For the 24 hours to 23:00 GMT, the EUR declined 0.09% against the USD and closed at 1.3687, as the latter advanced after the minutes from the Fed’s 29-30 April policy meeting hinted towards a continuation in the tapering process of the central bank’s stimulus package. The minutes also revealed that policymakers began discussing ways to exit the central bank’s ultra-easy stimulus programme and the ways to control interest rates even as officials discussed about the different scenarios in the nation’s job’s markets.

Following the releases of the Fed minutes, the Minneapolis Fed president, Narayana Kocherlakota urged the US Fed to target the nation’s price level rather than the inflation rate. He stated that an inflation rate below the Fed’s target level signals a significant problem in the economy, while targeting price level would make long-term contracts safer for borrowers and lenders along with serving as an automatic stabiliser for the economy.

Meanwhile, in an interview with the Wall Street Journal, the San Francisco Fed President, John Williams highlighted the possibility for the world’s largest economy to witnesses its first interest rate hike sometime in the latter half of 2015. He further cautioned the Fed to avoid making decisions which would lead to shrinking of its balance sheet after it starts increasing interest rates from their current near-zero level.

Separately, the New York Fed Chief, William Dudley, opined that the Fed should continue buying bonds, with the money generated from its maturing government and mortgage securities, even after it starts raising its key interest rates.

In the Euro-zone, an ECB Governing Council member, Jens Weidmann told the Sueddeutsche Zeitung newspaper that it still remains unclear whether the ECB would take fresh policy action at its next policy meeting in June.

On the economic front, consumer confidence in the Euro-zone improved more than market expectations to reach its highest level in six and a half years in May. Meanwhile, a separate report showed that the Euro-zone’s current account surplus fell to a seasonally adjusted €18.8 billion in March.

In the Asian session, at GMT0300, the pair is trading at 1.3674, with the EUR trading 0.09% lower from yesterday’s close.

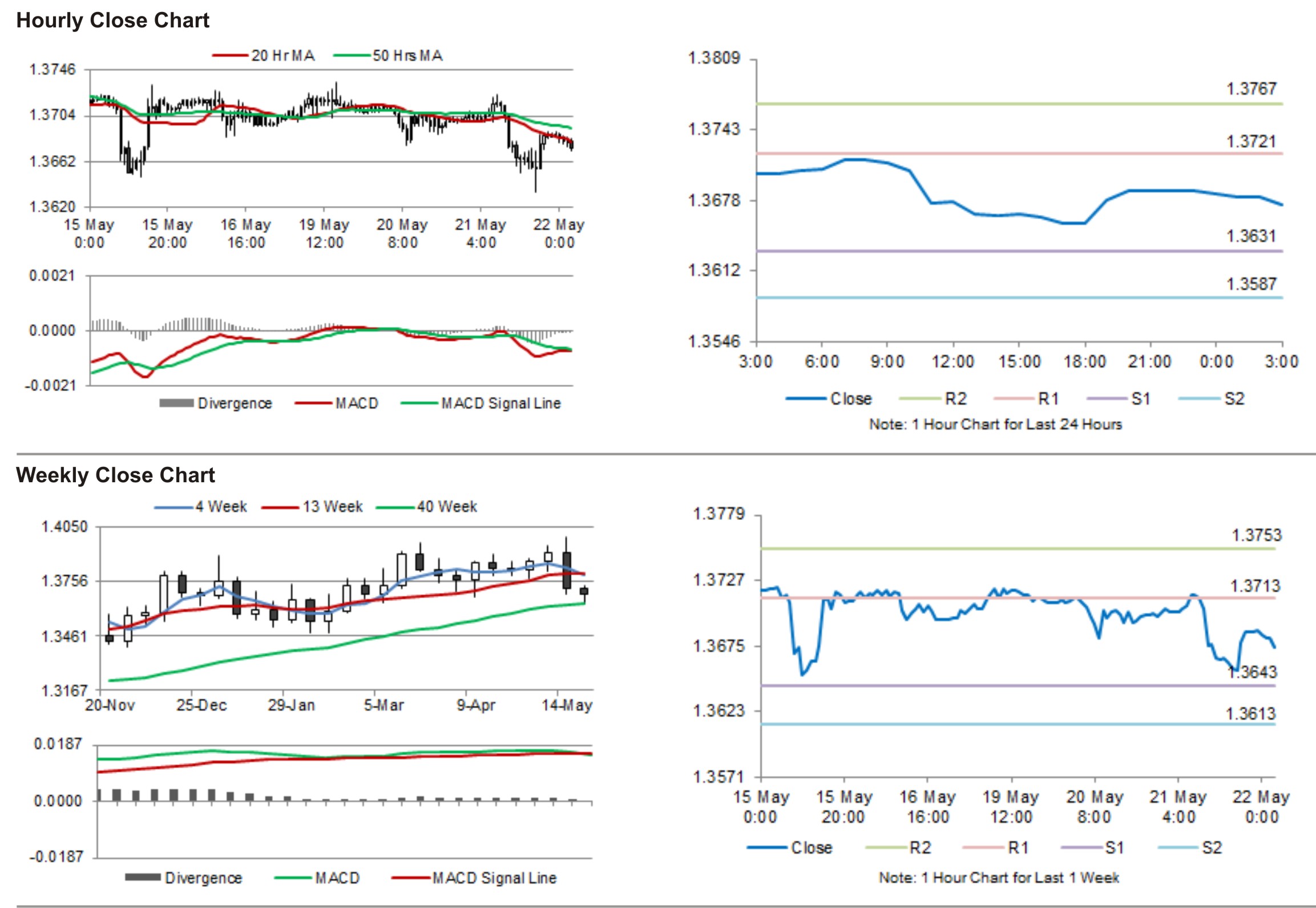

The pair is expected to find support at 1.3631, and a fall through could take it to the next support level of 1.3587. The pair is expected to find its first resistance at 1.3721, and a rise through could take it to the next resistance level of 1.3767.

Later today, the Markit Economics is expected to report May PMI numbers of the manufacturing and service sector for Euro-zone, Germany and France.

The currency pair is showing convergence with its 20 Hr moving average and is trading below its 50 Hr moving average.