For the 24 hours to 23:00 GMT, the EUR rose 0.14% against the USD and closed at 1.3607, as an official report revealed that German trade surplus widened more than market expectations for May, even as the nation’s current account surplus narrowed and exports fell more than economists’ projections.

The Federal Statistical Office of Germany reported that the seasonally adjusted trade surplus of Germany widened to €18.8 billion in May, from a revised surplus of €17.2 billion recorded in the previous month. Markets had expected Germany’s trade surplus to narrow to €16.2 billion in May.

Yesterday, Bank of Spain Head and ECB Governing Council Member, Luis Maria Linde cautioned that the inflation rate in the Euro-zone would remain far from the central bank’s 2% target in the near future and a possibility of deflation existed. He further added that the recent macro economic data from Spain pointed to a healthy recovery.

Meanwhile, the US Dollar lost ground after the Minneapolis Federal Reserve President, Narayana Kocherlakota stated that he expects the inflation rate in the world’s largest economy to stay below the central bank’s target for more years, may be till 2018. He clarified that the central bank is in no rush to increase the short term interest rates, as the economy still has a long way to go. On the other hand, Richmond Federal Reserve President, Jeffrey Lacker hinted that the inflation rate in the nation is gradually moving towards its target, with economic growth accelerating in a moderate pace.

On the economic front, the NFIB indicated a drop in small-business optimism in June, after three consecutive months of gain. Separately, the consumer credit improved in May, however, not as strong as expected, suggesting that the easy monetary policy in the nation is supporting the economy. The Labour Department in its Job Openings and Labor Turnover Survey revealed that job openings jumped to a seven years high level in May.

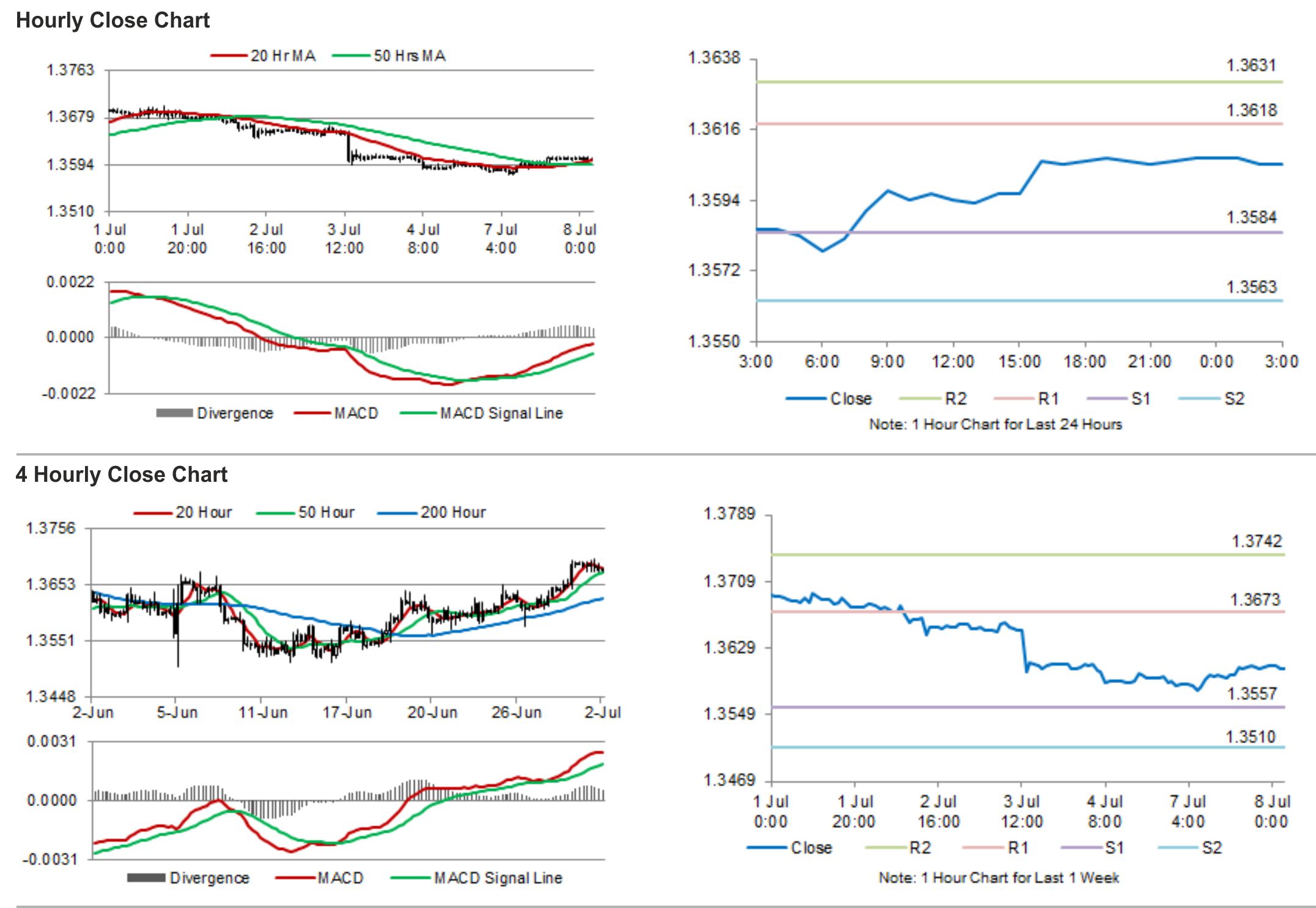

In the Asian session, at GMT0300, the pair is trading at 1.3605, with the EUR trading tad lower from yesterday’s close.

The pair is expected to find support at 1.3584, and a fall through could take it to the next support level of 1.3563. The pair is expected to find its first resistance at 1.3618, and a rise through could take it to the next resistance level of 1.3631.

Trading trends in the pair today are expected to be determined by the Federal Reserve’s latest monetary policy meeting minutes to be released alter during the day.

The currency pair is showing convergence with its 20 Hr moving average and trading just above its 50 Hr moving average.