For the 24 hours to 23:00 GMT, the GBP fell 0.81% against the USD and closed at 1.5837.

Yesterday, the BoE in a much expected move decided to keep its interest rates unchanged at a record low of 0.5% in November. Additionally, the central bank’s Monetary Policy Committee (MPC) maintained its volume of asset purchases untouched at £375 billion.

In other economic news, monthly manufacturing production in the UK rose 0.4% in September, exceeding market expectations for an advance of 0.3% and compared to a rise of 0.2% recorded in August. Meanwhile, the nation’s industrial production rebounded strongly by registering a 0.6% rise on a monthly basis in September, following a drop of 0.1% registered in August, while markets were expecting it to climb 0.4%. On the other hand, Halifax house price index surprisingly eased 0.4% on a monthly basis, compared to a revised advance of 0.4% in the previous month, while markets were expecting it to climb 0.4%.

Separately, leading think tanker, the NIESR forecasted that Britain’s economy to grow 0.7% in the three months to October, compared to a similar rate of growth estimated in the previous quarter.

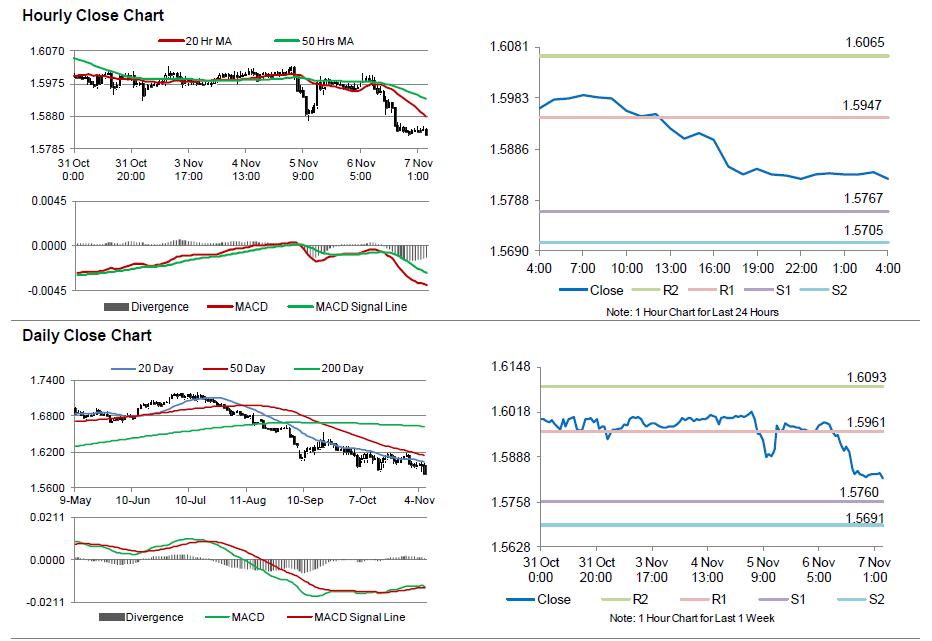

In the Asian session, at GMT0400, the pair is trading at 1.5828, with the GBP trading 0.06% lower from yesterday’s close.

The pair is expected to find support at 1.5767, and a fall through could take it to the next support level of 1.5705. The pair is expected to find its first resistance at 1.5947, and a rise through could take it to the next resistance level of 1.6065.

Trading trends in the Pound today are expected to be determined by the BoE Governor, Mark Carney’s speech, scheduled later in the day.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.