For the 24 hours to 23:00 GMT, EUR declined 0.31% against the USD and closed at 1.3724, after the ECB President, Mario Draghi signalled that policymakers discussed QE as well as a negative interest rate at the central bank’ latest policy meeting to bolster the economic recovery and push up prices in the region. He further added that the council unanimously committed to utilise all possible unconventional tools within their mandate to cope with low inflation. Mario Draghi’s comments followed the ECB’s decision to keep its interest rate at a record-low 0.25%.

Adding to the negative sentiment was a report from the Organization for Economic Cooperation and Development (OECD) that indicated a rise in deflation risks in the Euro-zone economy and suggested the ECB to keep its interest rates at a near zero level over the medium term and consider “additional nonconventional measures” should deflation risks intensify in the region.

On the economic front, the Euro-zone’s Markit service and composite PMI fell more than preliminary estimates to a level of 52.2 and 53.1, respectively in March while retail sales in the region surprisingly registered a 0.4% (MoM) rise in February. Meanwhile, data from Germany’s and Italy revealed that its Markit service PMI came in below market expectations while Markit Economics’ PMI for France and Spain’s service sector surpassed analysts’ estimates for March.

Meanwhile, in the US, the ISM non-manufacturing PMI rose less-than-expected to a reading of 53.1 in March, from February’s reading of 51.6. Another report showed that trade deficit in the nation unexpectedly widened to $42.30 billion, as US exports hit a five-month low level in February. Additionally, data revealed that the number of claims for jobless benefits rose to 326,000, last week, more than market expectation for jobless claims to rise to 317,000. Separately, Markit Economics reported that its final service sector PMI in the nation rose to a reading of 55.3 in March, slightly below the preliminary reading of 55.5 and compared to a level of 53.3 in February

In the Asian session, at GMT0300, the pair is trading at 1.3711, with the EUR trading 0.09% lower from yesterday’s close.

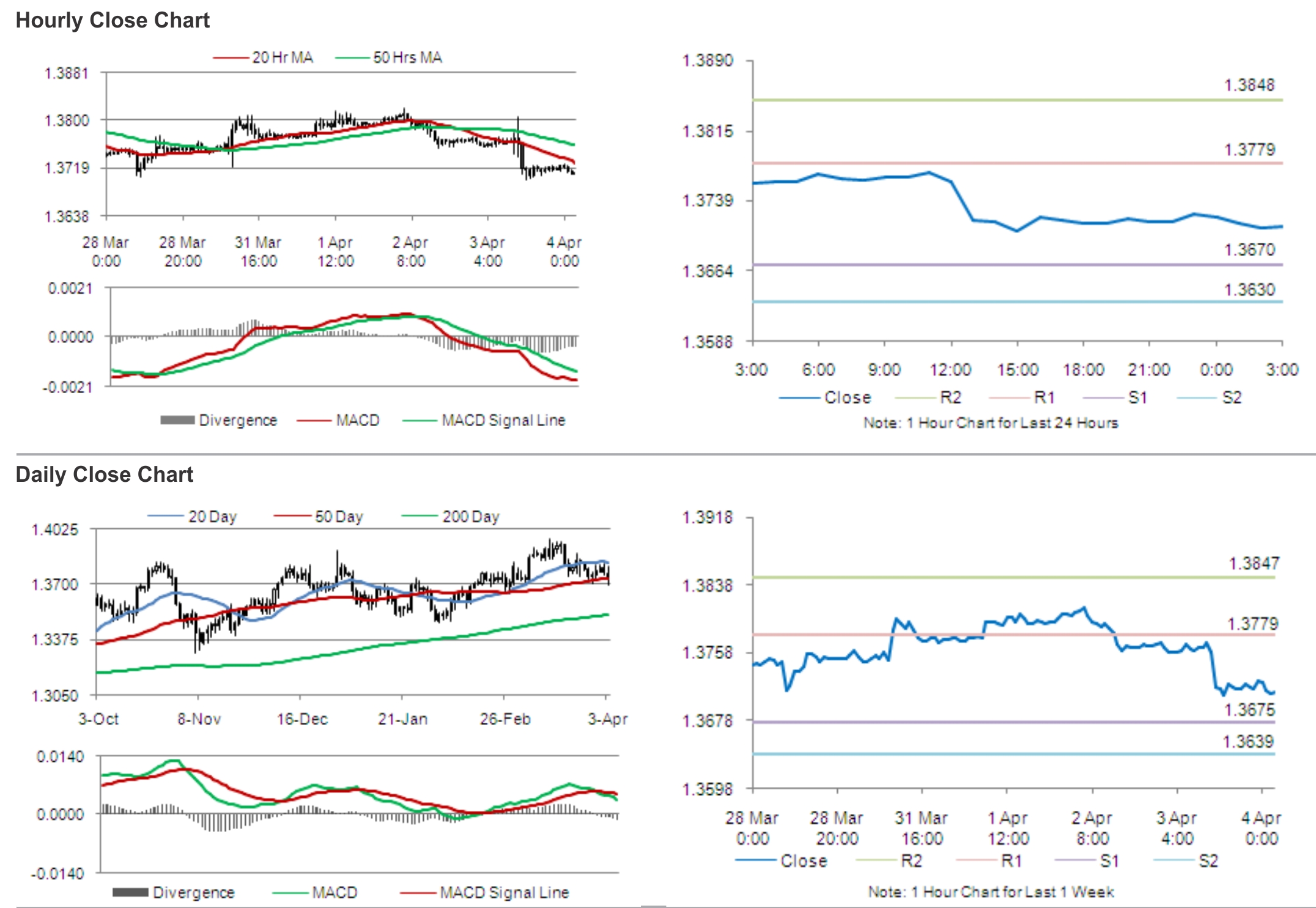

The pair is expected to find support at 1.3670, and a fall through could take it to the next support level of 1.3630. The pair is expected to find its first resistance at 1.3779, and a rise through could take it to the next resistance level of 1.3848.

Meanwhile, against the backdrop of upbeat private employment data and disappointing jobless claims data during the week, today’s non-farm payrolls would be closely followed to determine the condition of the labour market in the US.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.