For the 24 hours to 23:00 GMT, the GBP rose 0.13% against the USD and closed at 1.7154, after Bank of England’s new policy committee member and head of banking and markets, Nemat Shafik, said that the slack in the UK economy has considerably reduced and hinted that the interest rate in the nation may be raised very soon. However, initially during the day, the British Pound came under pressure after the release of soft economic data from the UK.

The Halifax house price index in the UK declined 0.6% (M-o-M) in June, compared to a revised 4.0% (M-o-M) rise recorded in the previous month. Markets were expecting house price index to fall 0.3% in June. Additionally, the UK BRC shop price index registered its biggest annual decline since 2006 in June.

In the Asian session, at GMT0300, the pair is trading at 1.7153, with the GBP trading marginally lower from yesterday’s close.

Overnight data released by Royal Institution of Chartered Surveyors (RICS) indicated that house price balance in the UK rose to 53.0% in June, its slowest rise in 15 months, compared to a revised 56.0% recorded in the previous month. Markets were expecting house price balance to increase to 55.0% in June.

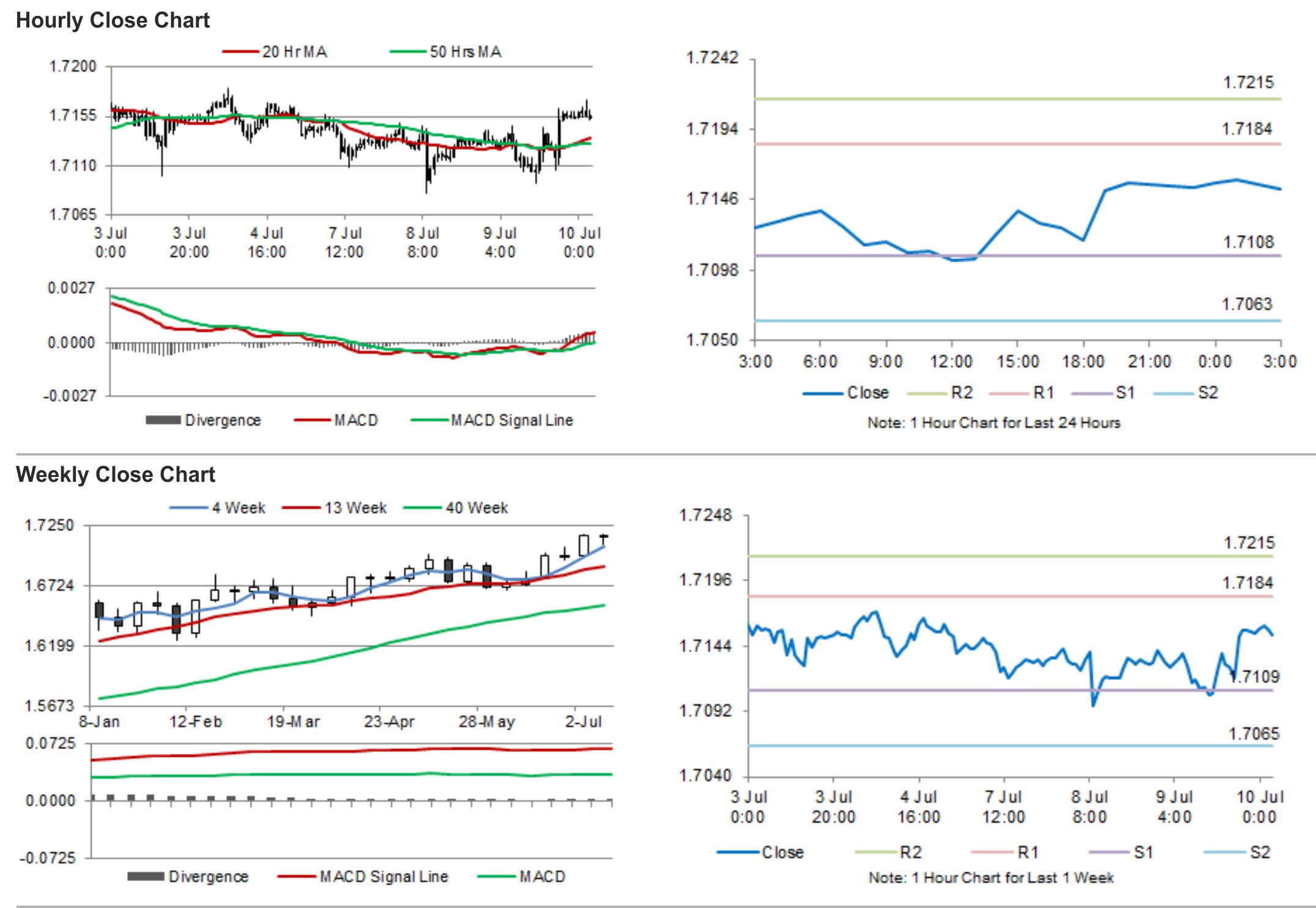

The pair is expected to find support at 1.7108, and a fall through could take it to the next support level of 1.7063. The pair is expected to find its first resistance at 1.7184, and a rise through could take it to the next resistance level of 1.7215.

Trading trends in the pair today are expected to be determined by the Bank of England’s interest rate decision scheduled later today.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.