For the 24 hours to 23:00 GMT, the GBP fell 0.12% against the USD and closed at 1.7134, after disappointing industrial and manufacturing data from the UK. The industrial production in the UK declined 0.7% (M-o-M) in May, following a revised rise of 0.3% recorded in April. Market had expected industrial production to rise 0.3% in May. On a similar note, the manufacturing production on a monthly basis, dropped 1.3% in May, following a revised rise of 0.3% recorded in the preceding month.

The British Pound gained strength during the day for some time after the NIESR reported that the economic recovery in the UK garnered momentum and grew at its fastest pace in more than six years in the second quarter, even as the manufacturing output unexpectedly declined in May. The Gross Domestic Product (GDP) in the UK rose 0.9% in the three months ended in June, compared to a similar rise in the three months to May.

Other data indicated that the British Retail Consortium (BRC) reported that on an annual basis, the BRC shop price index in the UK declined 1.8% in June, compared to a 1.4% fall recorded in the previous month.

In the Asian session, at GMT0300, the pair is trading at 1.7132, with the GBP trading marginally lower from yesterday’s close.

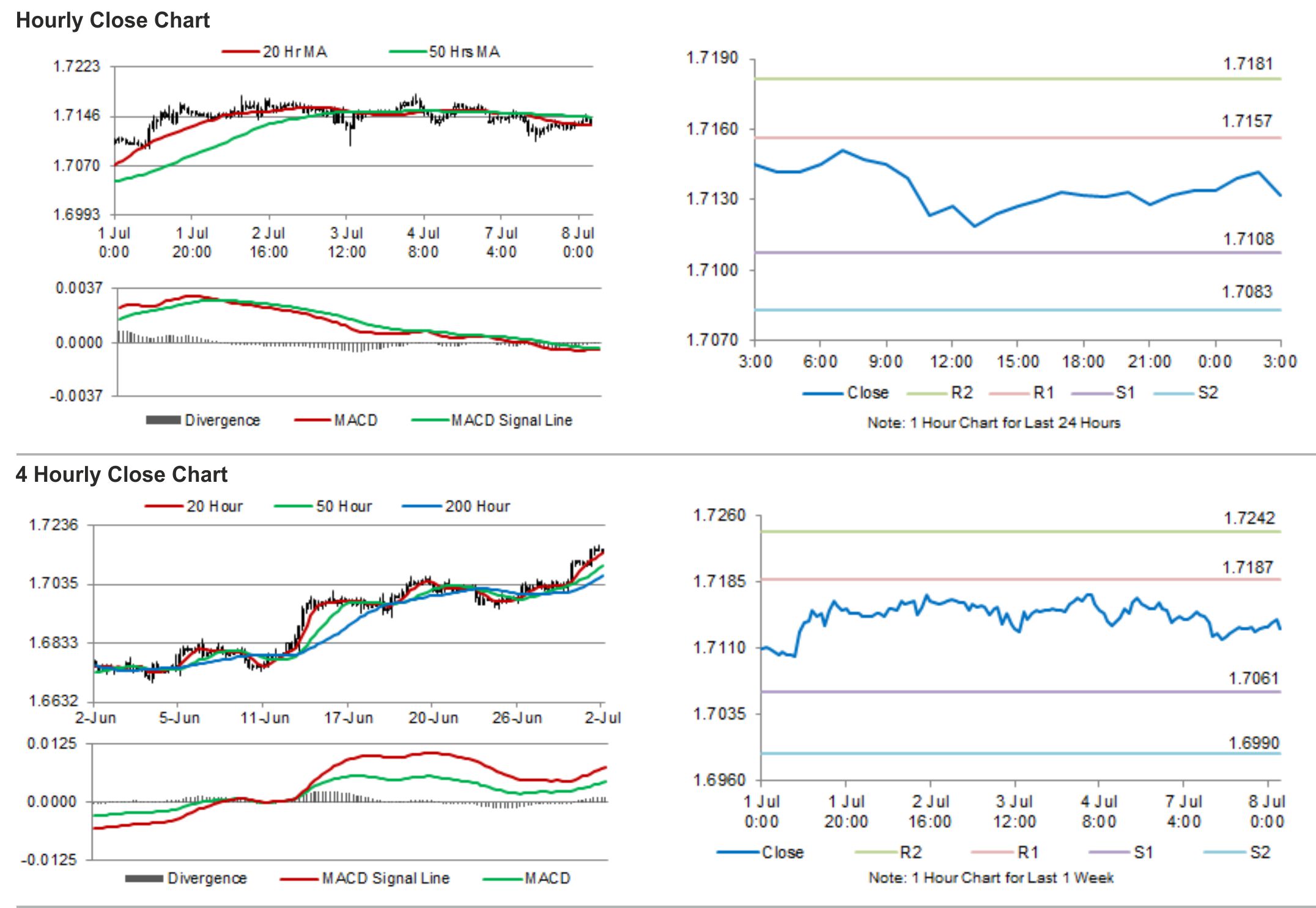

The pair is expected to find support at 1.7108, and a fall through could take it to the next support level of 1.7083. The pair is expected to find its first resistance at 1.7157, and a rise through could take it to the next resistance level of 1.7181.

Investors would pay attention to RICS Housing Price Balance for the month of June, the sole release from UK during the day.

The currency pair is trading between its 20 Hr and 50 Hr moving averages.