For the 24 hours to 23:00 GMT, the EUR declined 0.37% against the USD and closed at 1.0619.

Yesterday, the European Central Bank (ECB) President, Mario Draghi, at a hearing of the Committee on Economic and Monetary Affairs of the European Parliament, stated that Euro-zone’s economy proved to be resilient in 2016, despite economic and political uncertainty, largely due to the stimulus measures adopted by the ECB. He further added that inflation has gradually edged up, and that the ECB’s monetary stimulus has been a key ingredient of the ongoing recovery. Regarding the impact of ‘Brexit’ on the Euro-zone, Draghi urged the British government to disclose more information about its Brexit plans and stated that it was difficult to predict the precise economic implications of the event as it would depend on the timing, progress and outcome of the upcoming negotiations.

Separately, the Organisation for Economic Cooperation and Development (OECD), in its twice-yearly economic outlook, revised Euro-zone’s growth forecast slightly higher, primarily due to European Central Bank’s (ECB) ultra-loose monetary policy. Economic growth in the common currency region was predicted to be 1.7% this year and 1.6% in 2017.

Additionally, the OECD forecasted that global growth, along with the US, will gather steam in the coming months, citing President-elect Donald Trump’s planned tax cuts and consumer spending. It now expects global growth to hit 3.3% for next year, up from 3.2% in its last outlook while growth will be pushed higher to 3.6% in 2018.

In other economic news, the US Dallas Fed manufacturing business index rebounded to a level of 10.2 in November, notching its highest level since July 2014, compared to a reading of -1.5 in the prior month while markets anticipated the index to advance to a level of 2.0.

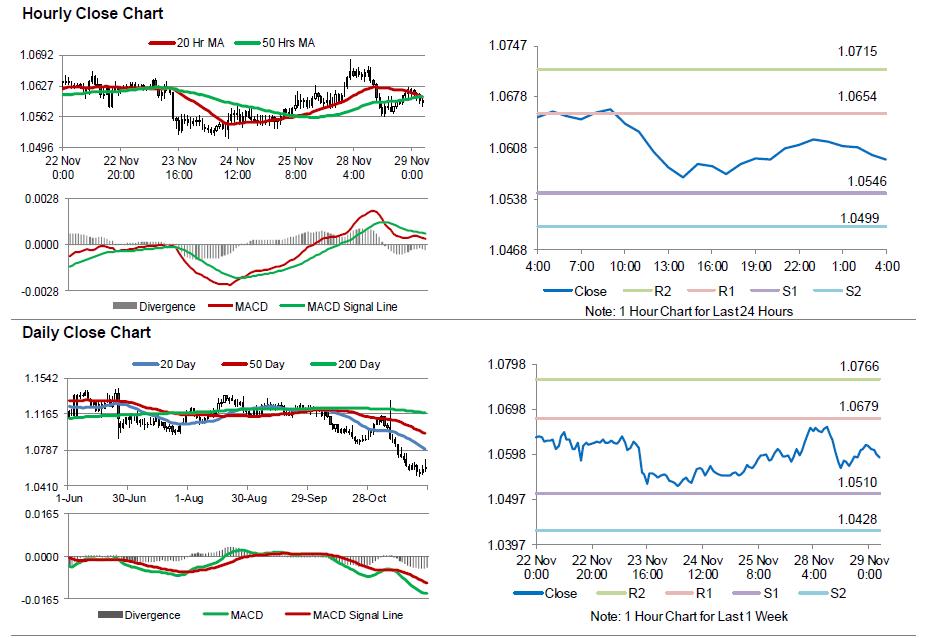

In the Asian session, at GMT0400, the pair is trading at 1.0592, with the EUR trading 0.25% lower against the USD from yesterday’s close.

The pair is expected to find support at 1.0546, and a fall through could take it to the next support level of 1.0499. The pair is expected to find its first resistance at 1.0654, and a rise through could take it to the next resistance level of 1.0715.

Moving ahead, investors would look forward to Germany’s flash inflation data for November, slated to release later today. Moreover, in the US, flash annualised GDP for 3Q and consumer confidence for November, would pique investor attention.

The currency pair is showing convergence with its 20 Hr and 50 Hr moving averages.