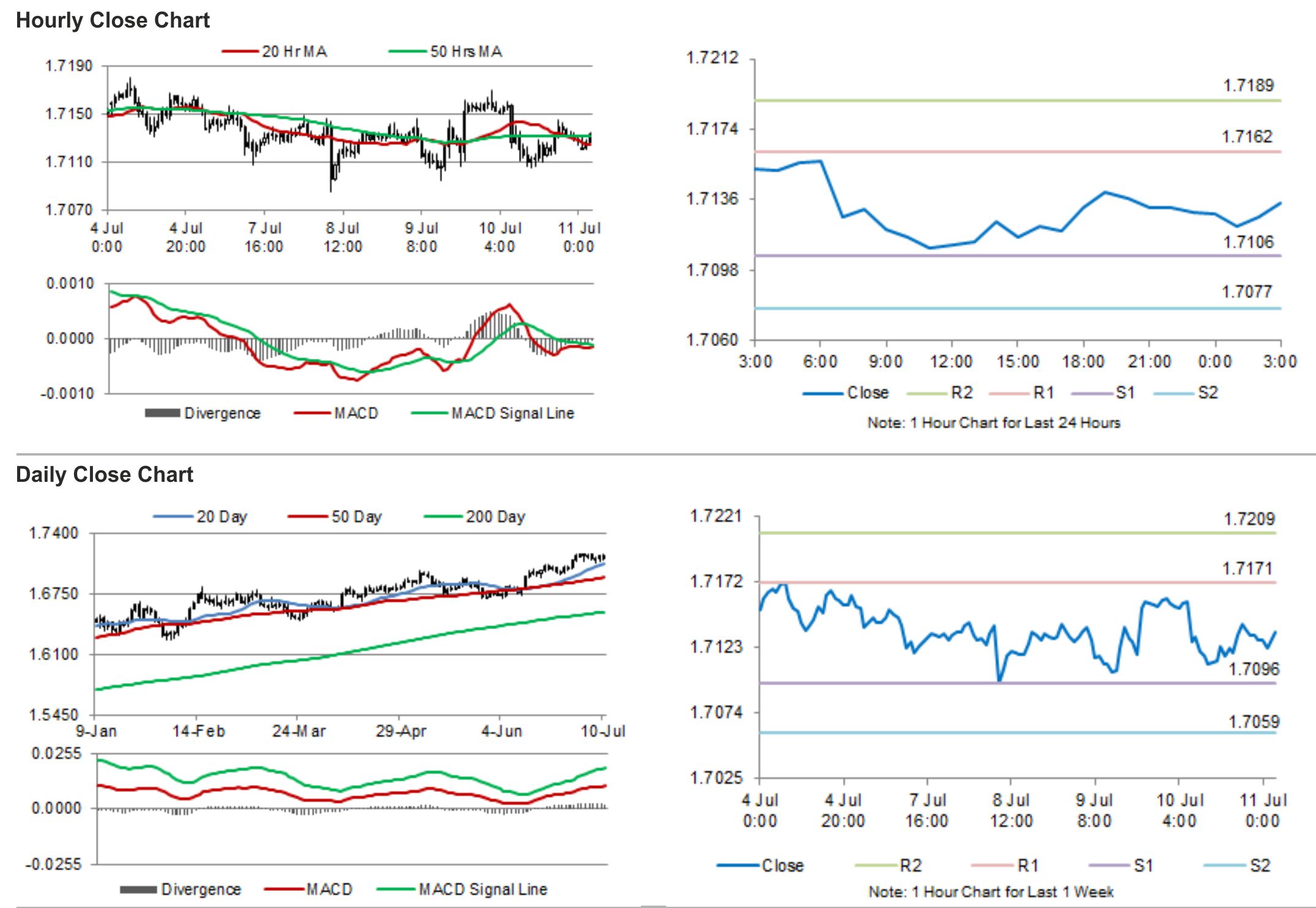

The pair is expected to find support at 1.7106, and a fall through could take it to the next support level of 1.7077. The pair is expected to find its first resistance at 1.7162, and a rise through could take it to the next resistance level of 1.7189.

Investors would pay attention to the release of CB Leading Economic Index for May from the UK, which would measure the economic stability in the country.

The currency pair is trading just above its 20 Hr moving average and is showing convergence with its 50 Hr moving average.