For the 24 hours to 23:00 GMT, the GBP declined 0.87% against the USD and closed at 1.2416, after OECD predicted steep fall in UK’s economic growth in 2017, following Brexit uncertainties.

Yesterday, the OECD upgraded its growth forecasts for UK to 2.0% from 1.8% this year, and to 1.2% from 1.0% in 2017, mainly due to the Bank of England’s moves to shore up the economy since the EU referendum. However, it sharply reduced its growth prediction for 2018 to just 1.0% as the nation prepares for its goal of leaving the European Union. Further, it stated that Britain’s economy is growing more strongly than previously anticipated but needs extra spending on infrastructure to improve its long-term prospects.

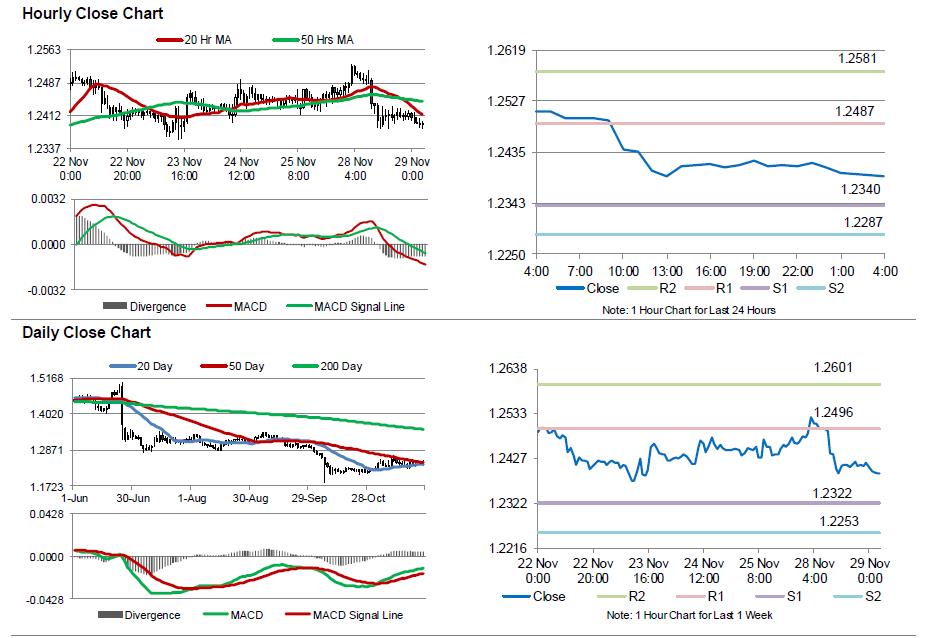

In the Asian session, at GMT0400, the pair is trading at 1.2392, with the GBP trading 0.19% lower against the USD from yesterday’s close.

The pair is expected to find support at 1.234, and a fall through could take it to the next support level of 1.2287. The pair is expected to find its first resistance at 1.2487, and a rise through could take it to the next resistance level of 1.2581.

Moving ahead, market participants will closely monitor UK’s mortgage approvals for October, scheduled to release in a few hours.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.