For the 24 hours to 23:00 GMT, the EUR declined 0.76% against the USD and closed at 1.2380, after the ECB remained more dovish in its monthly monetary policy meeting.

Yesterday, the ECB Chief, Mario Draghi indicated that the central bank policymakers are actively preparing additional measures to inject liquidity into the Euro-economy if needed. Meanwhile, the ECB maintained its interest rate at 0.05%, at par with market expectations.

In other economic news, German factory orders rose 0.8% on a monthly basis in September, following a revised drop of 4.2% registered in the preceding month. Market expectations were for factory orders to advance 2.2%.

The greenback traded on a stronger footing, after number of people claiming initial jobless benefits in the US dropped more than expected to 278,000, compared to a revised level of 288,000 in the week ended 01 November, while market expectations were for initial jobless claims to ease to a level of 285,000, thus fuelling optimism over the strength of the nation’s labour market. Similarly, the seasonally adjusted continuing jobless claims in the nation eased to 2348.0 K, compared to market expectations of a fall to 2365.0 K, in the week ended 25 October. Meanwhile, non-farm business productivity advanced 2.0% on a quarterly basis in 3Q 2014, beating market expectations for the productivity to rise 1.5%.

Separately, the Cleveland Fed President, Loretta Mester anticipated a rise in the US interest rates to come some time around in 2015, as inflation continued to remain stable and was expected to increase to the Fed’s target of 2% by the end of 2016.

In the Asian session, at GMT0300, the pair is trading at 1.2379, with the EUR trading marginally lower from yesterday’s close.

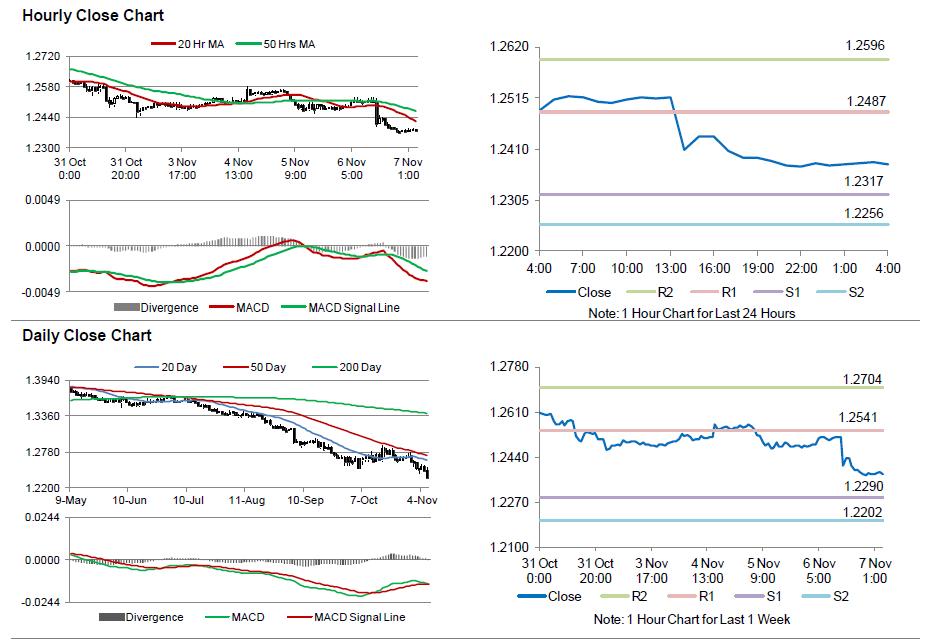

The pair is expected to find support at 1.2317, and a fall through could take it to the next support level of 1.2256. The pair is expected to find its first resistance at 1.2487, and a rise through could take it to the next resistance level of 1.2596.

Trading trends in the Euro today are expected to be determined by Germany industrial as well as its trade balance data, set for release in a few hours. Meanwhile, the US unemployment rate and the crucial nonfarm payrolls data would keep investors on their toes, scheduled later today.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.