For the 24 hours to 23:00 GMT, GBP fell 0.16% against the USD and closed at 1.6599, after Markit Economics reported that its PMI for the UK’s service sector fell to a 9-month low reading of 57.6 in March, below economists’ forecast and compared to previous month’s level of 58.2. The UK Pound also faced some resistance from comments of a BOE official, Ian McCafferty, who opined that interest rate in the nation would remain at the record-low level of 0.5% for some time and any future increases would be gradual. Additionally, he noted that London and the South East of England are leading the recovery at present with other parts of the UK further behind in the growth cycle. Furthermore, he highlighted that the UK housing market has still not gained momentum in a full swing, despite a rise in housing prices in almost all regions in the country. However, the BOE, in its quarterly survey of credit conditions in the nation presented a different outlook of the housing market in the nation wherein it projected a significant increase in mortgages along with business loans in the first quarter and a further rise over the next three months.

In the Asian session, at GMT0300, the pair is trading at 1.6585, with the GBP trading 0.08% lower from yesterday’s close.

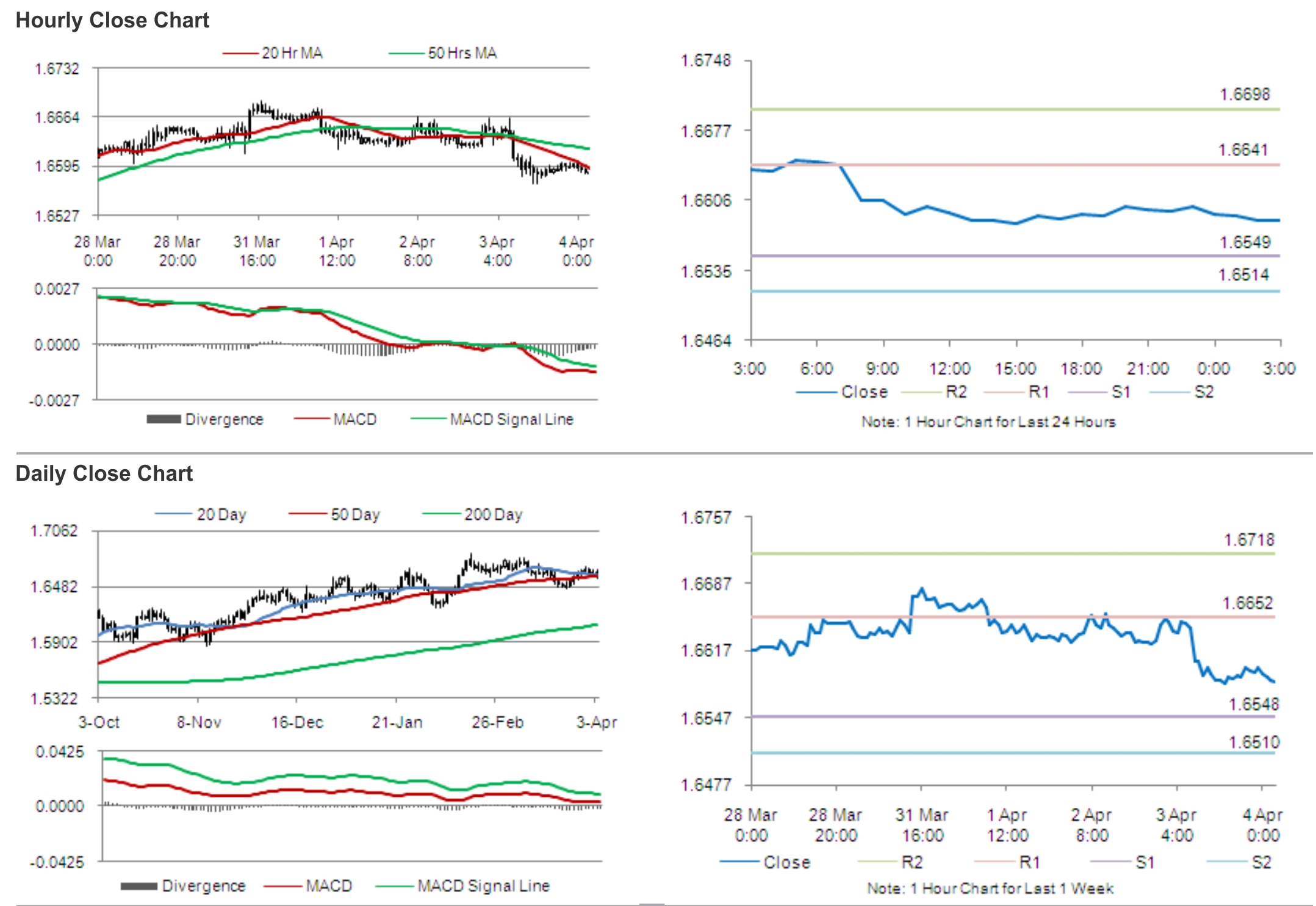

The pair is expected to find support at 1.6549, and a fall through could take it to the next support level of 1.6514. The pair is expected to find its first resistance at 1.6641, and a rise through could take it to the next resistance level of 1.6698.

Amid lack of major economic releases from the UK, traders would eye the release of the US non-farm payrolls and unemployment rate data for further guidance in the pair.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.