For the 24 hours to 23:00 GMT, the EUR rose 0.21% against the USD and closed at 1.3641. The US Dollar declined after the minutes of the Federal Reserve’s latest meeting failed to give any clarity on when it would raise its key interest rates. However, the minutes revealed that the officials have decided to end the central bank’s bond-buying programme by October, only if the economy improved in the second quarter and held on to its outlook. Furthermore, the minutes sounded optimistic about the economy and the labour market, however it expressed concerns over the housing sector which continued to one of the major laggards in the world’s largest economy.

The Euro traded on a higher footing, despite the ECB Chief, Mario Draghi reiterated his concerns on the strength of the common currency. He added that the risks to price stability in the region still existed and further assured that the central bank would continue to be accommodative for an extended period of time. However, the ECB Governing Council member, Luc Coene downplayed the strength of the Euro and cautioned that the central bank should avoid going beyond its mandate to influence the exchange rate.

Meanwhile, another ECB member, Peter Praet stated that the central bank should not do anything to influence the common currency, rather they should undertake measures to improve competitiveness in the region. He also indicated that the ECB’s latest policies require some time to show the desired results.

Yesterday, ECB Executive Board member, Benoit Coeure indicated that the Euro-zone should go ahead with its existing budget rules however they should not be extended for a longer period as it would loss its credibility.

In the Asian session, at GMT0300, the pair is trading at 1.3647, with the EUR trading tad higher from yesterday’s close.

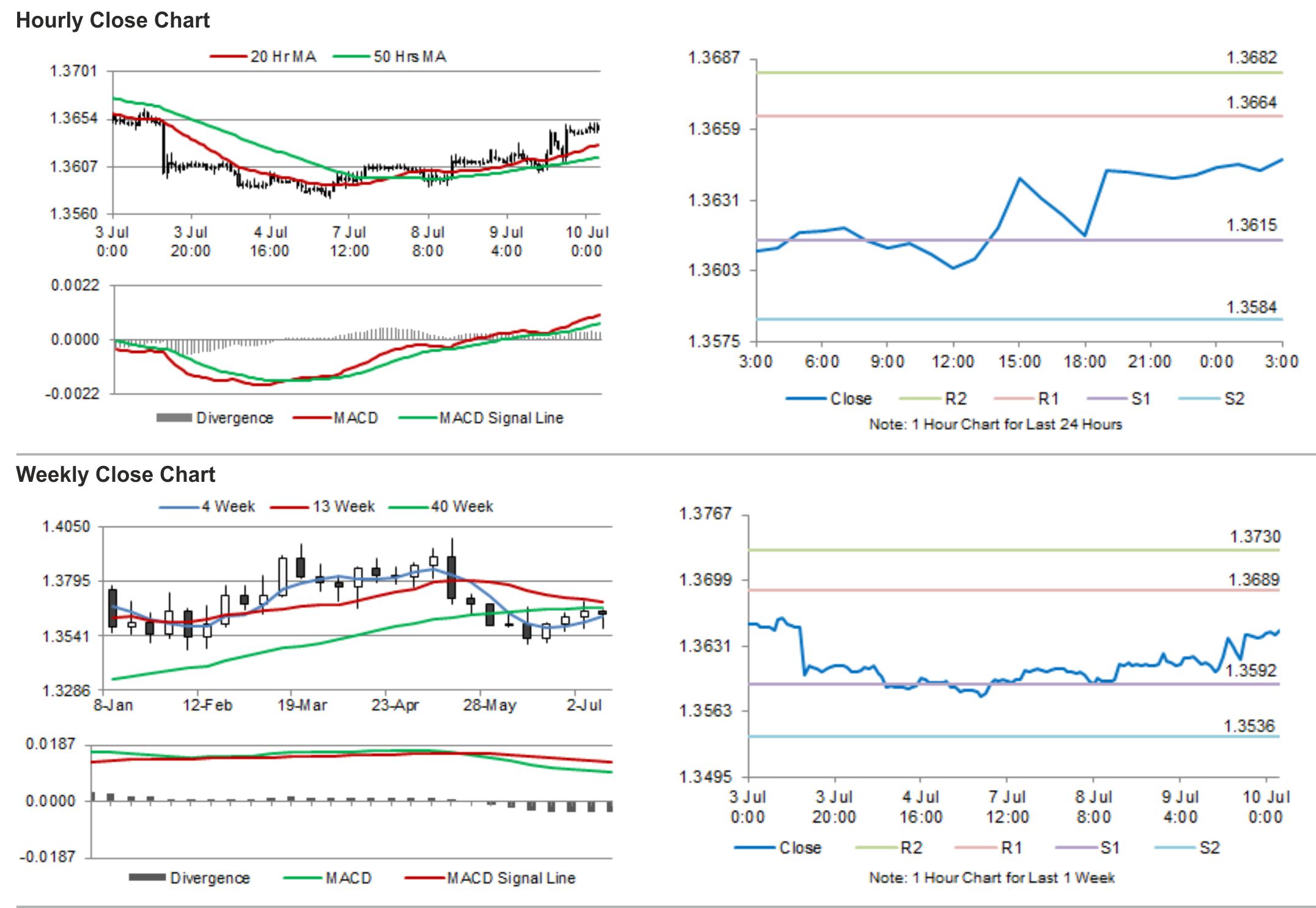

The pair is expected to find support at 1.3615, and a fall through could take it to the next support level of 1.3584. The pair is expected to find its first resistance at 1.3664, and a rise through could take it to the next resistance level of 1.3682.

Trading trends in the pair today are expected to be determined by the ECB monthly report slated to release later during the day. Meanwhile, jobless claims data from the US would also be highly scrutinised by investors.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.